The Generic Drug User Fee Act (GDUFA) came into effect on October 1, 2012. The law was designed to accelerate the access to safe and effective generic drugs to the people of the United States, while reducing the costs for the industry.

The law mandated all firms that manufactured human generic drug products and active pharmaceutical ingredients (APIs) for human generic drug products distributed in the US to be subject to the US Food and Drug Administration’s user fees.

Five years after the passage of the original law, on August 18, 2017, the GDUFA was reauthorized (as GDUFA II), with provisions that came into effect on October 1, 2017. These provisions will remain in effect until September 30, 2022.

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

GDUFA II fees varied significantly from that in GDUFA I due to two fundamental adjustments made to the fee structure:

1. The revenue base for GDUFA II was increased to US$ 493.6 million from US$ 323 million in the final year of GDUFA I. The reason for this increase was that generic drug applications — or Abbreviated New Drug Applications (ANDAs), the primary workload driver of the program, submission of which to the FDA were anticipated to be 750 ANDAs per year — increased over the first four years of GDUFA I to an average of around 1,000 per year. To address the increased workload, the FDA had to hire additional staff. GDUFA II’s revenue base factored in these additional costs.

2. GDUFA II is designed to rely on annual program fees, which would shift the fee burden somewhat from facility fees. As a result, while the facility fees remained relatively unchanged or was even reduced in some cases, the fee for ANDAs saw an increase of more than US$ 100,000 per application.

|

Generic Drug User Fee Act (GDUFA) (in US$) |

||||

|

Abbreviated New Drug Application (ANDA) |

171,823 |

70,480 |

76,030 |

58,730 |

|

Drug Master File (DMF) |

47,829 |

51,140 |

42,170 |

26,720 |

|

Finished Dosage Form Facility (Domestic) |

211,087 |

258,646 |

243,905 |

247,717 |

|

Finished Dosage Form Facility (Foreign) |

226,087 |

273,647 |

258,905 |

262,717 |

|

Active Pharmaceutical Ingredient Facility (Domestic) |

45,367 |

44,234 |

40,867 |

41,926 |

|

Active Pharmaceutical Ingredient Facility (Foreign) |

60,367 |

59,234 |

55,867 |

56,926 |

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

GDUFA II also introduced an ANDA holder fee, also known as program fee. This fee has three tiers: entities that hold 20+ approved ANDAs, entities that hold six-19 approved ANDAs, and entities that hold one to five approved ANDAs. ANDAs pending approval are not added to this count, just as facilities that are only referenced in pending ANDAs are not subject to a facility fee.

