Global

pharmaceutical companies are increasingly focusing on the development of new

biologics. In fact, in 2016, nine out of the top

15 pharmaceutical drugs by sales were of biologic origin. This makes us wonder

what the future holds for manufacturers specializing in drugs that originate

from chemical synthesis.

This

week, PharmaCompass continued its analysis of the top pharma drugs by

sales to evaluate the drugs that registered large sales growth in 2016.

Click here to Access All the 2016 Data (Excel version available) for FREE!

Please

note that these are not the top-selling drugs, but are the top 10 drugs that

registered the maximum growth in global sales over 2015.

Interestingly, things didn’t appear that bad for drugs originating from chemical synthesis — while the top two drugs on the list were biologics, the remaining originated from chemical synthesis.

Here’s a list of drugs that witnessed the largest sales growth in 2016:

1. Opdivo (nivolumab) – Bristol-Myers Squibb

2016

sales: US$ 3,774 million

2015 sales:

US$ 942 million

Sales

growth: US$ 2,832 million

First

approved in 2014, Bristol-Myers Squibb’s Opdivo and Merck’s Keytruda — also known as checkpoint inhibitors — continued to stay on track to be among the top 20 best-selling drugs in the world by 2020. They represent the hot new field of immunotherapy and are known to have given 90-year old Jimmy Carter (former President of the United States) hope in his fight against cancer.

With

a sales growth of US$ 2.832 billion, Opdivo registered the highest sales growth

of any single drug in 2016. However, Bristol-Myers Squibb received a nasty

surprise last year when Opdivo did not demonstrate the desired slowdown in the

progress of advanced lung cancer in a trial, as compared to conventional

chemotherapy.

While Bristol-Myers’ stock price plunged on this news, Merck announced that not only did Keytruda succeed in a clinical trial as an initial treatment for advanced non-small cell lung cancer, but patients actually lived longer. Although Keytruda did not make it to our list of top 10 drugs by sales growth in 2016, it did register a sales increase of US$ 836 million, as its sales grew from US$ 566 million to US$ 1,402 million.

Click here to Access All the 2016 Data (Excel version available) for FREE!

2. Humira (adalimumab) – AbbVie

2016

sales: US$ 16,078 million

2015

sales: US$ 14,012 million

Sales

growth: US$ 2,066 million

Abbvie’s Humira (adalimumab)

juggernaut continued as it not only remained the best-selling drug in the

world, but also added another US$ 2 billion to its 2015 sales by generating

record sales of US $16.078 billion in 2016.

Last

year, the US Food and Drug Administration (FDA) approved Amgen’s Amjevita™ (adalimumab – atto) — a biosimilar of Humira®. Therefore, it remains to be seen if Humira will be able to sustain the momentum. Amjevita was approved for treating adults with a variety of medical conditions ranging from rheumatoid arthritis, plaque psoriasis, to ulcerative colitis.

3. Epclusa (sofosbuvir and velpatasvir) – Gilead

2016

sales: US$ 1,752 million (new launch)

Gilead’s third sofosbuvir-based regimen — Epclusa (sofosbuvir and velpatasvir) was approved by the US FDA in June 2016. It is the first and only all-oral, pan-genotypic single tablet regimen for chronic Hepatitis C virus infection. While Epclusa registered an impressive start, Gilead's other two sofosbuvir-based treatments — Sovaldi (sofosbuvir) and Harvoni (sofosbuvir and lepidasvir) — saw their combined sales decline by almost US$ 6 billion.

Click here to Access All the 2016 Data (Excel version available) for FREE!

4. Imbruvica (ibrutinib) — Johnson & Johnson / AbbVie

2016

sales: US$ 3,083 million

2015

sales: US$ 1,443 million

Sales

growth: US$ 1,640 million

Abbvie’s 2015 US$ 21 billion buy of Pharmacyclics seems to be paying off.

