The first half of

2018 witnessed a spate of M&A activity in the pharmaceutical and biotech

space with the industry witnessing some of the biggest deals from companies

like Takeda, Celgene and Sanofi.

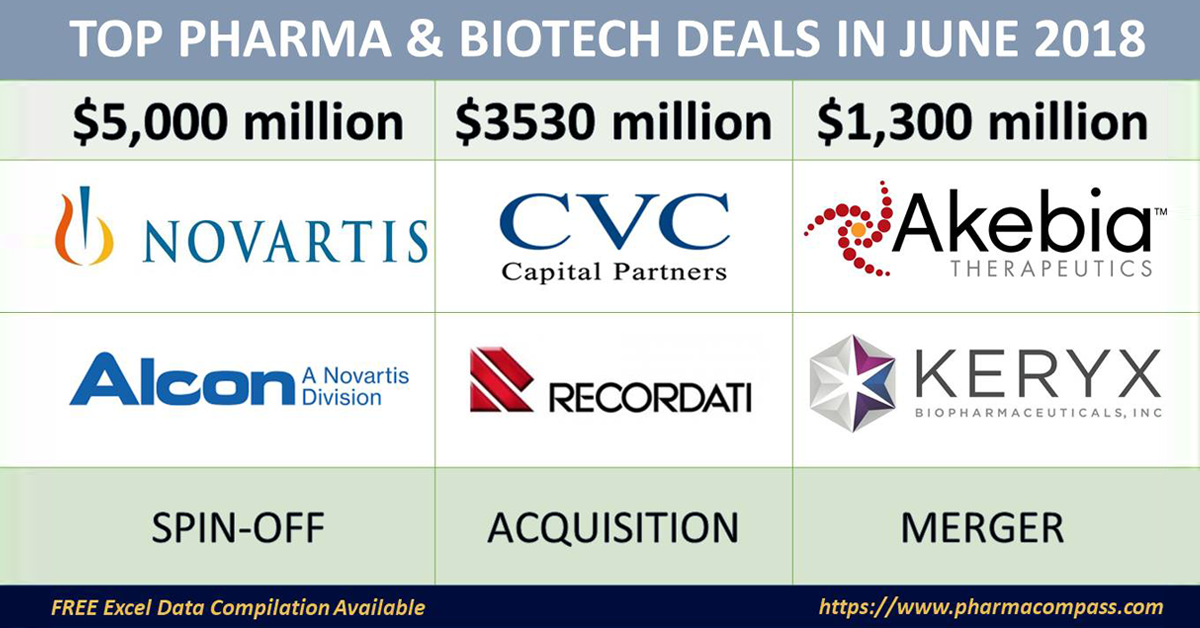

Leading the announcements in June was Novartis, as it announced its decision to spin-off Alcon, its eye-care division, and buyback shares worth US$ 5 billion.

Meanwhile, one of Italy’s billionaire pharma families — Recordati — which owned Recordati SpA, a 100-year-old pharmaceutical business, gave away its controlling stake to CVC Capital Partners in a deal worth over €3 billion (US$ 3.5 billion).

In the United States, two renal-focused companies — Akebia Therapeutics and Keryx Biopharmaceuticals — announced an all-stock merger deal worth US$ 1.3 billion, thereby creating a larger kidney disease-focused company.

Dealmaking hasn’t stopped for Sanofi either. After its acquisitions of Bioverativ (for US$ 11.6 billion) and Ablynx (for US$ 4.8 billion) in January this year, the French drug major struck a three-year R&D collaboration agreement with Cambridge, MA-based Translate Bio for US$ 805 million.

The deal focuses on the development of mRNA vaccines for up to five infectious diseases. mRNA vaccines are an upcoming and promising alternative to conventional vaccine approaches.

Click here to view the major deals in June 2018 (FREE Excel version available)

Novartis announces

Alcon spin-off; to buyback US$ 5 billion in shares

Swiss drugmaker Novartis Pharmaceuticals Corporation announced it plans to spin off its Alcon eye care business into a separately traded standalone company and buy back up to US$ 5 billion in stock. This is part of CEO Vas Narasimhan’s strategy to refocus on prescription drugs.

