The pharma industry clearly recalibrated itself in 2023, turning its focus away from Covid and onto two of the biggest threats to human health – obesity and cancer. The top lines of the major pharma companies reflect this shift in focus.We

always knew that Pfizer’s record US$ 100 billion revenue for 2022 wasn’t sustainable. Even though Pfizer’s 2023 sales were lower by nearly 42 percent against its 2022 sales, the New York-headquartered drugmaker managed to retain its pole position. The two main reasons behind its ‘top of the charts’ sales of US$ 58.5 billion were Pfizer’s record nine new molecular entity approvals by the US

Food and Drug Administration (FDA) and the launch of its vaccine for

respiratory syncytial virus (RSV).Johnson & Johnson came second with sales of US$ 54.8

billion (excluding its consumer business and MedTech units). AbbVie took bronze despite Humira being subject to biosimilar competition

and Merck maintained its fourth position. Roche nabbed the fifth position from Novartis (which stood sixth). Bristol Myers Squibb maintained its position at seven, as did

AstraZeneca (eighth) and Sanofi (ninth). And Eli Lilly bumped into the tenth spot, knocking out

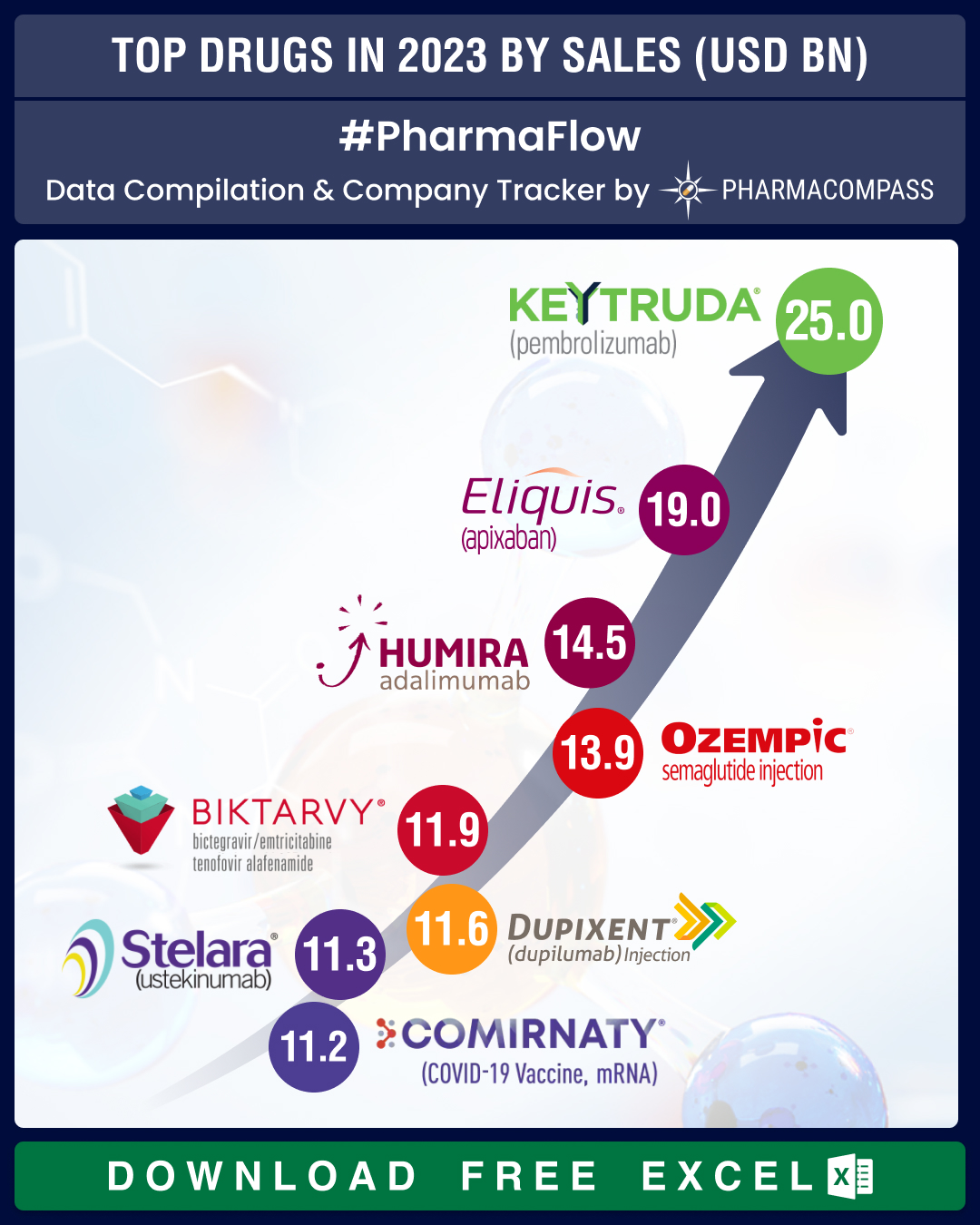

GSK.View Our Interactive Dashboard on Top Drugs in 2023 by Sales (Free Excel Available)Keytruda, Eliquis, Humira top charts; Novo’s Ozempic debuts top 10 list at number fourMerck’s Keytruda became the number one selling drug in the world, a position that was held

by AbbVie’s Humira for long, and Pfizer’s Comirnaty in the Covid years. This

oncology drug raked in a whopping US$ 25 billion, with sales increasing 19 percent last

year. In fact, Keytruda accounted for 46.7 percent of Merck’s pharmaceutical sales, which grew 3 percent in 2023 to US$ 53.6 billion.At number two was

Pfizer and BMS’ anticoagulant Eliquis — it posted global sales of US$

