The year

2018 has witnessed a record-setting pace in approvals of new drugs. By early

November, the US Food and Drug Administration (FDA) had approved 48 new drugs,

as compared to a total of 46 new drugs approved in calendar 2017. This year,

the number of small-molecule drugs (35) approved is significantly higher than

the number of biologic drugs (13).

Although

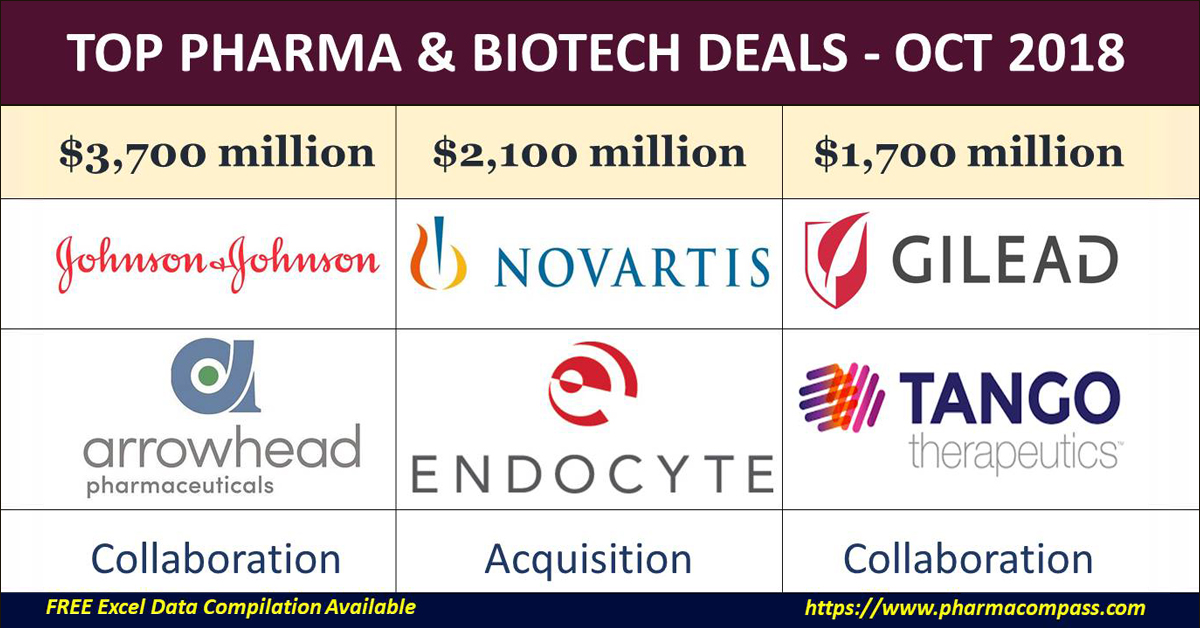

September witnessed a slight slump in deal making, October witnessed

significant activity. Here is our quick recap:

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

Novartis

buys Endocyte for US$ 2.1 billion

Novartis continued to make dealmaking headlines by placing its second bet on radiology with a buyout of Endocyte for US$ 2.1 billion. Endocyte’s experimental treatments attach a radioactive therapeutic atom to a ligand, a molecule that can bind to receptors on the surface of cancer cells. These radioligand therapies are supposed to shrink tumors while sparing healthy tissue from the toxic effects of radiation.

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

Endocyte’s Phase III lead candidate, 177Lu-PSMA-617, is designed to target the prostate-specific membrane antigen (PSMA) by

delivering the short-range beta-emitting radioactive isotope lutetium (177Lu)

selectively to tumor cells while bypassing non-PSMA-expressing healthy cells.

Last year,

Novartis had signed a US$ 3.9 billion deal to acquire Advanced Accelerator Applications (AAA). In January this year,

AAA won FDA approval for lutetium Lu 177 dotate (Lutathera) — a radiotherapy for neuroendocrine tumors.