The pharma giant said

the planned spinoff would enable both Novartis and Alcon to focus fully on

their respective growth strategies and create a global leader in eye-care

devices.

Alcon was purchased in

2011 for US$ 51.6 billion,

under the regime of former Novartis boss Daniel Vasella. However, it’s been a problematic buy.

Click here to view the major deals in June 2018 (FREE Excel version available)

Post its acquisition,

it expanded into implantable lenses for cataract patients, surgical devices and

contact lenses. The Alcon division is now fully focused on surgical and vision care, and

continues to be the global leader in eye-care devices. It has an estimated book

value of around US$ 21.6

billion.

Alcon’s surgical equipment and contact lens operations have been battling a long streak of losses since 2015. Despite steps to improve operations, Alcon’s profit plummeted 31 percent in 2016. Even last year’s sales figures plummeted 3 percent to US$ 5.81 billion as revenue from surgical equipment dropped.

Click here to view the major deals in June 2018 (FREE Excel version available)

In January 2016, Novartis transferred Alcon’s ophthalmic pharmaceuticals to Novartis’ Innovative Medicines Division. The ophthalmology pharmaceuticals business posted sales revenue of US$ 4.6 billion in 2017. The business includes

potential blockbuster medicine RTH258 (brolucizumab) that is in development. RTH258 is a potential treatment for neovascular age-related macular degeneration and diabetic macular edema.

Joerg Reinhardt, chairman of Novartis, said: “Our strategic review examined all options for Alcon ranging from retention, sale, IPO to spinoff. The review concluded that a spinoff would be in the best interest of Novartis shareholders and the board of directors intends to seek shareholder approval for a spinoff at the 2019 AGM. This transaction would allow our shareholders to benefit from potential future successes of a more focused Novartis and a standalone Alcon, which would become a publicly traded global medtech leader based here in Switzerland.”

Click here to view the major deals in June 2018 (FREE Excel version available)

CVC acquires controlling stake in Italy’s Recordati SpA

CVC,

a world leader in private equity and credit with US$ 69 billion of assets under

management, announced that a consortium of funds had agreed to buy the

holding company that owns a majority interest in Recordati.

FIMEI SpA, a la Finanziaria Industriale Mobiliare ed Immobiliare SpA — the family holding company that owns 51.8 percent shares of Recordati SpA — was acquired for approximately €3 billion (US$ 3.53 billion). The consideration will be payable as approximately €2.3 billion (US$ 2.68 billion) in cash.

Furthermore, Andrea Recordati will continue to remain the CEO.

Click here to view the major deals in June 2018 (FREE Excel version available)

Recordati was founded

by Giovanni Recordati as a business out of a family apothecary dating back to

the 19th century. He created Laboratorio Farmacologico Reggiano, the

predecessor to Recordati SpA, in 1926.

Giovanni died in 1952

and left the company to his son, Arrigo, who moved it to Milan a year later and

began expanding research and development, product lines and access to markets

outside of Italy. Arrigo died in 1999, bequeathing the business to his four

children and putting management in the hands of his son Giovanni, who died last

year, leaving his share to his wife.

Three of Recordati’s products date back to the family apothecary, including an anti-spasm intestinal drug created in 1927, a laxative from 1930, and Tefamin, a heart tonic, diuretic and blood-pressure-reducing agent devised in 1935.

Currently, the company is involved in chemical syntheses of intermediates and active ingredients for Recordati’s brand-name medications and has built a rare disease portfolio through its dedicated subsidiaries — Orphan Europe and Recordati Rare Diseases.

The Recordatis weren’t the only billionaires to emerge from the Italian pharmaceuticals industry, one of the nation’s best performing sectors in recent years. Luigi Rovati, founder of Rottapharm Madaus, and Alberto and Paolo Chiesi, the septuagenarian brothers behind Parma-based Chiesi Farmaceutici SpA, are also identified as billionaires.

