Synopsis

Synopsis

0

API Suppliers

0

USDMF

0

CEP/COS

0

JDMF

0

EU WC

0

KDMF

0

NDC API

0

VMF

0

Listed Suppliers

0

EDQM

0

USP

0

JP

0

Others

0

FDF Dossiers

0

FDA Orange Book

0

Europe

0

Canada

0

Australia

0

South Africa

0

Listed Dossiers

DRUG PRODUCT COMPOSITIONS

0

US Patents

0

US Exclusivities

0

Health Canada Patents

US Medicaid

NA

Annual Reports

NA

Regulatory FDF Prices

NA

0

API

0

FDF

0

Stock Recap #PipelineProspector

0

Weekly News Recap #Phispers

0

News #PharmaBuzz

1. Bis(2-hydroxypropyl)amine

2. Diisopropanolamine Hydrochloride

1. 110-97-4

2. Bis(2-hydroxypropyl)amine

3. 1,1'-iminodipropan-2-ol

4. Bis(2-propanol)amine

5. 1,1'-iminodi-2-propanol

6. 2-propanol, 1,1'-iminobis-

7. Di-2-propanolamine

8. Di-isopropanolamine

9. Dipa (alcohol)

10. Dipropyl-2,2'-dihydroxy-amine

11. 1-(2-hydroxypropylamino)propan-2-ol

12. N,n-bis(2-hydroxypropyl)amine

13. 1,1'-iminobis-2-propanol

14. 2-propanol, 1,1'-iminodi-

15. Diisopropanolamin

16. 1-[(2-hydroxypropyl)amino]propan-2-ol

17. Nsc 4963

18. Nsc-4963

19. 1,1'-iminobis[2-propanol]

20. 0w44hyl8t5

21. Dsstox_cid_179

22. Dsstox_rid_75418

23. Dsstox_gsid_20179

24. 1335-54-2

25. 1,1'-iminobis(2-propanol)

26. 1,1'-azanediylbis(propan-2-ol)

27. Cas-110-97-4

28. Ccris 6234

29. Hsdb 338

30. Einecs 203-820-9

31. Di-isopropanol Amine

32. Brn 0605363

33. Unii-0w44hyl8t5

34. 2-propanol,1,1'-iminobis-

35. Dipa Alcohol

36. Diiso-propanolamine

37. Diisopropanol Amine

38. Mfcd00004531

39. Di(2-hydroxypropyl)amine

40. 2-propanol,1'-iminodi-

41. 2-propanol,1'-iminobis-

42. Bis-(2-hydroxypropyl)amine

43. Ec 203-820-9

44. Bis-(2-hydroxypropyl)-amine

45. Schembl22774

46. 3-04-00-00761 (beilstein Handbook Reference)

47. 1,1'-azanediyldipropan-2-ol

48. Di(2-hydroxy-n-propyl) Amine

49. Diisopropanolamine [ii]

50. Diisopropanolamine [mi]

51. 1,1'-imino-di(2-propanol)

52. Chembl2106303

53. Dtxsid8020179

54. 1,1'-azanediylbis Propan-2-ol

55. Diisopropanolamine [hsdb]

56. Diisopropanolamine [inci]

57. 1,1'-azanediyldi(propan-2-ol)

58. Diisopropanolamine [vandf]

59. Nsc4963

60. Chebi:143266

61. Wln: Qy1 & 1m1yq1

62. Diisopropanolamine [mart.]

63. Albb-005923

64. Amy25531

65. Tox21_201602

66. Tox21_302859

67. 2-propanol, 1,1'-iminobis-, N-(hydrogenated Tallow Alkyl) Derivs.

