By PharmaCompass

2018-08-02

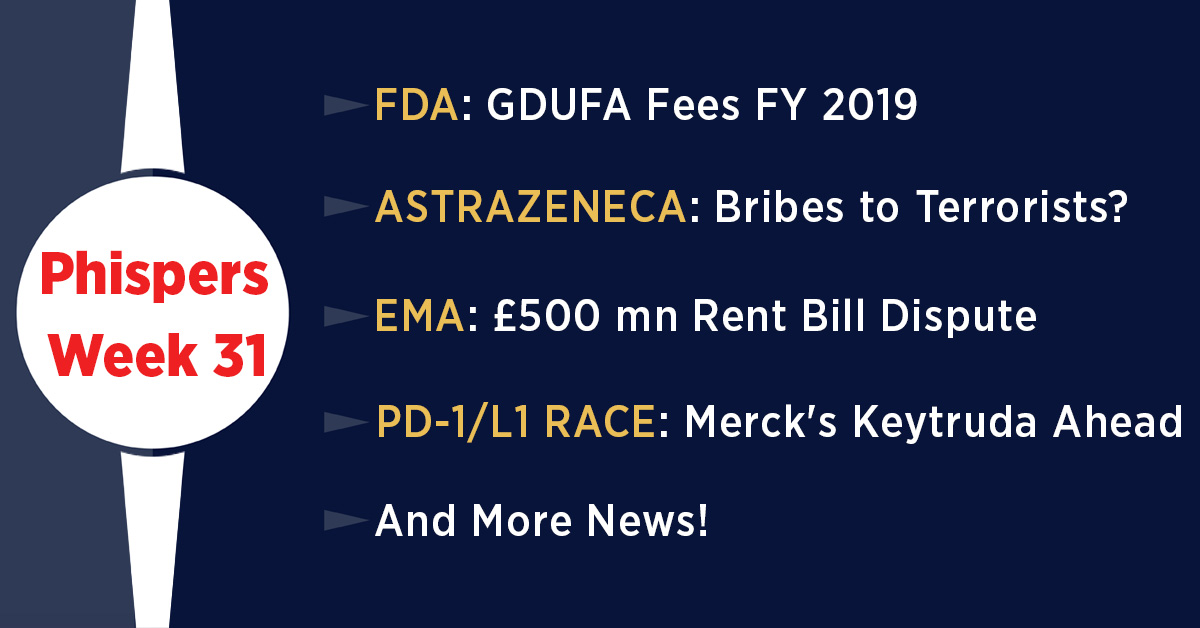

Impressions: 2741

This week, Phispers brings you the FY19 user fee schedule under GDUFA II, released by the USFDA, which saw a significant hike for generic drug applicants. For the first time since its launch in 2014, Merck’s Keytruda beat Bristol-Myers Squibb’s Opdivo in the battle of PD-1/L1 oncology drugs. Bayer finally stopped selling Essure contraceptive device in the US after a CNN report and a documentary on Netflix revealed more damaging evidence on how its harmed women. The USFDA also published its first-ever list of surrogate endpoints in order to accelerate drug development. AbbVie’s Humira faced viability concerns in Europe as the fourth biosimilar — this time from Novartis — bagged approval. And EMA’s landlord in London took the agency to court and asked it to keep paying rent, amounting to US$ 660 million, despite its imminent move to Amsterdam.

FDA

announces generic user fees for upcoming year

The US Food and Drug Administration (FDA) released its GDUFA II user fees for fiscal 2019. It included a significant hike for generic drug applicants.

The new GDUFA II fees will come into effect on October 1. It raises large-size operation generic drug applicant program user fees from US$ 1,590,792 to US$ 1,862,167. For medium-scale operations, the fee has been increased from US$ 636,317 to US$ 744,867, and for small operations the fee jumps from US$ 159,079 to US$ 186,217.

On the generics side, the fee for Abbreviated New Drug Applications (ANDAs) had increased by more than US$ 100,000 last year — from US$ 70,480 in 2017 to US$ 171,823 in 2018. This year, the fee increase is less than US$ 10,000 — from US$ 171,823 to US$ 178,799.

|

Fee category |

GDUFA II fee for FY 2019* |

GDUFA II fee for FY 2018 |

|

Applications |

||

|

ANDA |

178,799 |

171,823 |

|

DMF |

55,013 |

47,829 |

|

Facilities |

||

|

Domestic API facility |

44,226 |

45,367 |

|

Foreign API facility |

59,226 |

60,367 |

|

Domestic FDF facility |

211,305 |

211,087 |

|

Foreign FDF facility |

226,305 |

226,087 |

|

Domestic CMO facility |

70,435 |

70,362 |

|

Foreign CMO facility |

85,435 |

85,362 |

|

GDUFA program |

||

|

(20+ANDAs) Large-size operation generic drug applicant program |

1,862,167 |

1,590,792 |

|

(6-19 ANDAs) Medium-size operation drug applicant program |

744,867 |

636,317 |

|

(1-5 ANDAs) Small business generic drug applicant program |

186,217 |

159,079 |

*The fee is applicable from October 1, 2018, until September 30, 2019.

