Now that it has been

established that the novel coronavirus is going to globally impact the drug

supply chain, it becomes imperative to analyze the extent of the impact.

Since the outbreak of

the novel coronavirus — COVID-19 — in December, PharmaCompass has been constantly reaching out to

manufacturers around the world to assess the current state of the drug supply

chain. This week, we share our preliminary analysis based on the feedback we

have received from drug manufacturers around the world.

Drug shortages are

for real

Last week, the US

Food and Drug Administration (FDA) announced the first human drug shortage

as a result of the coronavirus outbreak. In addition, the FDA announced it was

tracking 20 drugs that could face shortages. Some generic drugmakers are predicting shortages

as early as in June or July, due to the novel coronavirus.

The FDA did not disclose the name of the drug in shortage or the 20 drugs it is tracking, as this is considered ‘confidential commercial information’.

In India, a committee constituted by the country’s Department of Pharmaceuticals started monitoring the availability of 58 active pharmaceutical ingredients (APIs) to take preventive measures

against illegal hoarding and black-marketing in the country.

According to a report published in The Economic Times, after

reviewing the list of drugs, 34 were found to have no alternatives which

include critical and essential drugs like potassium clavulanate, ceftriaxone sodium sterile, piperacillin tazobactam, meropenem, vancomycin, gentamycin and ciprofloxacin.

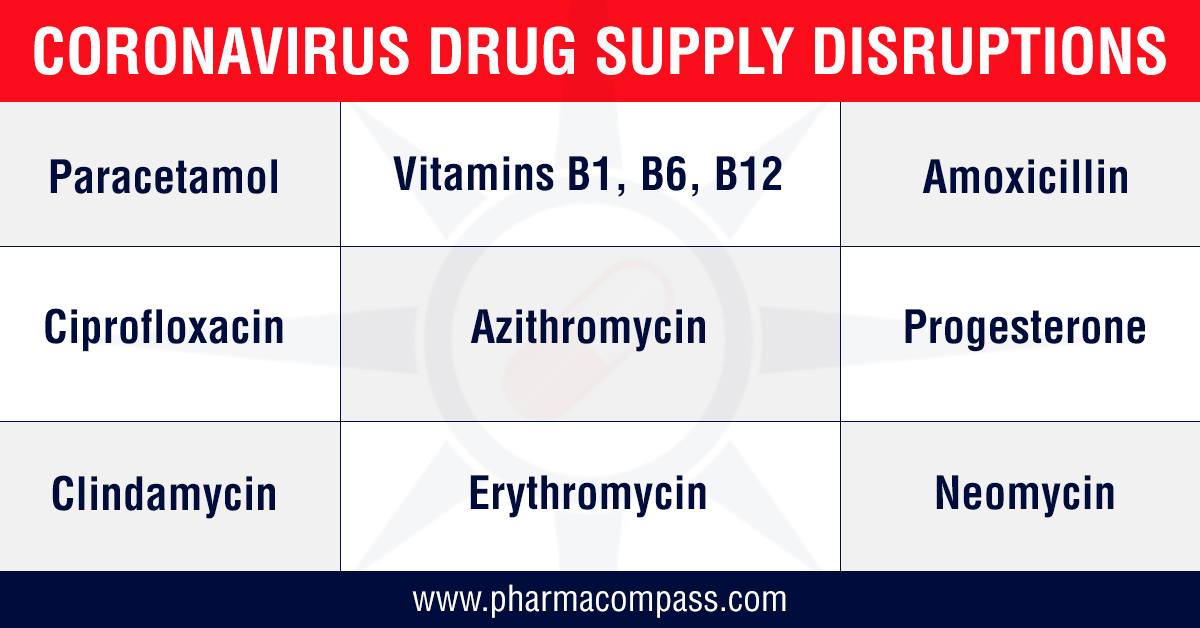

This was immediately

followed by the Indian government restricting the exports of 13

APIs along with some of their finished formulations. The list includes paracetamol, tinidazole, metronidazole, acyclovir, vitamin B1, vitamin B6, vitamin B12, progesterone, chloramphenicol and neomycin. For most

of the products on this list, India is a net importer, as there is little

domestic manufacturing of these APIs.