The Pharmacyclics buy was a way to get access to Imbruvica (ibrutinib), a cancer drug which

is co-marketed with Johnson & Johnson. It generated sales of US$ 3.083 billion in 2016. Imbruvica works by blocking a specific protein called Bruton’s tyrosine kinase (BTK). In December 2011, Johnson & Johnson said it would pay Pharmacyclics as much as US$ 975 million to fund getting the drug to market in exchange for half the profits generated globally.

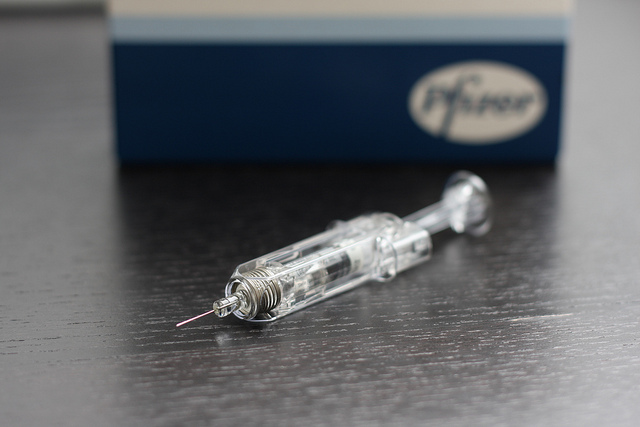

5. Eliquis (apixaban) -

Bristol-Myers Squibb / Pfizer

2016

sales: US$ 3,342 million

2015

sales: US$ 1,860 million

Sales

growth: US$ 1,483 million

Although

apixaban was the third-to-market

novel oral anticoagulant (NOAC), which is co-promoted by Pfizer and Bristol-Myers Squibb as Eliquis, it continues to unseat Johnson & Johnson’s Xarelto (rivaroxaban) as the leader in its

class based on total prescriptions. Rivaroxaban's total 2016 sales were US$

5.392 billion.

While Pfizer’s reports its sales as part of Alliance revenues, and exact sales are not known, Bristol-Myers Squibb results alone put Eliquis in the top 10 list. Generics are hot on their tail as, last month, Pfizer and Bristol-Myers’ filed suits against 16 generic makers to uphold their patents for apixaban.

6. Genvoya (elvitegravir,

cobicistat, emtricitabine, tenofovir alafenamide) — Gilead

2016

sales: US$ 1,484 million

2015

sales: US$ 45 million

Sales

growth: US$ 1,439 million

Genvoya has been the most

successful HIV treatment launch since the introduction of Atripla (the first

single-tablet regimen launched a decade ago). Gilead is the dominant HIV

player in the US market and has the top three most-prescribed HIV regimens in

the US.

Genvoya

adds Tenofovir Alafenamide (TAF) to already known

treatments. TAF based drugs have demonstrated a better safety profile. They

would also allow Gilead to maintain its dominance in the HIV market.

Click here to Access All the 2016 Data (Excel version available) for FREE!

7. Ibrance (palbociclib) — Pfizer

2016

sales: US$ 2,135 million

2015

sales: US$ 723 million

Sales

growth: US$ 1,412 million

Discovered

in Pfizer laboratories and approved by the US

FDA in February 2015, Ibrance is used in combination

with Letrozole as a first-line

treatment of postmenopausal women with estrogen receptor-positive, human

epidermal growth factor receptor 2-negative (ER+/HER2-) metastatic breast

cancer.

8. Triumeq (abacavir,

dolutegravir, lamivudine) – GlaxoSmithKline

2016

sales:US$ 2,151 million

2015

sales: US$ 905 million

Sales

growth: US$ 1,246 million

GlaxoSmithKline's HIV drugs business — ViiV Healthcare — has been enjoying sales growth with the introduction of Triumeq ® in its portfolio. While GSK is the major shareholder in ViiV Healthcare, Pfizer and Shionogi also have a stake. Triumeq® is the company’s first fixed-dose combination tablet for a once-daily single pill regimen that combines dolutegravir, an integrase inhibitor, with the nucleoside reverse transcriptase inhibitors — abacavir and lamivudine.