Click here to view the major deals in June 2018 (FREE Excel version available)

Kidney disease firms — Akebia and Keryx — merge to create US$ 1 billion company

With the intention of targeting similar patient populations, Akebia and Keryx have decided to join forces in an all-stock merger agreement, which will give Keryx stockholders about one Akebia share for every three they own today.

The deal had an implied pro forma equity value of

approximately US$ 1.3 billion and

the

combined company will be named Akebia Therapeutics, Inc.

The merger of Akebia

and Keryx creates a renal-focused company committed to offering therapeutic

options to patients across all stages of CKD (chronic kidney disease),

including non-dialysis dependent and dialysis dependent patients, and to become

a partner of choice for the renal community and for companies developing renal

products.

Click here to view the major deals in June 2018 (FREE Excel version available)

Keryx’s Auryxia (ferric citrate) is a US Food and Drug Administration (FDA)-approved medicine to treat dialysis dependent CKD patients. During the first quarter of 2018, Auryxia has witnessed net US sales of US$ 20.6 million, with prescription numbers rising to 34,600 (up by 119 percent).

A little more than a month back, Auryxia reported promising results from a small, open-label investigator-sponsored study that stated: “administering ferric citrate to late-stage pre-dialysis patients not only improves biochemical parameters associated with chronic kidney disease, but also has the potential to delay the need for dialysis.”

Akebia’s vadadustat is an investigational Phase 3 oral hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI) with the potential to advance the treatment of patients with anemia due to CKD, many of whom are currently receiving injectable erythropoietin-stimulating agents (ESAs).

Click here to view the major deals in June 2018 (FREE Excel version available)

The companies believe

that Auryxia and vadadustat, if approved by the FDA, have the potential to

deliver an all-oral treatment approach for patients with anemia due to CKD.

After setbacks,

Sanofi collaborates on vaccine development

Sanofi Pasteur, the vaccines division of French pharma giant Sanofi, will pay Translate Bio — a Lexington, Massachusetts-headquartered company formerly known as RaNA Therapeutics — US$ 45 million up front for rights to experimental vaccines for up to five undisclosed

infectious diseases.

Under the agreement, Translate Bio and Sanofi Pasteur will jointly conduct R&D activities to advance mRNA vaccines during an initial three-year research term. Sanofi Pasteur will make an upfront payment of US$ 45 million to Translate Bio. In total, Translate Bio is eligible to receive up to US$ 805 million in payments.

The deal provides Sanofi a chance to grow its vaccine pipeline after setbacks in 2017. In November, Sanofi warned of an increased risk of severe dengue in people vaccinated with Dengvaxia who haven't had prior exposure to the virus. Sanofi agreed to refund unused doses, although issues with the vaccine cost the drugmaker €158 million (US$ 184 million) in the fourth quarter last year.

Click here to view the major deals in June 2018 (FREE Excel version available)

Translate Bio is developing synthetic mRNA

drugs, meant to coax the body into producing proteins that might be

dysfunctional or missing in disease. Translate Bio is one of several companies

working on it, along with CureVac, BioNTech, and Moderna Therapeutics.

Privately-held Moderna has secured more than US$ 1.6 billion in venture financings, another US$ 1 billion in partnerships, and has been valued at of over US$ 7 billion.

Click here to view the major deals in June 2018 (FREE Excel version available)

Sanofi paid BioNTech US$ 60 million in 2015 to

co-develop mRNA-based immunotherapies for cancer. BioNTech then aligned with

Genentech Inc for its mRNA-based cancer vaccine platform.

Meanwhile, Translate Bio joined the IPO club in June by raking in a handsome US$ 121.6 million that the startup aims to use for funding the clinical trials of its two lead drug candidates — MRT5005 and MRT5201. Translate got these programs through a deal with Shire at the end of 2016, making Shire Translate’s largest stockholder.

The company’s two lead programs are being developed as treatments for cystic fibrosis (CF) and ornithine transcarbamylase (OTC) deficiency (a genetic disease that causes too much ammonia to accumulate in the blood).