COVID-19 is also

likely to impact bottomlines. Leading generic drugmaker Mylan said it expects the coronavirus outbreak to impact its financial results

while some of the largest drugmakers — including AstraZeneca, Merck and Pfizer — have said that the coronavirus outbreak could affect their supplies or sales.

Paracetamol

affected; prices double in less regulated markets

The decline in industrial activity in China is certainly taking its toll, as drugs which are on the World Health Organization’s Model list of Essential Medicines are beginning to face significant price increases in the wake of disruption of key starting raw materials for bulk drugs.

The export

restriction out of India on commonly used analgesic, Paracetamol — sold under the brand names such as Tylenol (in the US), Panadol (in the UK), Dafalgan (France) and Crocin

(India) — is not surprising as the API has witnessed almost doubling of prices in less regulated markets because exports of its key building block para-amino phenol (PAP) have dramatically reduced from China.

While there are only

a few manufacturers who produce paracetamol without being dependent on Chinese

PAP, a few major manufacturers in India depend almost completely on Chinese PAP

for their paracetamol production and usually only keep three to four months of

inventory.

By the end of

February, their inventory stockpiles had halved and in the event of a continued

supply disruption, their entire inventory pipeline is likely to dry out. In

addition, Chinese paracetamol manufacturers, who export a significant amount of

their bulk ingredient production globally, including to India, are also

currently unable to export. This is beginning to create the potential of panic

among sourcing executives across the world.

Several

antibiotics also in danger of acute shortages

While paracetamol was listed on the API watch list circulated by India’s Department of Pharmaceuticals, our survey has revealed that other products on the list like ciprofloxacin, amoxicillin and azithromycin are also facing severe raw material

shortages. As a result, the prices of these bulk drugs have also increased

sharply.

In a statement to The Economic Times, leading Indian generic manufacturer Mankind Pharma’s chairman and managing director said

amoxicillin is the most commonly used API to manufacture antibiotics and the

company has invested Rs 1 billion (US$ 14 million) in placing irregular orders

with vendors to try and address the potential shortage that is expected. He

went on to say that if the situation continues until April, there will be an

acute shortage.

In a statement to the US House of Representatives last October, Janet Woodcock, the FDA’s Director of Center of Drug Evaluation and Research, said the FDA has determined that there are three WHO Essential Medicines whose API manufacturers are based only in China. The three medicines are: capreomycin, streptomycin (both indicated to treat Mycobacterium

tuberculosis) and sulfadiazine (used to treat chancroid and trachoma).

Streptomycin is also on the watch list published by India’s Department of Pharmaceuticals along with commonly used anti-hypertensives like losartan, valsartan, telmisartan and olmesartan and diabetes treatment metformin.

Intermediates

becoming a problem for generic drugmakers

PharmaCompass’ discussions have also revealed that in many cases while API manufacturing factories in China have returned to work, there are disruptions in the availability of raw materials and/or logistics at sea ports and airports which have led to unavailability of supplies.

While the FDA has a

list of the number of API facilities in China which are in a position to supply

to the United States, Woodcock said in her statement that the FDA “cannot determine with any precision the volume of API that China is actually producing, or the volume of APIs manufactured in China that is entering the US market.”

This visibility

reduces drastically when one has to assess the dependence of each API

manufacturer around the world on China for intermediates. Our discussions have

revealed that it is these intermediates which are becoming a problem for most

API manufacturers, even those based in India.

It was worth

highlighting that a manufacturing process change at an intermediate stage of

commonly used blood pressure medicine valsartan resulted in the recall of

millions of pills as it was found to contain a cancer causing impurity above

acceptable levels. Similarly, in 2008, the adulteration of heparin in China,

which killed 81 people and left 785 severely injured, was an outcome of the

subcontracting of precursor chemicals of Heparin.

Our view

The over-dependence

on China for key starting materials has been the subject of discussion ever

since we launched PharmaCompass. Rosemary Gibson explored this subject

in detail in her book China Rx: Exposing the Risks of America’s Dependence on

China for Medicine.

The restrictions imposed on industrial activity and transportation in China in the first two months of this year has resulted in NASA’s satellite images showing a decline in pollution levels over China.

