Top news of 2025: Drugmakers invest in US capacities, agree to lower Medicaid prices; Pfizer buys obesity-focused biotech Metsera

The year 2025 was an eventful one, marked by increased trade

tensions, tariff threats, accelerated

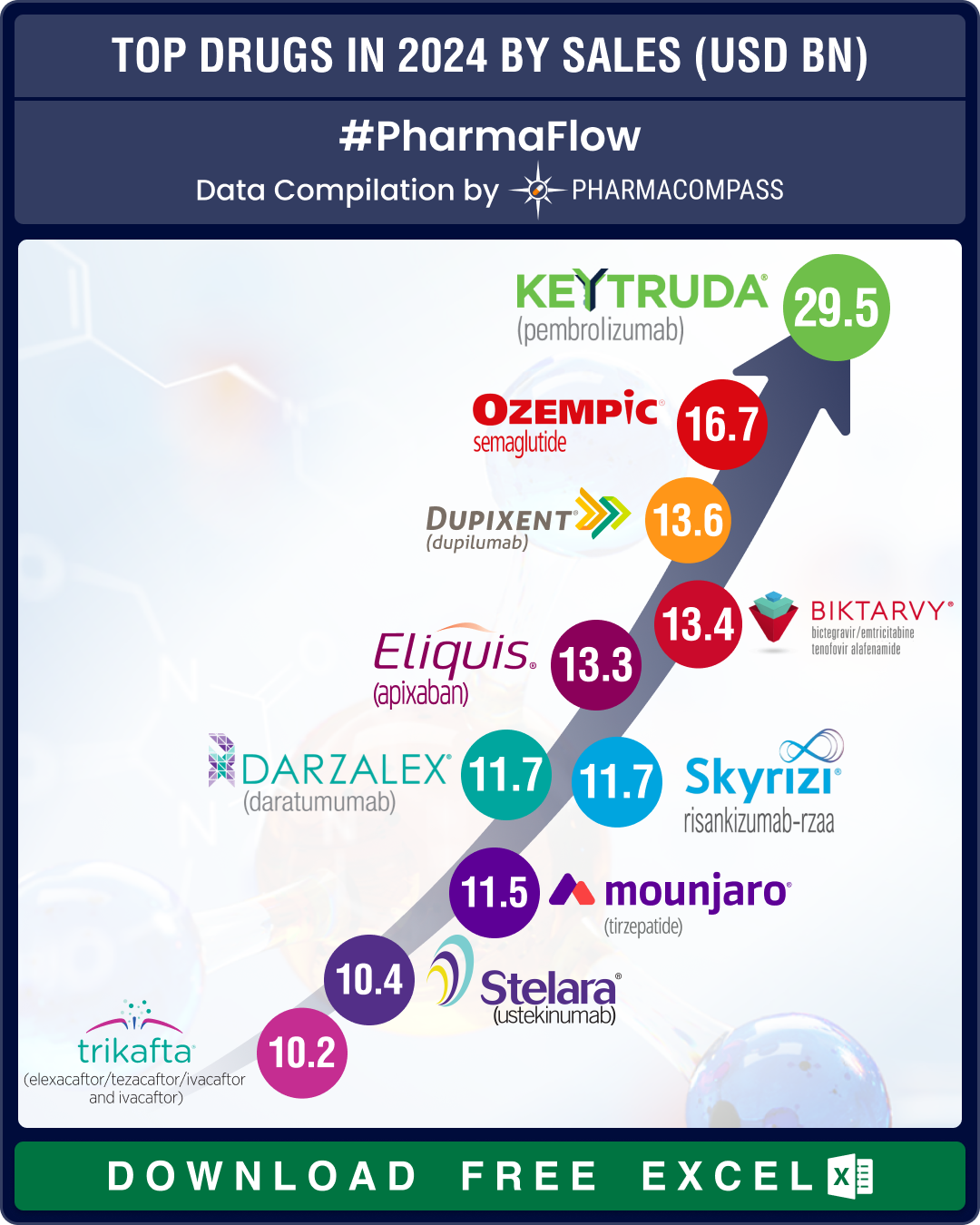

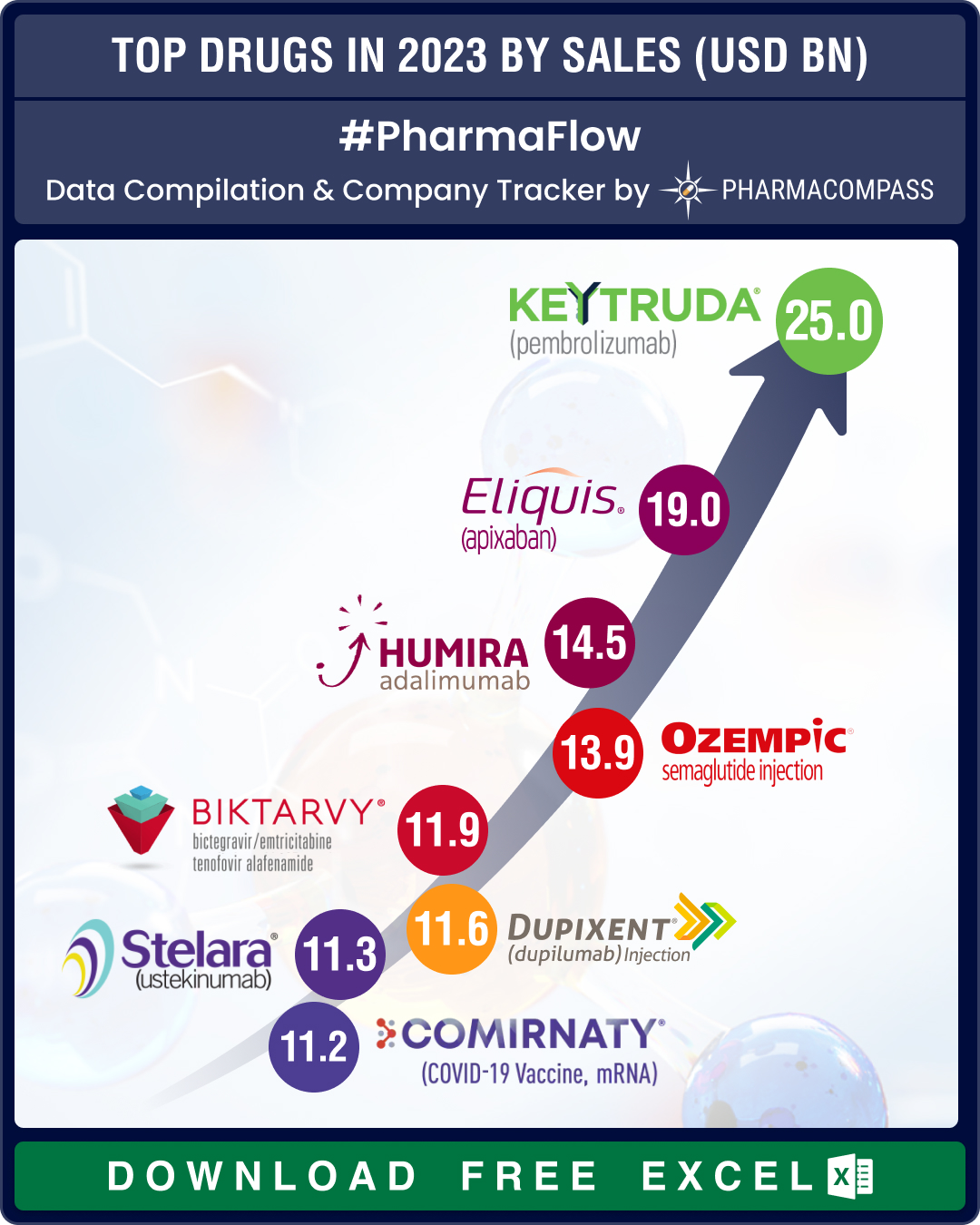

Top Pharma Companies & Drugs in 2024: Merck’s Keytruda maintains top spot as Novo’s semaglutide nips at its heels