Click here to view the major deals in June 2018 (FREE Excel version available)

Biogen increases stake in Samsung Bioepis to 49.9 percent

In late June, US biotech firm Biogen exercised its option to

purchase additional shares of biopharma developer Samsung Bioepis — a joint venture established in 2012 by Samsung BioLogics and Biogen.

Click here to view the major deals in June 2018 (FREE Excel version available)

Biogen will pay Samsung Bioepis US$ 673.4 million to

increase its minority stake in the joint venture. Thereby, Biogen will

increase its stake in the JV from 5.4 percent to approximately 49.9 percent.

However, last week South Korea’s top financial regulator imposed a top-level sanction after it announced it had found intentional breaches of accounting rules at

Samsung Biologics.

The Financial Services Commission said it will ask Samsung Biologics to dismiss executives in charge of accounting breaches and will also penalize an accounting firm that audited Samsung.

Click here to view the major deals in June 2018 (FREE Excel version available)

The inspection mostly focused on the company’s sudden profits after changing the value calculating method for Samsung Bioepis.

According to the commission, Biogen’s right to exercise a call option to raise its stake in the joint venture to 50 percent minus one share, a right effective until June 2018, was not reflected in the company’s official notice until 2015.

The missing information impacted the valuation

of Samsung Biologics and its subsidiary Samsung Bioepis as Samsung BioLogics logged a one-time net profit of 1.9 trillion won

(US$ 1.68 billion), after four straight years of losses.

The sudden profitability, for the first time in 2015, coincided with the initial public offering of Samsung Biologics in the Seoul stock market a year later.

Click here to view the major deals in June 2018 (FREE Excel version available)

Samsung has invested big in the biologics business to find a future cash cow when profits from its existing businesses dwindle.

Our view

The first half of the year has been a big year for biopharma investments with big acquisitions like Takeda’s US$ 62.2 billion acquisition of Shire.

In a recent Forbes article, an analysis by PitchBook of deals conducted

so far this year talked about US$ 15 billion in healthcare startup funding from

venture capital firms. This figure of US$ 15 billion is 70 percent higher than

the corresponding figure for last year.

Although the number of companies that were set up in

the first half of 2018 is about 10 percent lower than last year, it seems

investors are making bigger investments this year.

Keep track of all that is happening with PharmaCompass’ compilation of Top Pharma & Biotech Deals — PharmaFlow.

Click here to view the major deals in June 2018 (FREE Excel version available)

Impressions: 2977

PharmaCompass has assessed the second quarter US Drug Master

File (DMFs) filings. In our view, with five potential first-to-file (FTF)

applications along with another five DMFs challenging markets that have been

monopolized for decades, the pharmaceutical industry in the United States

should brace itself for some serious shakeups. Unlike the first

quarter of 2015 where 241 new DMF filings were listed on the USFDA site,

this quarter saw a reduction of almost 35 percent in the DMFs filed. As DMFs

form a critical part of the regulatory submissions made by generics to

challenge innovator companies, a reduction in filings, in the recent quarter,

seems to bear no correlation with the disruption the market will potentially

witness in times to come. The ‘first-to-file’ disruptors Profits in the generic pharmaceutical business are highly dependent on how quickly a drug is introduced in the market. The ‘first-to-file’ generic is a coveted position, since the company is legally granted

a 180-day period of market exclusivity, where no other generic can be in the

market. This six month exclusivity invariably leads to windfall gains for the

company.This quarter DMFs were received by the FDA, which could potentially drive the first-to-file challenges against J&J’s blockbuster Inovkana (canagliflozin), Eisai’s Belviq (lorcaserin

hydrochloride), Incyte’s Jakavi (ruxolitinib

phosphate), Celgene’s Pomalyst (pomalidomide) and Akorn’s Zioptan (tafluprost).However, given the complexities involved in bringing a