The fee for drug master files (DMFs) will go up from US$ 47,829 to US$ 55,013.

GDUFA II stipulates that user fees should total US$ 493,600,000 annually, adjusted each year for inflation. FDA utilized data from ANDAs submitted from October 1, 2013, to April 30, 2018, to estimate the number of new original ANDAs that will incur filing fees in FY 2019. For FY 2019, the FDA estimates that approximately 918 new original ANDAs will be submitted and incur filing fees.

Bernstein analyst Ronny Gal said FDA is seeing a “sharp reduction in small companies participating in the generic industry … We do not believe we are close to the bottom yet.”

Merck’s Keytruda leaps ahead of BMS’ Opdivo in PD-1/L1 race

In what may seem like an epic battle of PD-1/L1 blockbusters, Merck & Co.’s Keytruda beat Bristol-Myers Squibb’s Opdivo for the first time since its launch in 2014. Keytruda sales have been growing sequentially every quarter.

PD-1/L1 inhibitors are a novel group of checkpoint inhibitors being developed for the treatment of cancer. PD-1 and PD-L1 are both proteins present on the surface of cells. These immune checkpoint inhibitors are emerging as a front-line treatment for several types of cancer.

Keytruda earned US$ 1.66 billion during the second quarter — an 89 percent increase over the same period just a year ago. BMS reported Opdivo earnings of US$ 1.62 billion — up 36 percent — during the same period.

Merck is betting big on PD-1/L1. It is working on more than 750 clinical trials involving PD-1. The drugmaker sees a lot of room for growth in the lucrative lung cancer market. The Keytruda-chemo combo has received a recommendation from the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP), setting it up for a go-ahead from the agency.

In April, at the annual meeting of the American Association for Cancer Research, Merck had rolled out results showing that the Keytruda-chemo tandem could cut patients’ risk of death by 51 percent. These facts, mostly likely, helped Keytruda overtake Opdivo.

Bayer

stops selling risky contraceptive, AstraZeneca probed on bribes to Iraqi

terrorists

An analysis done by CNN has revealed that German drug giant Bayer paid US doctors millions of dollars to prescribe a risky contraception device — Essure — that left thousands of women in pain.

The CNN report coincided with the release of a documentary on the device — The Bleeding Edge — on Netflix.

The film explores the undesirable relationship between medicines and money in the US by narrating the story of this device and the harm it caused the women who used it.

Last week, Bayer announced it would stop selling Essure in the US after the FDA raised more concerns over the device.

The FDA had been inundated with tens of thousands of reports claiming that the device tore the uterus and Fallopian tubes and moved into the abdomen of patients, but the agency stopped short of recalling it. In April this year, the FDA had ordered Bayer to implement additional safety measures on Essure.

According to the CNN, Bayer paid US$ 2.5 million to 11,850 physicians for services related to Essure from August 2013 through December 2017.

Essure was approved by the FDA in 2002, becoming the only form of non-surgical permanent birth control available in the US. The device is a tapered metal spring, about two inches long, which is inserted into the Fallopian tubes, blocking sperm from fertilizing the egg.

But in 2013, horror stories started emerging. As complaints mounted and demand slipped, Bayer stopped Essure sales in Canada, Europe, South America, South Africa and the UK.

Despite 16,000 lawsuits, the documentary, the CNN report, thousands of reports to the FDA, penalties from the FDA, and its own ‘business decision’ to effectively recall Essure, Bayer said in a statement last week that the “safety profile of Essure...remains positive and unchanged”.

Meanwhile, the US Department of Justice is probing claims that AstraZeneca bribed Iraqi terrorists to win contracts.

AstraZeneca was named in an October 2017 lawsuit alleging the company paid bribes to a terrorist-run Ministry of Health in Iraq.

Last year, more than 100 veterans had filed a lawsuit against several drugmakers, alleging they financed terrorism by paying bribes to win contracts with the Iraqi Ministry of Health. Now, the DOJ is investigating similar claims. And according to a security filing by AstraZeneca, the company is part of the probe.

FDA

publishes list of surrogate endpoints to accelerate drug development

Last week, the FDA published the first-ever list of surrogate endpoints, giving sponsors the first concrete suggestions for the kinds of laboratory measures or physical signs that might help develop drugs even when clinically meaningful data proves elusive.

The list, created due to the 21st Century Cures Act, includes surrogate endpoints that sponsors have used as primary efficacy clinical trial endpoints for approval of new drug applications (NDAs) or biologics license applications (BLAs). It also includes surrogate endpoints that may be appropriate for use as primary efficacy clinical trial endpoints for drug or biologic approvals, although they have not yet been used to support an approved NDA or BLA.