AstraZeneca divests Nexium rights

As AstraZeneca’s blockbuster Nexium (esomeprazole) lost its patent protection in most parts of the world, the company agreed to divest the prescription medicine rights to Nexium (esomeprazole) in Europe, as well as the global rights (excluding the US and Japan) of Vimovo (naproxen/esomeprazole) to Grünenthal for a total deal value of US$

922 million.

Grünenthal will pay US$ 815 million upfront, plus up to US$ 107 million in milestones for the drug rights, which exclude Vimovo in the US and Japan. While Nexium has lost its patent protection, Vimovo holds patents in Europe until 2025.

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

Huahai gets US$ 43 million in government

support

China’s Zhejiang Huahai Pharmaceutical (ZHP) has been in the news for

supplying commonly used blood pressure medicine valsartan with cancer-causing impurities. In October, the Chinese city government of Linhai in the eastern province of Zhejiang, where the company is based, gave the company 300 million yuan (US$ 43 million). Huahai described the payout as an “industrial development assistance fund” in two announcements made through the Shanghai Stock Exchange.

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

Quotient Sciences expands its US operations

The month saw a lot of investments in manufacturing. For

instance, Quotient Sciences (a drug development services organization) announced significant expansion of its US operations with the opening of a 45,000-square-foot facility. The investment has been made with an intent to “create a center of excellence for early-phase formulation development and clinical trial manufacturing.”

Here are some other instances of capacity expansion:

— In Italy, Catalent announced the expansion of its softgel manufacturing capabilities.

— Sun Pharma added a sterile injectable manufacturing line in India.

— Abu-Dhabi based Neopharma purchased facilities of Dr Reddy’s in India and

the United States.

— Companies like Astellas,

Lonza,

Sarepta and MaSTherCell announced investments into expanding

their cell therapy manufacturing capabilities, since cell therapies continue to

be regarded as the future of human health.

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

GSK announces expansion plan, to make APIs for

its COPD drug

Respiratory drugs remain key to GlaxoSmithKline. The company announced an expansion to make APIs for one of its COPD (chronic obstructive pulmonary disease) drugs that it believes will be a key revenue generator in the future. GSK opened a new £54 million (US$ 70.3 million) production building at a site in Scotland to make APIs for Ellipta, a drug that

treats COPD.

However, not all pharma deals were built around new drugs and manufacturing. For instance, GlaxoSmithKline also awarded its estimated US$ 1.5 billion media planning and buying account to Publicis Media.

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

SQZ

expands tie up with Roche

SQZ Biotechnologies, a cell therapy company developing novel treatments for multiple therapeutic areas, announced the expansion of its collaboration with Roche. SQZ and Roche will jointly develop and

commercialize certain products based on antigen presenting cells (APCs) created

by the SQZ platform for the treatment of oncology indications.

Under the

collaboration, SQZ may receive up to US$ 125

million in upfront payment and near-term

milestones. SQZ could earn up to US$ 250 million in clinical, regulatory and sales milestones per

product that emerges from the collaboration. In addition, SQZ may receive development

milestone payments of over US$ 1 billion.

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

J&J

in agreement with Arrowhead Pharmaceuticals

Janssen, the research unit of Johnson & Johnson, entered into an agreement with Arrowhead Pharmaceuticals, to develop and commercialize its ribonucleic acid interference (RNAi) therapy candidate being investigated for the treatment of chronic hepatitis B viral infection. The deal makes Arrowhead eligible to receive up to US$ 3.5 billion in milestone payments. When the deal closes, Arrowhead will receive US$ 250 million right away through a US$ 175 million upfront payment and a US$ 75 million equity investment from J&J’s investment arm.

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

Other

deals and investments

— Dicerna Pharmaceuticals, which is also developing a pipeline of RNAi therapies, announced collaboration deals with Eli Lilly and Alexion Pharmaceuticals.

— Gilead Sciences and Tango

Therapeutics announced a global strategic collaboration to discover, develop and commercialize a pipeline of innovative targeted immuno-oncology treatments for patients with cancer. If the milestones are met, the deal could be worth US$ 1.7 billion.