9. Revlimid (lenalidomide) – Celgene

2016

sales: US$ 6,974 million

2015

sales: US$ 5,801 million

Sales

growth: US$ 1,173 million

Celgene’s Revlimid (lenalidomide) — a thalidomide-derivative introduced in 2004 as an immunomodulatory agent for the treatment of various cancers such as multiple myeloma — brought in US$ 5.8 billion in 2015, and grew another 20 percent this year, to US $6.974 billion. Revlimid now contributes more than 60 percent to Celgene's total sales of US$ 11.229 billion.

10. Xarelto (rivaroxaban) – Johnson & Johnson (US) and Bayer

2016

sales: US$ 5,392 million

2015

sales: US$ 4,255 million

Sales

growth: US$ 1,137 million

Bayer’s Xarelto, which is promoted by Johnson & Johnson in the United States, provided patients with an alternative to the old-guard therapy — warfarin. While rivaroxaban is competing with other

novel oral anticoagulants (NOAC) like Eliquis (apixaban) and Pradaxa (dabigatran), rivaroxaban has the

class lead in indications.

Xarelto

recently posted positive results in a large-scale Phase 3 study —COMPASS, involving 27,402 patients, that assessed the effect of the

blood thinner in preventing major adverse cardiac events (MACE).

The

trial was stopped a year early

on the advice of an independent Data Monitoring Committee, after the primary

endpoint of prevention of MACE (which includes cardiovascular death, myocardial

infarction and stroke) reached its pre-specified criteria for superiority over aspirin.

Click here to Access All the 2016 Data (Excel version available) for FREE!

Our

view

In QuintilesIMS Institute’s new annual drug spending report, analysts have forecasted that

over the coming five years the industry should continue to receive 40 to 45 new

drug approvals every year.

A quarter of all the drugs in late-stage development are now

focused on oncology. The rate of oncology drug development has hit such a

rapid pace that new drugs are superseding old ones in a matter of a few years.

It’s clear that this compilation will see radical changes next year. However, with eight out of the 10 fastest-selling drugs coming from chemical synthesis, traditional generic manufacturers still have a lot of opportunities to explore.

Sign up,

stay ahead

In order to stay informed,

and receive industry updates along with our data compilations, do sign up for

the PharmaCompass Newsletter and you will receive updated information as

it becomes available along with a lot more industry analysis.

Click here to Access All the 2016 Data (Excel version available) for FREE!

Impressions: 9289

Within two

months of 2017, we have already seen several pharmaceutical companies come

under the regulatory lens and face action.

This week, PharmaCompass

does a compliance recap, wherein companies like Pfizer saw lapses in their current good

manufacturing practices (cGMPs) and companies in India, like Dr. Reddy’s and Cadila Healthcare, who received warning letters in the

past, were busy with regulatory re-inspections at the erring sites.

Pfizer’s US facility receives a warning letter from the FDA

Pfizer’s fill/finish manufacturing facility in the United States recently received a warning letter from the US Food and Drug Administration (USFDA). This information was revealed in a press release

issued by Momenta Pharmaceuticals a

biotechnology company developing a generic version of Teva’s long-acting Copaxone® 40mg/mL (glatiramer acetate injection).

Momenta’s Glatopa 20 mg/mL product is already

available in the US market and is promoted by Sandoz, which in turn has contracted the fill/finish manufacturing operation to Pfizer’s facility in McPherson, Kansas.

In February 2015, Pfizer

acquired the McPherson site through its US $17 billion acquisition

of Hospira. Pfizer was aware of Hospira's manufacturing record when it struck

the deal to buy the drugmaker as the company was issued FDA warning letters on four of the seven continents

Europe, North America, Asia and Australia.