While China works

towards getting its industrial and transportation engine up and running to 2019

levels, the outbreak has spread to other countries which will further increase

the demand for drugs to fight the virus.

This is a time when

the pharmaceutical industry needs to act responsibly and make decisions which

are in the best interests of patients globally.

Sharing information is one such step — it will allow for drug stockpiles and inventories that exist to be re-distributed to areas which need them most. For, in the event of an urgent need, drugs will become available to those who are most in need.

Impressions: 8188

A few months ago, PharmaCompass covered

the Health Canada request to quarantine drugs linked to leading Chinese drug maker, Zhejiang Hisun Pharma (Hisun) due to data integrity concerns.The “interim precautionary measure” was taken “in light of recent findings from a trusted regulatory partner that raised concerns about the reliability of the laboratory data generated at this site”.Last week, the trusted regulatory partner – i.e. the United States Food and Drug Administration (FDA) – announced it had placed Zhejiang Hisun Pharma on its import alert list.

Regulators unite against data

integrity violations International regulatory agencies are collaborating with each other at an unprecedented pace. Health Canada’s decision to quarantine drugs from Hisun almost three months before FDA’s official action indicates an extremely low level of tolerance for companies that fail to maintain data integrity. Health Canada has also taken similar action against companies who have recently failed European inspections (e.g. India’s Polydrug Laboratories and China’s Jinan Jinda Pharmaceutical Chemistry). Polydrug Laboratories was also included

in the most recent FDA Import Alert list indicating a growing impatience in

international regulatory agencies against non-compliant firms. Last week, Brazilian Health Surveillance Agency (ANVISA) announced suspending import of all APIs from India’s Parabolic Drugs. ANVISA’s resolution was driven by Parabolic’s failure of a European Good Manufacturing Practices (GMP) inspection in July this year Hisun’s importance in the pharmaceutical supply chainThe FDA decision to ban almost all products coming from the Hisun facilities into the United States is going to create significant disruption in the pharmaceutical supply chain, given the colossal scale of Hisun Pharma’s operations.Zhejiang Hisun Pharma qualifies as one of

the most prominent active pharmaceutical ingredients (API) manufacturers in the

business, with more than 93 Drug Master Files submitted with the FDA, four

approved finished products listed in the FDA Orange Book and 35 Certificates of

Suitability issued by the European Directorate of Quality Medicine,.Hisun’s core operations in Taizhou city cover a very large area and are divided into three parts (the

Yantou campus; Waisha Campus; and East Factory) which are separated by public

roads. The Taizhou site employs approximately 4,000 people and focuses on fermentation-based anti-infectives, cardiovascular

products (e.g. statins) along with synthetic anti-cancer products. Hisun’s branded generic player ambitions Two years ago, Hisun’s ambitions to transform itself from an API maker to a branded generic

company were announced through the launch of Hisun-Pfizer

Pharmaceutical Co., a joint venture with Pfizer where Hisun has a controlling stake of 51 percent while

Pfizer has the balance 49 percent.With a vision to become “a widely respected international pharmaceutical company,” Hisun exports more than “80 percent of its API products” to more than 30 nations and regions. Hisun will not disappear post

the import banHowever, Hisun’s importance in the supply chain is demonstrated by the number of exemptions which the FDA had to make in order to ensure that there are no drug shortages created as an outcome of the import alert. Fourteen products have been excluded from

the import alert. Bleomycin, Capreomycin, Daunorubicin Citrate Liposomal, Doxorubicin Hydrochloride, Mitomycin, Tazobactam, Granisetron, Cladribine, Cyclophosphamide finished form and API, Cytarabine, Floxuridine, Fludarabine, Ivermectin and Adenosine will still be allowed entry into the United

States from the Hisun plant. Our viewLast month we analyzed if “speedy action by European agencies suggest revival of API production in the West” and suggested that the

era where companies were securing their supply of APIs by looking for low-cost

players in Asia appears to be waning away.With a major Chinese player like Hisun now

running into severe compliance problems and the number of alternatives

available being quite limited, we foresee a significant shift in the

pharmaceutical supply chain.

Impressions: 9886