The list, which will be updated every six months, features surrogate endpoints for numerous diseases including acromegaly, different cancers, chronic kidney disease, cystic fibrosis, hepatitis A, B and C, HIV, hypertension and osteoporosis, among others.

The FDA stresses that sponsors still need to clear plans with the review divisions of the Center for Biologics Evaluation and Research (CBER) or the Center for Drug Evaluation and Research (CDER) before starting trials, because the proposed surrogates will only be accepted on a “case-by-case” basis.

According to section 507(e)(9) of the Food Drug & Cosmetic Act, “[t]he term ‘surrogate endpoint’ means a marker, such as a laboratory measurement, radiographic image, physical sign, or other measure, that is not itself a direct measurement of clinical benefit, and (A) is known to predict clinical benefit and could be used to support traditional approval of a drug or biological product; or (B) is reasonably likely to predict clinical benefit and could be used to support the accelerated approval of a drug or biological product in accordance with section 506(c).”

AbbVie’s Humira just about beats forecasts; its biosimilar from Novartis gets nod

The world’s best-selling prescription medicine — AbbVie’s Humira — barely beat its sales forecasts last quarter. Humira made US$ 5.19 billion in second-quarter sales, when on an average analysts had expected US$ 5.18 billion in sales. This has raised concerns about the drug’s viability in the future.

Humira accounts for two-thirds of the overall sales for AbbVie. But as cheaper biosimilar versions come closer to entering the market, AbbVie could lose share and be forced to slash prices to remain competitive, analysts have said.

Meanwhile, a division of Novartis — Sandoz — received European Commission’s approval for its Humira biosimilar — Hyrimoz (adalimumab). Hyrimoz has been approved for use in all indications of Humira, including rheumatoid arthritis, plaque psoriasis, Crohn's disease, uveitis and ulcerative colitis.

This is the fourth Humira biosimilar to bag the nod in Europe. The other companies that have bagged nods for their Humira biosimilars are Amgen (Amgevita and Solymbi), Boehringer Ingelheim (Cyltezo) and Samsung Bioepis (Imraldi).

AbbVie CEO Richard Gonzalez reiterated the company’s current strategy of signing agreements with rival drugmakers to delay the launch of Humira copies.

“There’s a lot of skepticism, concerns about rebates and biosimilars. Some of that is quite reasonable,” Gonzalez told analysts. “(But) every year since I can remember, there has been fretting about Humira.”

Intas, Coherus take lead in Europe with EMA nods for Neulasta biosimilars: EMA’s Committee for Medicinal Products for Human Use (CHMP) recommended 16 medicines for approval, including two orphan medicines, at its July 2018 meeting.

This includes marketing authorization of Coherus BioSciences’ Udenyca (formerly CHS-1701), a pegfilgrastim (Amgen’s Neulasta) biosimilar candidate. Another Neulasta biosimilar — Pelgraz — from Accord Healthcare (an arm of Indian drug major Intas Pharmaceuticals Ltd) also received green signal from the CHMP.

The current market for pegfilgrastim in the EU is about half a billion euros.

This spells bad news for Biocon-Mylan. In July last year, Biocon’s biosimilar program had suffered a serious setback as a current Good Manufacturing Practices (cGMP) inspection by the French health agency — ANSM — in March 2017 of its site located in Bengaluru, India, had uncovered 35 deficiencies, of which 11 were deemed major.

The inspection was conducted on behalf of the EMA as a pre-approval inspection for the drug product manufacturing activities of the following biosimilar products — Fulphila (pegfilgrastim), Ogivri (trastuzumab) and Semglee (insulin glargine). In August 2017, Biocon withdrew its applications for pegfilgrastim and trastuzumab and then resubmitted them in December 2017.

In June this year, the USFDA had approved Mylan and Biocon’s pegfilgrastim biosimilar. Though Biocon/Mylan’s Fulphila has gained an edge in the US, Coherus’ Udenyca and Intas’ Pelgraz have taken a lead in Europe.

EMA’s landlord in London says keep paying rent; takes agency to court

It’s not always easy for a tenant to vacate premises. The European Medicines Agency, which is moving from London to Amsterdam because of Brexit, has been taken to court by its landlord in the UK. The reason — the landlord wants EMA to keep paying a rent bill estimated at around 500 million pounds (US$ 660 million).

EMA had signed a 25-year lease in 2014 on its premises in London’s Canary Wharf, but it now argues Brexit amounts to an unforeseen event of “frustration” of the lease, while the property owner strongly disagrees.

Property owner Canary Wharf T1 Ltd has taken the case to court, asking a judge to enforce the lease. The outstanding bill for the remainder of the lease, including service charges and rates, is around US$ 660 million.

“We feel that the EMA should continue to comply with their freely negotiated legal obligations,” a spokesman said.

“We have been working with the EMA for nine months to see if they can resolve the issue. However, we are seeking this declaration so that the EMA is clear that its lease obligations will not be affected by Brexit,” the spokesman added.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : #Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”