While previous FDA inspections

at the McPherson facility had raised concerns over the assurance of product

sterility, no warning letter had ever been issued to this site.

This has been the first

positive news for Teva this year, after a series of setbacks. Copaxone

had generated US $ 4.22 billion in sales

last year.

And as per Momenta’s press statement, “Glatopa 40 mg ANDA (abbreviated new drug application) remains under regulatory review.” While Momenta says it is working with Sandoz to resolve the matter, it is of the view that “an approval in the first quarter of 2017 is unlikely.”

“Pfizer has indicated that the warning letter does not restrict the production or shipment of the Glatopa 20 mg (glatiramer acetate injection) product,” Momenta stated in its press release.

The Pfizer warning letter

will also be welcome news for Mylan as it had recently won a court ruling where four Orange Book-listed patents relating to Copaxone® 40 mg/mL were invalidated based on obviousness. Mylan has “filed a substantially complete ANDA” for a three times per week Glatiramer Acetate Injection 40 mg/mL.

Baxter’s cGMP deficiencies result in US$ 18 million settlement

Last

month, Baxter International and Baxter Healthcare Corporation settled a type of civil lawsuit that

whistleblowers are known to bring. It was settled under the False Claims Act

(FCA) case with the Department of Justice (DOJ) for US$ 18 million.

The

settlement in which there was

neither an admission of liability by Baxter nor a concession by the United States that its claims are not well founded was an outcome of the government alleging that Baxter submitted false claims for a drug sold to the Department of Veterans Affairs and Department of Defense, as well as reimbursed by the Medicare and Medicaid programs, because the drug was “adulterated.”

A detailed blog written by Stephanie Trunk and Emily M. Leongini

highlights that the issue emanated from the “presence of visible mold on HEPA filters installed above the clean rooms” where Baxter manufactured sterile intravenous (IV) solutions. The managers at Baxter prevented the relator and others from removing the moldy filters and from cleaning or sanitizing other associated contaminated surfaces, says the complaint.

This

handling of the moldy filters by Baxter allegedly violated numerous cGMP

requirements set forth in the FDA regulations. This includes the requirement

that a manufacturer establish, and also follow, its own internal standard

operating procedures.

While the government acknowledged that there was no evidence to suggest that Baxter’s IV solutions had been impacted by the moldy filters, it alleged that the IV solutions violated the FCA because of “Baxter’s failure to comply with cGMP requirements.”

In

the past, cGMP violations have had the DOJ collect US$ 750 million from a GSK subsidiary in 2010 and US$ 500

million from Ranbaxy in India in 2013. With an increasing trend of warning letters being issued by the FDA to pharmaceutical manufacturers, it remains to be seen if DOJ will further “highlight the materiality of cGMP compliance to product purchases in support of FCA claims”.

Zydus turns around compliance problems with a zero 483 inspection

Zydus’ Moraiya (Gujarat, India) facility accounted for 60 percent of Cadila’s revenues

in the US, its largest market. In an inspection performed by the FDA in

September 2014, the investigators found that in 2013, Cadila had failed to

adequately review 106 consumer complaints (out of 106 complaints received) and

in 2014, up to the date of the inspection, they failed to adequately review

another 132 consumer complaints (out of 132 complaints received).

While at the time of the

inspection, Cadila had already taken the decision to recall products like Warfarin 2 mg (due to oversized tablets), Promethazine 25 mg (due to mixed tablets in the

same bottle) and Atenolol 25 mg (due to “thicker appearance”), the inspectors got “no assurance” that the quality system at Cadila was under control and stated that the “deficiency appears to be a pattern of problem” at the Cadila site.

Zydus

received a warning letter from the FDA in December 2015. Last week, Zydus announced

that it did not receive any observations from the USFDA for its formulation facility at Moraiya,

which indicates a successful resolution of the compliance at the plant.