68. Bbl013266

69. Stk503623

70. Akos005457854

71. Dipa Low Freeze Grade 85 (salt/mix)

72. Dipa Low Freeze Grade 90 (salt/mix)

73. Ncgc00249081-01

74. Ncgc00256476-01

75. Ncgc00259151-01

76. 68153-96-8

77. Vs-03726

78. Diisopropanolamine (dl- And Meso- Mixture)

79. Bis(2-hydroxypropyl)amine, >=98.0% (t)

80. D0924

81. Q777543

82. J-660021

83. F0001-0230

84. 9afd2c98-2177-4499-8eb2-1c8ea079f21d

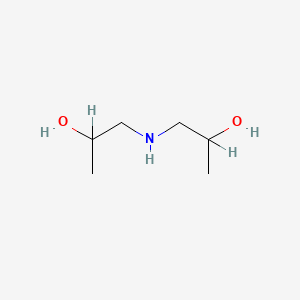

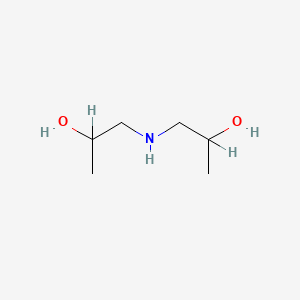

| Molecular Weight | 133.19 g/mol |

|---|---|

| Molecular Formula | C6H15NO2 |

| XLogP3 | -0.8 |

| Hydrogen Bond Donor Count | 3 |

| Hydrogen Bond Acceptor Count | 3 |

| Rotatable Bond Count | 4 |

| Exact Mass | 133.110278721 g/mol |

| Monoisotopic Mass | 133.110278721 g/mol |

| Topological Polar Surface Area | 52.5 Ų |

| Heavy Atom Count | 9 |

| Formal Charge | 0 |

| Complexity | 60.1 |

| Isotope Atom Count | 0 |

| Defined Atom Stereocenter Count | 0 |

| Undefined Atom Stereocenter Count | 2 |

| Defined Bond Stereocenter Count | 0 |

| Undefined Bond Stereocenter Count | 0 |

| Covalently Bonded Unit Count | 1 |

19.5 mg/kg (14)C-DIPA in acetone /was applied dermally/ to an area of skin on the shoulder of four female Fisher 344 rats. After evaporation of the solvent /site of application remained covered for 48 hr/. At 48 hr 25% of the substance had penetrated the skin (12% excreted in the urine, 1% excreted in the feces and expired air, 12.5% remaining in the tissue and 73% was recovered from the application site and surroundings.

European Chemicals Bureau; IUCLID Dataset, diisopropanolamine (110-97-4) (2000 CD-ROM edition). Available from, as of September 19, 2005: https://esis.jrc.ec.europa.eu/

When 4 female Fischer-344 rats were injected iv with 19 mg (14)C-labelled diisopropanolamine in aqueous solution, more than 70% of the radioactivity was eliminated from the blood during the first 6 hr. About 90% of the dose was recovered from the urine within 12 hours.

Institution for Statutory Accident Insurance and Prevention in the Chemical Industry (Berufsgenossenschaft der chemischen industrie); Toxicological Evalution No. 178 Diisopropanolamine p.175 (1991)

ABOUT THIS PAGE

32

PharmaCompass offers a list of Diisopropanolamine API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, Price,and more, enabling you to easily find the right Diisopropanolamine manufacturer or Diisopropanolamine supplier for your needs.

Send us enquiries for free, and we will assist you in establishing a direct connection with your preferred Diisopropanolamine manufacturer or Diisopropanolamine supplier.

PharmaCompass also assists you with knowing the Diisopropanolamine API Price utilized in the formulation of products. Diisopropanolamine API Price is not always fixed or binding as the Diisopropanolamine Price is obtained through a variety of data sources. The Diisopropanolamine Price can also vary due to multiple factors, including market conditions, regulatory modifications, or negotiated pricing deals.

A Diisopropanolamine manufacturer is defined as any person or entity involved in the manufacture, preparation, processing, compounding or propagation of Diisopropanolamine, including repackagers and relabelers. The FDA regulates Diisopropanolamine manufacturers to ensure that their products comply with relevant laws and regulations and are safe and effective to use. Diisopropanolamine API Manufacturers are required to adhere to Good Manufacturing Practices (GMP) to ensure that their products are consistently manufactured to meet established quality criteria.

A Diisopropanolamine supplier is an individual or a company that provides Diisopropanolamine active pharmaceutical ingredient (API) or Diisopropanolamine finished formulations upon request. The Diisopropanolamine suppliers may include Diisopropanolamine API manufacturers, exporters, distributors and traders.

Diisopropanolamine Active pharmaceutical ingredient (API) is produced in GMP-certified manufacturing facility.

GMP stands for Good Manufacturing Practices, which is a system used in the pharmaceutical industry to make sure that goods are regularly produced and monitored in accordance with quality standards. The FDA’s current Good Manufacturing Practices requirements are referred to as cGMP or current GMP which indicates that the company follows the most recent GMP specifications. The World Health Organization (WHO) has its own set of GMP guidelines, called the WHO GMP. Different countries can also set their own guidelines for GMP like China (Chinese GMP) or the EU (EU GMP).

PharmaCompass offers a list of Diisopropanolamine GMP manufacturers, exporters & distributors, which can be sorted by USDMF, JDMF, KDMF, CEP (COS), WC, API price, and more, enabling you to easily find the right Diisopropanolamine GMP manufacturer or Diisopropanolamine GMP API supplier for your needs.

A Diisopropanolamine CoA (Certificate of Analysis) is a formal document that attests to Diisopropanolamine's compliance with Diisopropanolamine specifications and serves as a tool for batch-level quality control.

Diisopropanolamine CoA mostly includes findings from lab analyses of a specific batch. For each Diisopropanolamine CoA document that a company creates, the USFDA specifies specific requirements, such as supplier information, material identification, transportation data, evidence of conformity and signature data.

Diisopropanolamine may be tested according to a variety of international standards, such as European Pharmacopoeia (Diisopropanolamine EP), Diisopropanolamine JP (Japanese Pharmacopeia) and the US Pharmacopoeia (Diisopropanolamine USP).