18.95 billion (marking a

growth of 4

percent on 2022 sales). With

competition from generics, Humira’s sales fell by 32 percent to US$ 14.5 billion. As a result, this

blockbuster anti-rheumatic drug fell to the third rank.The

fourth spot was taken up by Novo Nordisk’s Ozempic, the wonder drug that treats type 2

diabetes. Gilead’s Biktarvy, a med that treats HIV-1, saw sales jump 14 percent — from US$ 10.39 billion posted in 2022 to US$ 11.85 billion last year. This way, Biktarvy emerged as

the fifth largest selling drug of 2023.At

number six was Sanofi and Regeneron’s Dupixent. This allergic diseases med posted

11-figure sales in 2023, netting € 10.72 billion (US$ 11.59 billion) globally, a growth of 34 percent over

2022 numbers.At

number seven was J&J’s biggest blockbuster immunology drug Stelara that raked in US$ 11.3 billion in 2023. Coming a close eighth was Pfizer-BioNTech’s Covid-19 vaccine Comirnaty — its sales fell by over 70 percent to US$ 11.22 billion in 2023. At the ninth spot was Lilly and Boehringer’s diabetes drug Jardiance that saw a 27.7 percent increase in

total global sales at US$ 10.6 billion. And rounding off the list at number 10

is BMS’s Opdivo, a Keytruda rival. Opdivo hauled in US$ 10 billion

in total global sales in 2023, a year-on-year increase of 8 percent.View Our Interactive Dashboard on Top Drugs in 2023 by Sales (Free Excel Available)Driven by diabetes, obesity care meds,

Novo, Lilly post double-digit sales growthDemand

for diabetes and new weight-loss drugs catapulted Novo Nordisk to emerge as the most valuable public

company in Europe. Its net sales zoomed 31 percent to DKK 232.3 billion (US$ 33.75 billion) compared to DKK 177

billion (US$ 25.8 billion) in 2022. Net profit jumped 51 percent to DKK 83.68 billion (US$ 12.51 billion) in 2023 from DKK