The

company said that the USFDA inspected the plant from February 6 to 15.

What’s next at Dr. Reddy’s and Marksans in India?

Marksans Pharma, a company with a questionable compliance track record, saw its manufacturing facility in Goa (India) fail an inspection by the UK drug regulator last year. The inspectors noted critical data integrity violations which included “evidence of destruction of multiple parts of records of prime data”.

In

a filing with the Bombay Stock Exchange (BSE), the company announced that its plant in Goa had an inspection by the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) from February 14-17, 2017. The inspection was completed without any critical observations, the company informed. It is now awaiting further instruction from the agency in this regard.

In a similar announcement, Dr. Reddy’s informed the bourses that its Miryalaguda facility has been issued a Form 483 by the USFDA with three observations, which the company is addressing. The audit of the company’s API manufacturing plant at Miryalaguda by the USFDA was completed on February 21, 2017.

Back

in November 2015, the same facility had received

a warning letter after FDA inspectors found partially-filled documents in the garbage.

Our view

Over

the past years, we have seen compliance concerns being raised time and again at

pharmaceutical manufacturing operations. Last week, Sato Pharmaceutical, a

company established in 1939 in Japan, received a warning letter from the FDA as it

failed to establish an adequate system for monitoring the conditions of its

cleanroom environments.

Prior to that, FDA’s April 2016 inspection of ACS Dobfar’s operations in Brazil Antibioticos do Brasil (ABL)

led to the issuance of a warning letter after

the FDA investigators found that the filling zone for sterile injectable

product was not sufficiently robust.

While

data integrity concerns dominated news headlines last year, it seems that

aseptic fill/finish may become a leading cause of concern with regulators.

It’s clear that manufacturing can no longer be taken for granted as companies of all sizes are suffering economically from their inability to comply with good manufacturing practices.

Impressions: 7176

Two weeks before the end of 2015, PharmaCompass compiled a list

of all the non-compliances issued in 2015 by major

global regulatory agencies.

Little did we know that, while the world was wrapping up for

the holidays, the U.S.

Food and Drug Administration (FDA) would be busy issuing warning

letters to Sun

Pharmaceuticals (Sun) and Cadila

Healthcare Ltd (Cadila / Zydus Cadila).

The facilities cited in the warning letters, for both Indian generic majors, are primary contributors to their revenues in the United States. While Sun’s Halol facility was cited in the warning letter, in Cadila’s case, the warning letter was issued for violating manufacturing standards at two of their production facilities, Zyfine and Moraiya. Data integrity issues at ZyfineThe data

integrity violations mentioned in the warning letter related to Zyfine, which

produces active pharmaceutical ingredients (APIs), did not come as a complete

surprise.PharmaCompass had covered most of

the data integrity concerns mentioned in the warning letter in May 2015 (read: Serious GMP concerns

uncovered at Lupin (ANVISA) and Zydus Cadila (USFDA)) Zyfine had glaring

data-integrity observations which ranged from:

Records were not made readily available during the inspection; the Vice President, Corporate QA stated that the requested document was located at an employee’s home.

During

the FDA walk through the inspectors found five original and rewritten

records, which were falsified.

Inspectors

found rough notebooks in the scrap yard as well as the engineering and QA

offices.

Documents

were signed and dated by individuals who were not present at the site.

Reprocessing

was performed without review and approval of the quality unit.

Batch

records were not reviewed by production and QA personnel before release.

Washing

and toilet facilities lacked soap.

Cadila’s response stating that papers found were “personal notebooks intended only for meeting and other discussion notes” failed to sway the FDA.

