13 Nov 2023

// PRESS RELEASE

10 Oct 2023

// PRESS RELEASE

13 Mar 2026

// PRESS RELEASE

About

Industry Trade Show

Exhibiting

23-26 March, 2026

Industry Trade Show

Booth #3C1

06-08 October, 2026

Industry Trade Show

Not Confirmed

16-18 March, 2026

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Exhibiting

23-26 March, 2026

Industry Trade Show

Booth #3C1

06-08 October, 2026

Industry Trade Show

Not Confirmed

16-18 March, 2026

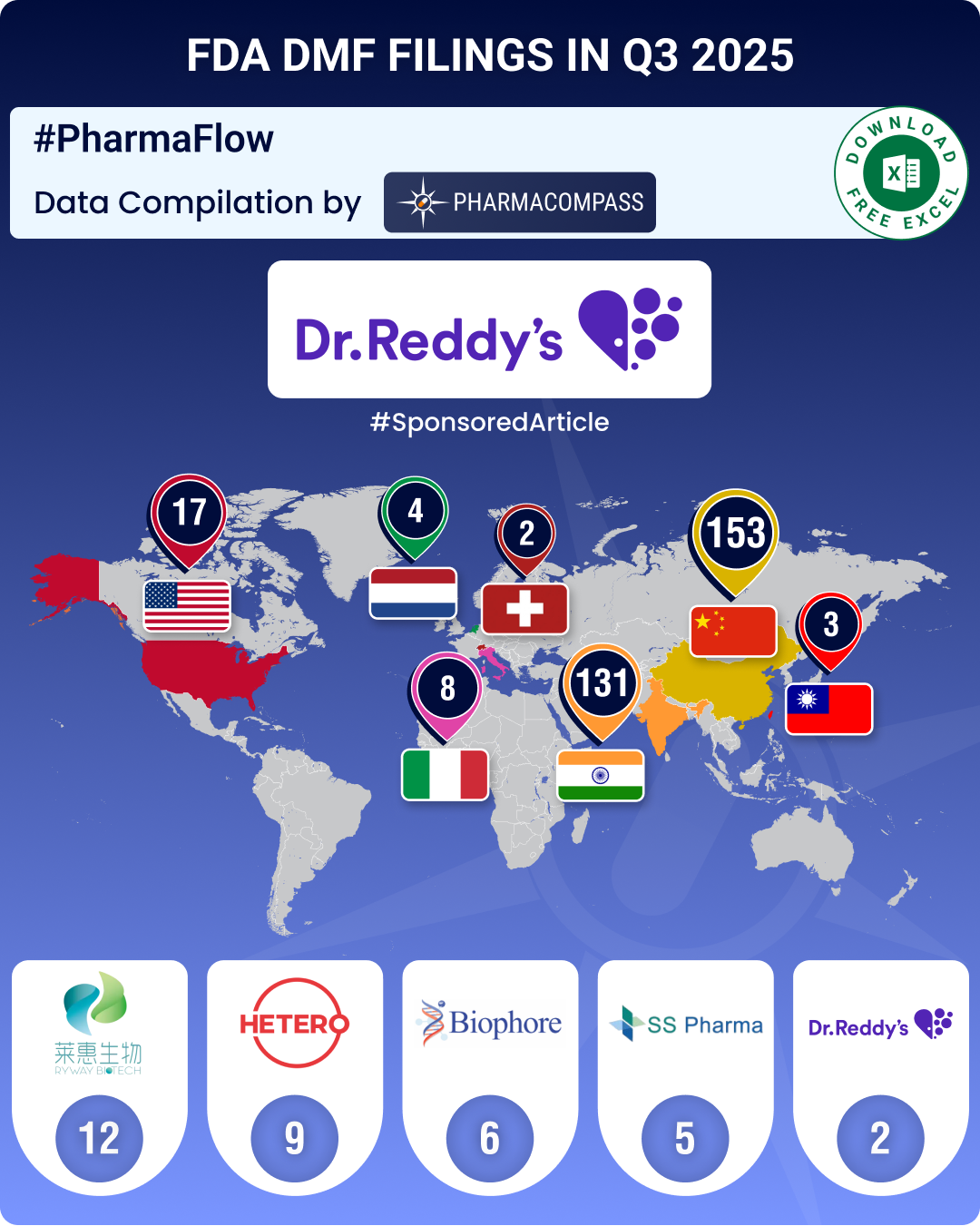

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-rise-4-5-in-q3-2025-china-holds-lead-india-records-20-growth-in-submissions

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-veranova-carbogen-lead-adc-investments-axplora-polfa-tarchomin-famar-expand-european-footprint

13 Nov 2023

// PRESS RELEASE

https://www.axplora.com/farmabios-an-axplora-company-granted-cgmp-approval-from-aifa-for-extended-production-capacity-in-hpapis-and-steroids/

Inspections and registrations

Country : Italy

City/Region : Gropello Cairoli

Audit Date : 2026-02-18

Audit Type : On-Site

Country : Italy

City/Region : Gropello Cairoli

Audit Date : 2025-05-15

Audit Type : On-Site

Country : Italy

City/Region : Gropello Cairoli

Audit Date : 2024-06-12

Audit Type : On-Site

Country : Italy

City/Region : Gropello Cairoli

Audit Date : 2023-03-29

Audit Type : On-Site

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]ABOUT THIS PAGE

Farmabios SPA is a supplier offers 2 products (APIs, Excipients or Intermediates).

Find a price of Prednisolone bulk with DMF offered by Farmabios SPA

Find a price of Testosterone Cypionate bulk with DMF offered by Farmabios SPA

Farmabios SPA

Farmabios SPA