Click Here to View the Major deals in October 2018 (FREE Excel Version Available)

Impressions: 1988

This week, Phispers takes you to the US, where President Trump’s efforts to repeal and replace Obamacare received a setback. There is also news that the EMA has recommended suspending over 300 drugs due to data integrity concerns at a CRO based in Chennai — Micro Therapeutics — along with news on drug makers like Teva, Pfizer and Stada. Read on.

More

scrutiny for Pfizer as injectable facility in India comes under FDA lens

Pfizer’s fill/finish manufacturing facility in

the United States recently received a warning letter

from the US Food and Drug Administration (USFDA). In February 2015, Pfizer had

acquired the site in McPherson (Kansas) through its US $17 billion acquisition of Hospira. Pfizer was aware of Hospira's manufacturing record when it struck the

deal, as the company was issued FDA warning letters on four of the seven continents — Europe, North America, Asia and Australia.

Last

week, a Hospira facility in Visakhapatnam in India, set up to manufacture specialty

injectables at an anticipated cost of US $375-450 million, received 11

observations from the US drug regulator. An inspection by the US FDA took place

at the sterile injectables manufacturing unit between March 9 and 17 this year.

An initial audit had taken place

in 2015, during which 14 observations had been found. The company responded to

the observations in March 2015 and submitted additional support documentation

by the end of May 2015.

“The inspection was found to be acceptable following the FDA's review of the company's responses and support documentation. The company has begun limited commercial production at the facility,” the company had said.

The latest list of FDA

observations includes three repeat observations related to air supply, air

sampling and the root cause for microbial contamination.

Last year, Pfizer had to halt production at its Chennai plant, which was also

obtained as part of the Hospira acquisition, due to quality concerns.

EMA

endorses suspending 300 drugs due to clinical data integrity pitfalls

Late

last year, the European Medicines Agency (EMA) had raised data-integrity concerns over another contract research organization (CRO) in India — Chennai-based, Micro Therapeutics Research Labs.

The concerns had regulators reviewing the data of over 300 generic medicines

being sold across Europe.

Last week, the EMA announced it

is recommending the suspension of more than 300 approvals and applications for generic drugs for

which bio-equivalence studies were conducted at Micro Therapeutic

Research Labs.

The review concluded that data from studies conducted at two sites between June 2012 and June 2016 was “unreliable and cannot be accepted as a basis for marketing authorization in the EU.” However, there is no evidence of harm or lack of effectiveness of these medicines.

EMA’s list of drugs it is recommending for suspension covers

just about every EU member state, including Austria, Belgium, Czech Republic,

Denmark, Finland, France, Germany, Greece, Ireland, Italy, Norway, Portugal,

Spain, The Netherlands and the UK.

Generic drugs recommended for suspension

include those being marketed by Novartis’ Sandoz, Sanofi’s

Zentiva, Teva, Aurobindo Pharma and others. It includes dosage forms

containing the active substances bupropion, voriconazole, betahistine, amlodipine/valsartan, tadalafil and naproxen.

Though

not a manufacturing compliance issue, clinical data-integrity has made

headlines recently as labs across India had their data invalidated due to

data-integrity concerns. Clinical trial

falsification issues at the labs of Quest Life Sciences, GVK Biosciences, Alkem Laboratories, Semler Research Center

and now Micro Therapeutics indicate that a sustained supply of generics can no

longer be taken for granted.

Struggling Teva to slash jobs to improve

profitability

Things haven’t been going right for the Israeli generic drug giant Teva for quite sometime now. First, it’s CEO Erez Vigodman left the company. Second, its books were debt-ridden post the acquisition of Allergan Plc in July 2015. Third,

its R&D has not seen a breakthrough in years. And now, Teva is said to be

going in for major layoffs.

The

Israeli newspaper Calcalist reported that Teva is planning to cut 6,000 staffers (or 11 percent of its global workforce) after Passover. The company, however, denied this by saying it won’t layoff thousands. Instead, Teva said it is ending certain activities, consolidating operations and freezing new recruitments.