In 2024, Big Pharma players consolidated

and maintained their dominance, even as innovation continu

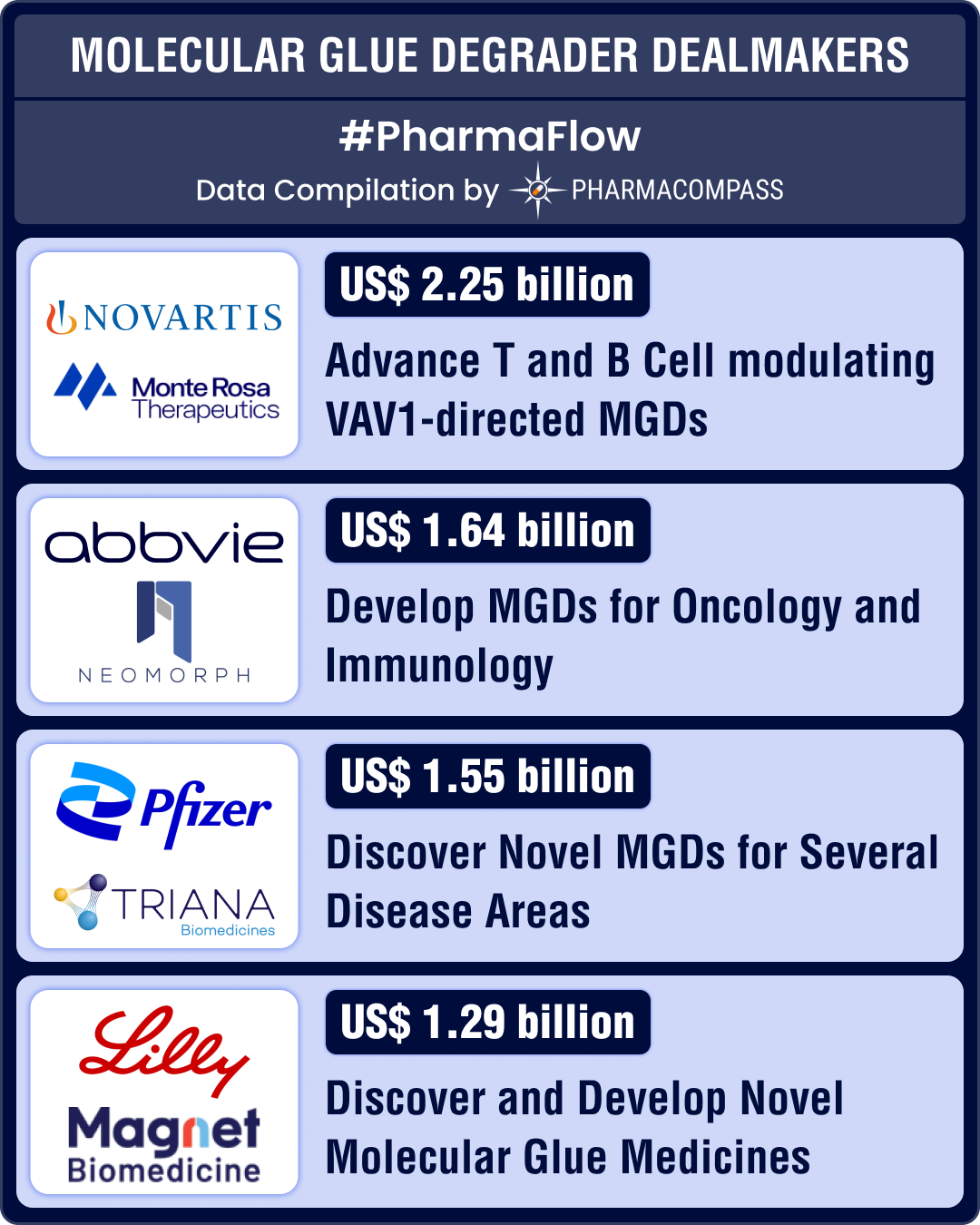

Molecular glue degraders: Lilly, AbbVie sign billion-dollar deals; BMS leads with three late-stage drugs

This week, we delve into molecular glue degraders (MGDs), one of the most promising frontiers in dru