55.5 billion (US$ 8.32

billion) in 2022 — the highest annual profit for the Danish drugmaker in over three decades.The

growth was driven by Ozempic, whose sales spiked 60 percent in 2023

to DKK 95.7 billion (US$ 13.91 billion), from DKK 59.8 billion (US$ 8.71 billion) the

year before.Rival

Eli Lilly’s revenue grew 20 percent in 2023 to US$ 34.1 billion from US$ 28.5 billion in 2022. Mounjaro turned out to be a star for the

Indianapolis drugmaker with its sales rocketing 970 percent in 2023 to US$ 5.16 billion. FDA also approved it to treat obesity

under the brand name Zepbound in November, which brought in additional

revenues of US$ 176 million.View Our Interactive Dashboard on Top Drugs in 2023 by Sales (Free Excel Available) GSK’s RSV jab makes strong debut; AbbVie’s immunology drugs post steep growthGSK’s Arexvy was the first RSV vaccine approved by the FDA. It made a strong debut — Arexvy contributed £ 1.2 billion (US$ 1.5 billion) to GSK’s sales in just four months.AbbVie posted another solid financial year.

Though the drop in Humira revenue was offset by two newer

immunology blockbuster drugs, Skyrizi and Rinvoq, the Illinois-headquartered drugmaker

did posted a marginal decrease in revenue of 6.4 percent to US$ 54.3 billion. However, revenue from Skyrizi soared 50 percent to US$ 7.8 billion,

while Rinvoq’s sales increased 57 percent to US$ 4

billion. AbbVie expects a combined US$ 16 billion from Skyrizi (US$ 10.5 billion) and Rinvoq (US$ 5.5 billion) sales in 2024. BMS attributed its 2 percent decrease in

revenue (of US$ 45 billion) to lower sales of Revlimid in the US due to competition from

generics. Sales of the multiple myeloma treatment dropped 39 percent to US$ 6.1

billion. Ophthalmology drug Eylea saw a drop in sales of

4 percent, at US$ 9.21 billion (from US$ 9.65 billion), as competition from Roche’s Vabysmo triggered a price cut by Regeneron. Vabysmo saw sales balloon 324 percent

from CHF 591 million (US$ 685.56 million) to CHF 2.4 billion (US$ 2.78 billion) in 2023.View Our Interactive Dashboard on Top Drugs in 2023 by Sales (Free Excel Available) Our viewAccording

to data analytics company GlobalData, GLP-1 agonist drugs (such as Ozempic and Mounjaro that treat type 2 diabetes) are slated to overtake PD-1 antagonists (such as oncology drugs

Keytruda and Opdivo) as the top-selling drugs on the market

in 2024. It estimates a robust compounded annual growth rate (CAGR) of 19.2

percent from 2023 to 2029 for GLP-1 drugs that seem to have more benefits

besides bringing down blood sugar levels (such as weight management, benefits

to the heart etc).The

market size for GLP-1 is likely to increase to US$ 105 billion by 2029. In

contrast, the data firm projects a CAGR of 4.7 percent in the PD-1 antagonist

market, with its market size projected to be around US$ 51 billion in 2029.

Given these projections, we are likely to see more movers and shakers in our

top 10 drug list this year.

Impressions: 844

In the intricate world of molecular biology, oligonucleotides stand out as versatile, powerful molecules. Oligonucleotides are essentially short, single strands of DNA or RNA that modulate gene expression. There are various oligonucleotide therapy (ONT) agents (such as antisense, deoxyribozymes, siRNA and CRISPR/Cas) that offer promising therapeutic tools.A variation of gene therapy, oligonucleotide gene therapies (OGTs) are manufactured using synthetic oligonucleotides. These therapies are designed to enter cells. ONTs act like tools that can fine-tune the behavior of certain genetic instructions, and are therefore often designed to treat rare and genetic diseases and cancers. Sometimes, they may be delivered into cells through lipid nanoparticles or adeno-associated viruses (AAV), halting the translation of a specific protein. Oligonucleotides have also revolutionized vaccine development through the creation of nucleic acid vaccines, such as mRNA vaccines.The first oligonucleotide

drug, known as fomivirsen, was approved by the

US Food and Drug Administration (FDA) back in 1998. It was developed by Ionis Pharmaceuticals (then known as Isis Pharmaceuticals), and was approved to treat a rare eye disease. However, ONT approvals have picked up since 2016. Currently, there are 20 oligonucleotide drugs approved by the FDA and the European Medicines