“The efficiency program is an integral part of Teva’s business reality. The program includes, among other things, ending unprofitable activities and consolidating functions, in addition to freezing recruitment and natural employee turnover,” the company said.

Teva

is also looking for a new CEO to turn around the business after its US $ 40.5 billion acquisition of Allergan’s generic business pushed it into debt.

Trump's plan to repeal and replace Obamacare

suffers a major setback

For

seven years, the Republican Party has pursued repealing Obamacare like an

obsession. But on Friday last, Speaker Paul Ryan and US President Donald Trump withdrew the bill at around 3.30 in the afternoon.

Ryan could not bridge the ideological gap between the center and the far right within the Republican Party. The first presentation of Trumpcare couldn’t pass, as it was not sufficiently hard-hearted for the far-right members of the Freedom Caucus. But Trump and Ryan kept tweaking the bill to appease the hardliners. They even did away with the essential benefit guarantees that health insurance plans in American must now cover. And then the bill lost supporters at the center.

The Bill fell short of around a dozen votes to get a winning

vote count. The Congressional Budget Office had said the bill would deprive 24

million Americans of insurance coverage, while only saving the federal

government US $ 151 billion.

Meanwhile,

Trump sought to spread blame for the failure of his first attempt at replacing Obamacare. He said: “Bad things are going to happen to Obamacare. There's not much you can do to help it”.

On Sunday morning, Trump wrote on Twitter: “Democrats are smiling in DC that the Freedom Caucus, with the help of Club for Growth and Heritage, have saved Planned Parenthood & Obamacare.”

However, latest reports signal that Trump hasn’t given up hope. On Tuesday, he spoke to a “semi-bipartisan” group of Democratic and Republican senators and their spouses in the White House, where he signaled support for another run at a new GOP health care bill. Trump hopes a second

go-around will be more successful.

Stada CEO finds his car bugged amid takeover

talks

Germany’s Manager Magazin reported last week that

the chief executive of German drugmaker Stada — Matthias Wiedenfels — found a bugging device in his car.

Stada

has faced pressure to overhaul its strategy and has also received two takeover

approaches. Wiedenfels, who became the CEO of Stada last summer, also received

anonymous letters containing photographs that depict him in private or

confidential business situations, the magazine said.

The

magazine, which did not cite sources or give information on those behind the

bugging, said the incidents took place in the second half of 2016. Stada,

however, did not comment on this report.

Stada

is the subject of takeover approaches from two private equity consortia. It has

postponed the structured auction to give the bidders a chance to improve their

offers which last valued the company at $3.9 billion.

Over

1,100 drugs in Australia to become cheaper from next month

From

April 1, millions of Australians will benefit from reduced prices of more than 1,100 medicine brands. Vital drugs have been added to Australia’s Pharmaceutical Benefits Scheme (PBS).

The price of drugs used in conditions like high cholesterol, Parkinson’s disease, depression, breast cancer, eczema and psoriasis will cost lesser. For instance, 467,000 Australians using rosuvastatin for high cholesterol

will save 22 percent per script.

According to Australia’s Health Minister Greg Hunt, “sick Australians will save $500 million (US $ 383 million) over four years and up to $200 (US $ 153 million) a year each on the cost of medicines.”

The country also

plans to list new drugs on its PBS. These include drugs for two rare cancers — Hodgkin’s lymphoma, and an advanced type of skin cancer — and treatments for psoriasis, arthritis, schizophrenia and iron deficiency. Hunt said the savings for patients would be "considerable".

Impressions: 2559

This week, Phispers delves into Pfizer’s acquisition of Medivation and its impact on Sanofi. There is also news on antipsychotic drug Abilify, besides snippets on a lawsuit against Valeant, Mylan’s price hikes and more quality snags that were unveiled at Pfizer’s plant near Chennai. Read on.

Rough week for Sanofi as FDA

delays its diabetes drugs, while Pfizer walks away with Medivation

Pfizer

agreed to pay US $14 billion in cash for Medivation in a deal that adds the

prostate cancer drug Xtandi

to its product portfolio.