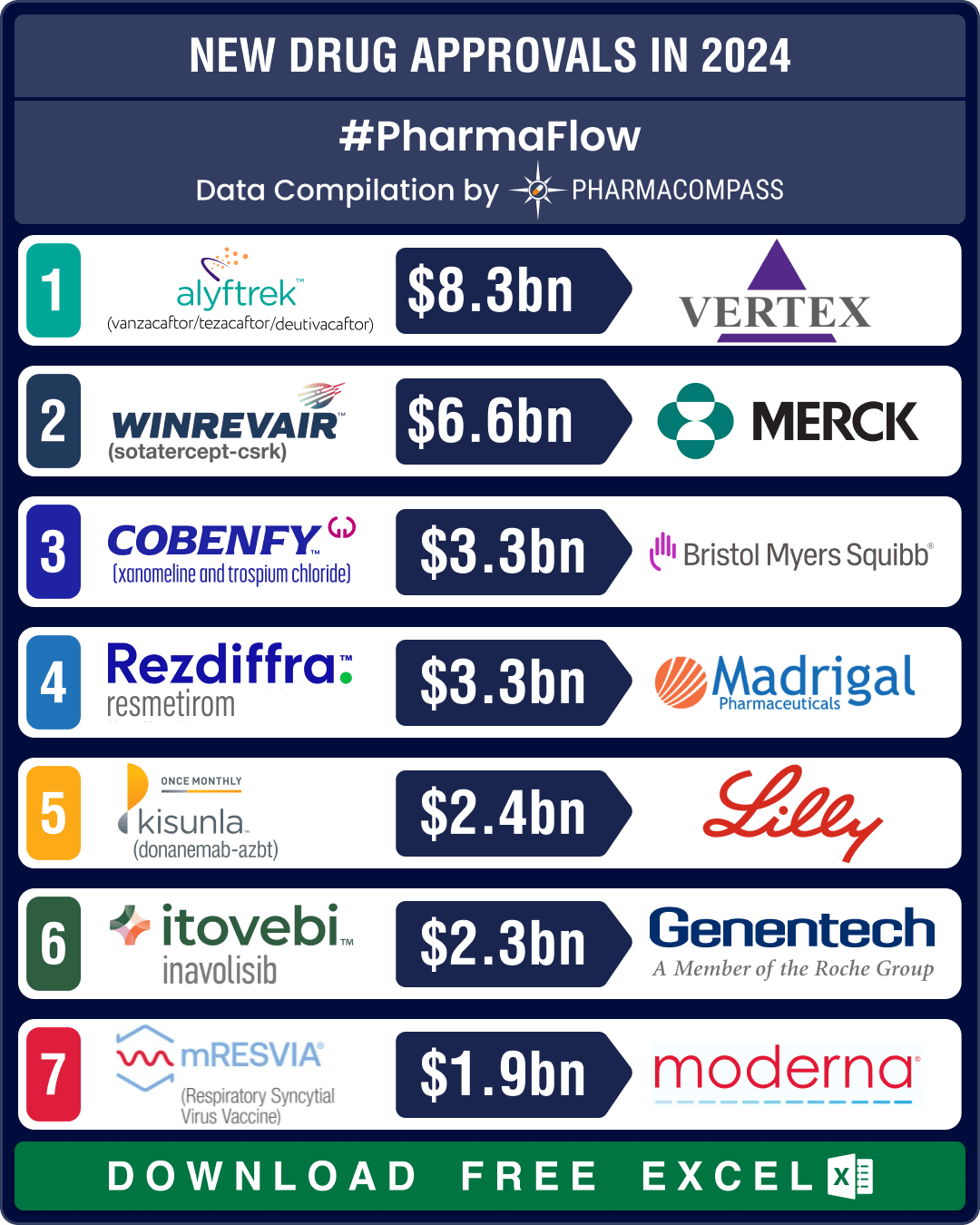

FDA okays 50 new drugs in 2024; BMS’ Cobenfy, Lilly’s Kisunla lead pack of breakthrough therapies

In 2024, the biopharma industry continued to advance on its robust trajectory of innovation. Though