A turnaround challenge at MoraiyaThe Moraiya

facility accounts for 60 percent of Cadila’s revenues in the United States, its largest market,

had no data integrity issues mentioned in the warning letter. However,

the task ahead for Cadila is formidable since PharmaCompass reviewed the Form

483 issued to the Moraiya facility by obtaining it from FDAZilla.com. The

September 2014 inspection found that, in 2013, Cadila had failed to adequately

review 106 consumer complaints (out of 106 complaints received) and in 2014, up

to the date of the inspection, they failed to adequately review another 132

consumer complaints (out of 132 complaints received).At the time

of the inspection, Cadila had already taken the decision to recall products

like Warfarin 2mg (due to oversized tablets), Promethazine 25mg (due to mixed tablets in the

same bottle) and Atenolol 25mg (due to “thicker appearance”). However, the inspectors got “no assurance” that the quality system at Cadila was under control and stated that the “deficiency appears to be a pattern of problem at your site”.Eleven responses later, the FDA still remained unconvinced and mentioned, in the warning letter, that “persistent failures indicate that your manufacturing process is not in a state of control.”

“Bottles containing Zydus (Cadila) products mixed with other Zydus (Cadila) products”At Moraiya, Cadila’s use of the same packaging line to bottle different products created problems as nine customer complaints were received “of bottles containing Zydus (Cadila) products mixed with other Zydus (Cadila) products”.The view at the time of the inspection was that the “mix-up might have taken place possibly at the pharmacy” which did not convince the FDA inspectors since the “two mixed products contained within the complaint bottle, were packaged on the same line at the same facility”. As a result of the FDA’s inspection, Cadila re-opened investigations related to the nine consumer complaints about product mix-ups and found manufacturing deficiencies that could have led to the mix-ups.

While Cadila initiated a product recall of several lots, the FDA still believes that the scope of Cadila’s activities are insufficient. Facility problems at Sun

Pharmaceuticals In the case of Sun Pharmaceuticals, the warning letter wasn’t a complete surprise for us.

PharmaCompass had asked the question almost 6 months ago, “Sun has a new quality head, why?” and subsequent news indicated that Sun’s problems were more than just their integration challenges with the acquisition of Ranbaxy.

However, on reviewing the warning letter issued by the FDA, the alarming concern about Sun’s sterile manufacturing operations is that the FDA found their “aseptic processing

equipment is not properly designed”.

Smoke studies or unidirectional airflow studies are performed to determine how the movement of air and personnel during aseptic operations could pose risks to product sterility. Almost every warning letter issued to sterile manufacturing operations is related to an organization’s inability to conduct smoke studies to the level of FDA’s expectations.

In Sun’s case, the concerns related to the adequacy of the facility were to be addressed by conducting smoke studies, by November 15, 2014.

However, their three responses dated December 12, 2014; February

10, 2015; and May 5, 2015 did neither submit a revised smoke test nor a

satisfactory new smoke study.

Sun’s case was definitely not helped by the fact that during the inspection, the inspector documented the “presence of leaks in the form of water stains and ceiling damage in the parenteral manufacturing area personnel corridor. The FDA investigator observed

buckets with water collected from ceiling leaks and other leaks in this

manufacturing area.”

The FDA in their warning letter has asked Sun to describe

any major equipment and facility upgrades that are planned.

It seems that without changes in the physical infrastructure at Sun’s Halol facility, a key anchor to their business in the United States, it will not meet the FDA’s expectations. Our View

Manufacturing non-compliances dominated pharmaceutical news

headlines last year.

As we’re still at the early stage of 2016, where people are making New Year resolutions, the big resolution manufacturers should make is what the FDA clearly says in their warning letter to Sun Pharmaceuticals.

“It is essential that executive management systematically improve their oversight of manufacturing quality to ensure sustainable quality assurance”.

View our UPDATED

non-compliances compilation In case you missed some of the compliance news, PharmaCompass

has compiled all the FDA Warning Letters, Import Alerts and EDQM (European Directorate for the Quality of Medicines) Non-Compliance Reports issued in 2015

for easy access. A special word of thanks to FDAZilla.com –makes actionable FDA information accessible.

Impressions: 15163