Medivation was one of the few independent companies with a cancer treatment

that is selling well. Xtandi currently generates about US $ 2 billion a year in

annual sales.

The acquisition has come as a setback

for French drug maker Sanofi that spent five months pursuing Medivation. At one point, Sanofi even attempted to replace Medivation’s board and force a deal.

There

was another setback for Sanofi,

as it saw the launch of its diabetes combination medicine get delayed until

November this year. Sanofi spent US $ 245 million on a priority

review voucher to beat Danish drug maker Novo

Nordisk to market with a diabetes drug that pairs its best-selling

medicine Lantus

(a basal insulin) with lixisenatide. However, the FDA’s fast-track review pushed out the launch of the combination till at least November.

The FDA asked Sanofi for more data on the dual-drug delivery pen – a device that triggered debate during an FDA advisory panel review in May this year.

The FDA decision on Novo’s product is due next month. With this unexpected delay, Novo could get more than a two months’ head start over Sanofi.

FDA warns against the

use of antipsychotic drug Abilify

In the US, patients taking the antipsychotic drug Abilify have

reported uncontrollable urges to gamble, binge eat, shop, and have sex, according

to the FDA. The regulator issued a warning this week

on the drug, which is one of the top-selling prescription medications in the

United States.

Other serious side effects of the drug include a higher chance

of developing diabetes and hyperglycemia, and increased risk of suicide among

patients under the age of 24.

Also known as aripiprazole,

the drug is used to

treat schizophrenia, and can be used in combination with other drugs to

treat depression. In the US, 1.6 million patients received Abilify

prescriptions last year.

The warning comes amid pending class-action lawsuits against

the manufacturer of Abilify – Otsuka America Pharmaceutical. The class-action suits allege the company didn’t properly warn patients about the possibility of impulse-control issues.

However, these problems are rare. In the 13 years since the

drug was approved, there have been only 167 reports of patients experiencing

significant impulse-control problems, according to the FDA.

Counterfeit pills may

have killed the late singer Prince

A little over a year ago, the Drug Supply Chain Security

Act (or Drug Quality and Security Act) became effective in the United States. The law was introduced to secure the supply chain of medicines and restrict counterfeit drugs – an industry estimated to be bigger than Pfizer and GSK put

together.

It seems that regulatory agencies still have a lot of work to do in this

area. A mis-labelled bottle of

pills found in the home of the late singer Prince contained the powerful

painkiller fentanyl, a synthetic opioid 50 times more powerful than heroin. Prince died on April 21 this year.

According

to sources close to the investigation, the pills were found in a bottle

of Aleve, an over-the-counter medication sold in the US that contains

the painkiller naproxen. Two dozen pills, found in one bottle, were falsely labelled as ‘Watson 385’ – an identifier for a mix of acetaminophen

(paracetamol)

and hydrocodone.

Valeant mired in trouble

with a lawsuit and faltering sales of female sexual dysfunction drug

According to a lawsuit

filed last week, Valeant

Pharmaceuticals refilled

patient prescriptions without their permission and directed them to buy expensive drugs in

order to boost sales. The lawsuit provides insight into how a mail-order pharmacy – Philidor Rx Services – assisted Valeant in directing prescriptions to its brand-name medicines over cheaper generic versions.

Meanwhile,

Valeant hired Paul Herendeen as its new chief financial officer, luring the

executive away from Zoetis,

the animal health products maker.

While

Valeant is busy battling

challenges on various fronts, its US $

1 billion acquisition of Sprout Pharmaceuticals of Addyi – the first medicine to combat female sexual dysfunction – is turning

out of be a bust, as it has reported meagre sales.

Pfizer’s plant in Chennai faces more compliance issues

Earlier this month, Pfizer had to halt production at a plant near Chennai in India, after a Pharmaceutical

Inspection Convention and Pharmaceutical Inspection Co-operation Scheme (PIC/S)

joint inspection highlighted quality concerns. The other regulators in the

PIC/S inspection were the Medicines and Healthcare products Regulatory Agency

of the UK (MHRA), the United States Food and Drug Administration (USFDA),

Therapeutic Goods Administration of Australia (TGA) and Health Canada.