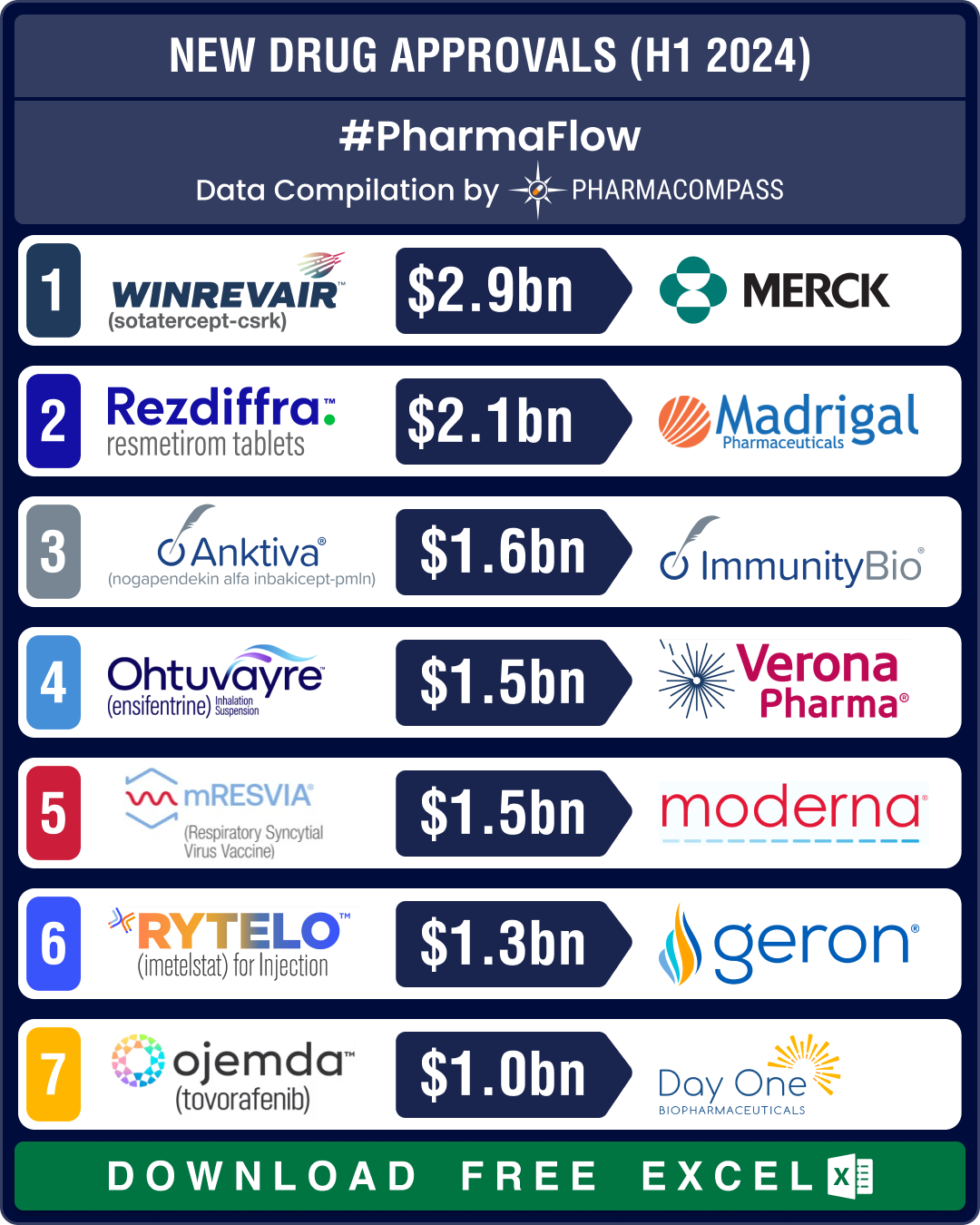

FDA approvals slump 19% in H1 2024; NASH, COPD, PAH get new treatment options

The first half of 2024 saw a significant slowdown in approvals of new drugs and biologics by the US