generic product to market, the first DMF filing does not always result in the

first generic challenge to the brand drug. The second DMFs filed for a product

are also strong contenders which must not be ignored. For example, Glenmark

recently filed their DMF for tofacitinib,

almost 18 months after serial-DMF filing by MSN

Pharmaceuticals. But Glenmark

has moved ahead by already getting their DMF reviewed by the FDA. Similarly, while Alp Pharma Beijing’s dapagliflozin, Perrigo’s ferric citrate and Amino Chemicals’ miglustat

are the second DMFs to be received by the FDA, the innovator should start

counting the days before they are plagued by generic challengers. Exclusively

not-patentedFor several years, Indian companies have been leading many

first-to-file generic challenges in the United States. However, as they have

scaled up in size, the same companies have also obtained rights to some

exclusive markets in the United States; either through acquisitions or

alliances. Sun Pharmaceutical’s US

$ 230 million acquisition of dermatology specialist Dusa was triggered by the successful sales of Dusa’s photo-chemotherapy treatment, Levulan. German Midas Pharma GmbH’s filing will not only subject Sun’s market domination to generic competition, the fact that there are six other DMFs filed for this product (of which none of the filings have come from Indian or Chinese companies) indicates a change in the way the industry is beginning to operate. Like Sun Pharmaceutical’s monopoly of Levulan, Dr. Reddy’s has enjoyed no competition for their topical treatment, Cloderm (clocortolone

pivalate) since 2011 when they purchased the rights for the product by

making an

upfront payment of US $ 36 million to Canadian, Valeant Pharmaceuticals. Dr. Reddy’s needs to start monitoring the progress of Italian Trifarma’s filing since this is the fifth time a DMF for this product has been received by the FDA.Indian companies aside, Aspen’s Leukeran, Bausch & Lomb’s Zirgan, Mission Pharmaceuticals’ Thiola and GSK’s topical treatment Abreva have

all marketed their products without any competition. The DMF filings of this

quarter indicate that generics have narrowed in on the profits being made and

the market dynamics for these products will change in the future. Down, but not outIntriguingly, companies like Apotex

Pharmachem, Emcure

Pharmaceuticals and Global Calcium

are currently on the FDA Import Alert list and banned from exporting products

to the United States since they did not operate in

conformity with the current good manufacturing practices (GMP's). However, these companies are definitely optimistic about

their future since they have all filed new DMFs this quarter. It remains to be

seen if the bans will get lifted in the near future.This quarter also saw Dr. Reddy’s get creative in their challenge to Japanese Astellas Pharma’s leaky bladder treatment, Myrbetriq (mirabegron).

After having filed a DMF last year, they re-filed again recently, with a

different polymorphic form, to potentially circumvent the patents around this

product. Our supportGeneric pharmaceutical companies are continuously looking

for opportunities where they can get the maximum possible market share in the

fastest way possible. While the number of manufacturers of active pharmaceutical

ingredients (APIs) keep increasing, we are also witnessing an increase in the cost

of regulatory support required to sustain the production of these APIs. The industry is becoming more challenging – identifying target markets is becoming a science which requires high-level management focus. In order to help you, PharmaCompass will share its compilation of this quarter’s DMF filing list. Just send

us an email by clicking here and we’re happy to support you in every possible way.Last week, the FDA also announced the fee dues (as on

October 1, 2015), as per the Generic Drug User Fee Act (GDUFA). We are sharing

the amounts due, in case you have not been able to access this information.

FISCAL YEAR AND FEE TYPE

2014 (Rate)

2015 (Rate)

$ & %

Difference from previous year

Abbreviated New Drug Application

$63,860

$58,730

-$5,130 (-8.0%)

Prior Approval Supplement

$31,930

$29,370

-$2,560 (-8.0%)

Drug Master File

$31,460

$26,720

-$4,740 (-15.1%)

Finished Dosage Form Facility

$220,152 (Domestic)

$247,717 (Domestic)

$27,565 (12.5%)

$235,152 (Foreign)

$262,717 (Foreign)

Active Pharmaceutical Ingredient

Facility

$34,515 (Domestic)

$41,926 (Domestic)

$7,411 (21.5%)

$49,515 (Foreign)

$56,926 (Foreign)

Impressions: 5140