Three

years ago, the plant was first cited with an FDA warning letter. Last year, when

Pfizer acquired the plant from Hospira, it was well aware of the quality issues.

But Pfizer was probably not aware of the extent of troubles that awaited it. Last

week, a GMP non-compliance report posted by European Medicines Agency (EMA) listed

that an inspection by the MHRA uncovered

a variety of critical issues, raising doubts on whether

the injectable products coming out of the facility are sterile or not.

MHRA inspectors found that employees were using aseptic processes that could allow for microbial contamination. Pfizer’s investigations into issues were not getting to root causes of problems, they said. All of the plant’s shortcomings were linked to employees who lacked the “scientific knowledge” to know what to do.

The MHRA withdrew the plant’s GMP certificate and has halted imports to the European Union of six injected antibiotics until the problems get addressed.

Mylan’s outrageous drug price hikes for EpiPen come under scrutiny

The EpiPen auto-injector, which reverses life-threatening

allergic reactions, is under scrutiny. In 2015, the drug had generated US $ 1.2

billion in sales for Mylan.

The EpiPen has been around since 1977, but Mylan acquired

the auto-injector in 2007. The EpiPen precisely calibrates the dosage of epinephrine.

The patient now pays

about 400 percent more for this advantage to receive a dollar’s worth of the life-saving drug. EpiPens were sold for about US $ 57 when Mylan acquired it. Today, it is being

sold at US $ 500 or more in the US.

Meanwhile, Senator Amy Klobuchar (District Minnesota) has

asked the US Federal Trade Commission and the Senate Judiciary Committee to investigate

price hikes undertaken by Mylan. Klobuchar is the ranking member of Senate

Judiciary Antitrust Subcommittee. And Senator Richard Blumenthal (District Connecticut)

wrote to the company for data about assistance programs for

patients and first responders. He also

demanded that Mylan lower its price.

Last year, Mylan raised the price on EpiPen — its biggest-selling product — twice by 15 percent (each time). Due to lack of competition, the

price hikes were easy.

Korea’s Celltrion ships first batch of biosimilar Remicade to US

Last week, a day after winning a lawsuit in the US, Korean pharmaceutical firm Celltrion shipped

the first batch of its biosimilar medicine -- Remsima – to the country. The lawsuit was on the sale of Remsima – an autoimmune disorder drug – in the US, the world’s largest pharmaceutical market.

Celltrion said that the move will accelerate the US launch of Remsima, a

biosimilar version of Janssen's

Remicade. Remsima has been on sale in Europe since 2013.

Pfizer will take charge of sales of Remsima in the US. The drug will soon be

available to patients in the US suffering from rheumatoid arthritis and

ulcerative colitis under the brand name of Inflectra.

Remicaid’s sales were in excess of US $

8 billion in 2015. Celltrion

CEO Kim Hyoung-ki has projected that the company will earn more than US $ 1.7 billion in the US market next year, assuming a

double-digit market share.

Four healthcare CEOs on the world’s top 20 severance packages list

Even though the Pfizer-Allergan US $ 160 billion merger did not go through, Allergan CEO’s Brent Saunders has little

to complain. In a recent Bloomberg

compilation, his severance package of US $ 140 million ranks in the top

20 of all S&P 500 CEOs.

Joining him in the top 20 are other CEOs of healthcare

companies such as McKesson (with a severance package of US $ 198 million),

Aetna (US $ 91 million) and Regeneron (US $ 90 million).

McKesson Corporation is an American company distributing

pharmaceuticals at a retail sale level and providing health information

technology, medical supplies, and care management tools.

Aetna is an American managed health care company, which sells

traditional and consumer directed health care

insurance plans and related services, such as medical, pharmaceutical, dental,

behavioral health, long-term care, and disability plans.

Regeneron is a US-based biotechnology company with four FDA approved products and over US $ 4 billion in revenues in 2015.

Impressions: 5522