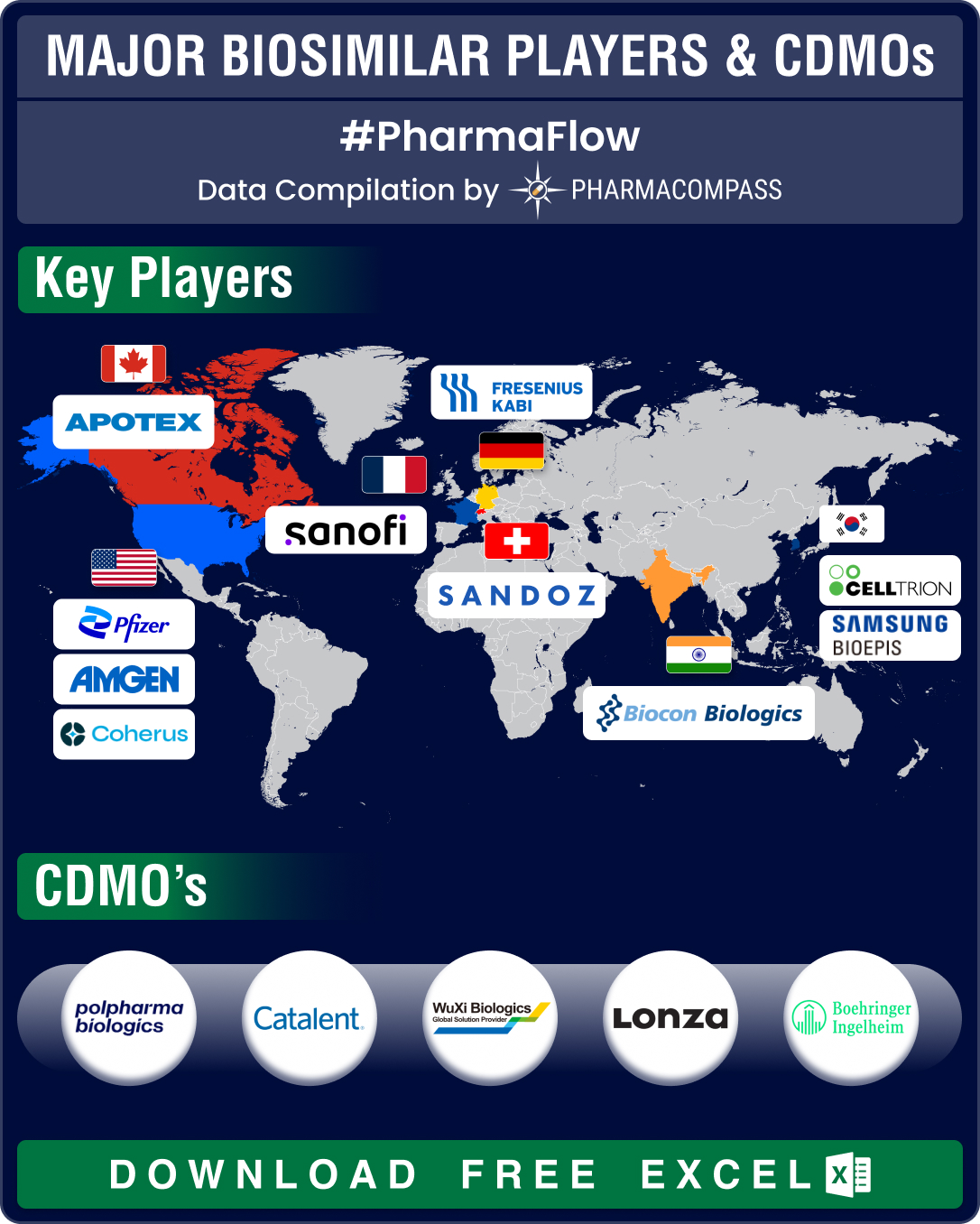

FDA approves record eight biosimilars in H1 2024; okays first interchangeable biosimilars for Eylea

Biologics, or complex drugs that are derived from living organisms, have revolutionized treatment of

Market Place

Market Place Sourcing Support

Sourcing Support