|

Recurring GDUFA program fee |

(in US$) |

|

(20+ANDAs) Large size operation generic drug applicant program |

1,590,792 |

|

(6-19 ANDAs) Medium size operation drug applicant program |

636,317 |

|

(1-5 ANDAs) Small business generic drug applicant program |

159,079 |

A 17 percent drop in facilities that paid for the

upcoming year

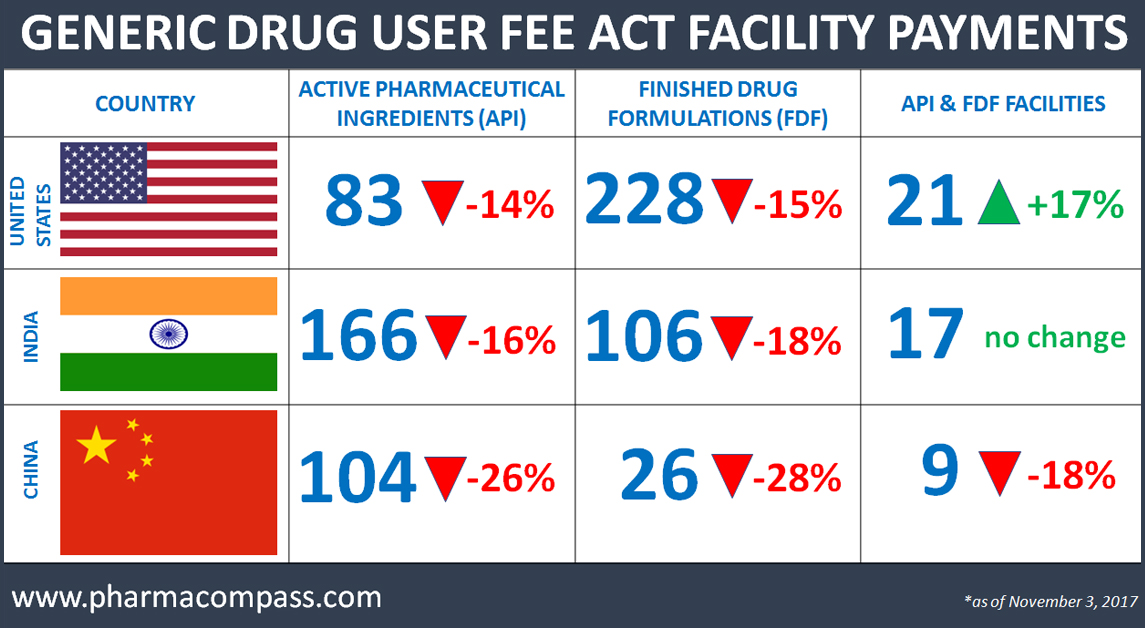

As the US generic business continues to face headwinds of increased competition, pricing pressure, channel consolidation and concerns over non-compliance, this week PharmaCompass reviewed a list posted on the FDA website which contains the GDUFA facility payments received by the agency.

The fees were due no later than October 1, 2017. A review more than one month later, as of payments listed on November 3, 2017, shows that as opposed to 1,436 facilities, which paid user fees last fiscal year, this year the number is down to 1,192, a reduction of almost 17 percent.

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

Country-wise list of facilities which paid for FY2017, but not for FY2018

|

COUNTRY |

API |

API & FDF |

FDF |

TOTAL FACILITIES |

|

United States |

14 |

1 |

44 |

59 |

|

India |

30 |

3 |

20 |

52 |

|

China |

40 |

1 |

11 |

52 |

|

Germany |

6 |

7 |

13 |

|

|

Italy |

5 |

6 |

11 |

|

|

France |

4 |

5 |

9 |

|

|

Japan |

6 |

3 |

9 |

|

|

Canada |

2 |

6 |

8 |

|

|

Spain |

8 |

8 |

||

|

United Kingdom |

2 |

3 |

5 |

|

|

Taiwan |

1 |

5 |

5 |

|

|

Mexico |

1 |

3 |

4 |

Was

failure to comply with GMP a possible cause of non-payment?

Among those who did not pay the user fees were companies that have been in the news for failure to comply with good manufacturing practices (GMPs).

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

However, the number of companies that did not register because of a failure to comply with current GMP requirements is a small fraction of the 265-odd facilities that did not re-pay the necessary fees .

There were 21 new facilities which paid to join the US generic drug supply chain in FY2018. These new facilities, which manufacture APIs and fixed dosage forms (FDFs), are located in the United States, Europe, India and China.

Our

view

Pharmaceutical manufacturing facilities don’t get created overnight. It takes years for them to refine their practices and comply with the FDA’s stringent compliance standards.

With more than 265 facilities not continuing to be part of the US generic supply chain, it is important to investigate whether the firms are simply delaying payments or is the business climate preventing companies from wanting to manufacture generic drugs for the US?

Since over 80 percent of all prescriptions filled in the United States are for generic drugs, if the US wants continued access to safe and affordable generic drugs, it will have to look into reasons behind companies falling out of the US generic supply chain. The answers to the question raised by us in the previous paragraph will be critical.

For, if the US doesn’t seek answers and looks for solutions, the generic supply chain of the world’s largest pharmaceutical market could surely be at risk.

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : GENERIC DRUG USER FEE ACT FACILITY PAYMENTS by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”