Agency (EMA) and a majority of them treat orphan and rare

diseases.In 2023, FDA approved four ONTs — AstraZeneca-Ionis’ Wainua (eplontersen), Novo Nordisk owned Dicerna Pharmaceuticals’ Rivfloza (nedosiran), Biogen-Ionis’ Qalsody (tofersen) and Iveric Bio’s Izervay (avacincaptad pegol).In 2021, the global ONT market size was estimated to be US$ 18.2 billion. It is expected to increase to US$ 51.4 billion by 2029, growing at a compounded annual rate (CAGR) of 13.85 percent. Similarly, the market for oligonucleotides synthesis (or the process of producing oligonucleotides) was estimated at US$ 7.7 billion globally in 2022

and is expected to grow 11.8 percent CAGR to reach US$ 16.4

billion by 2030. Some of the bigger players in oligonucleotides synthesis are Danaher Corporation, Thermo Fisher Scientific, Merck KGaA, Eurofins, Agilent, Bio-Synthesis, EUROAPI, Eurogentec, STA Pharma, and Bachem.View Our Interactive Dashboard on Oligonucleotide Therapies (Free Excel Available)ONTs address neuro disorders; four ONTs bring in US$ 1.24 bn for AlnylamONTs are widely applied to treat

neurodegenerative diseases, such as Duchenne muscular dystrophy (DMD). Multiple ONTs have been approved in Europe and the US for

DMD, such as Exondys 51 (eteplirsen), Vyondys 53 (golodirsen), and Amondys 45

(casimersen) from Sarepta and NS Pharma’s Viltepso (viltolarsen). Last year, Ionis bagged two approvals in the

space. FDA

approved its Biogen-partnered

therapy Qalsody (tofersen) to treat patients with amyotrophic lateral sclerosis

(ALS). The agency

also approved AstraZeneca and Ionis’ drug Wainua (eplontersen), rendering it as the

first self-administered treatment for a rare nerve damage

disease, known as hereditary transthyretin amyloidosis (ATTR-PN). Analysts

estimate global peak sales for Wainua to come in at US$ 750

million for ATTR-PN alone. The drug is also being

tested for transthyretin-mediated amyloid cardiomyopathy (ATTR-CM), a rare

heart muscle disorder.Alnylam

Pharmaceuticals has also successfully brought four ONTs to market in recent years — Onpattro (patisiran) and

Amvuttra (vutrisiran) for rare

nerve diseases, and Givlaari (givosiran) and Oxlumo (lumasiran). Givlaari has been approved to treat acute hepatic porphyria (a liver enzyme deficiency) while Oxlumo treats primary hyperoxaluria (a disorder characterized by increased urinary oxalate excretion). The four ONTs brought in US$ 1.24

billion for Alnylam in 2023.View Our Interactive Dashboard on Oligonucleotide Therapies (Free Excel Available) Novartis

buys rights to siRNA therapy, GSK bets big on ONT pipeline through dealsAfter Alnylam discovered

inclisiran (Leqvio), Novartis acquired

global rights to the therapy in a US$ 9.7

billion deal. Leqvio was the first

FDA-approved small interfering RNA (siRNA) therapy

for LDL-C (bad cholesterol) reduction. It brought in US$ 355

million for Novartis in 2023.GSK has increasingly

been investing

in its ONT pipeline. The British

pharma has promised over US$ 5 billion in upfront and milestone payments in

multiple deals. In February, GSK exercised

its option to license Elsie Biotechnologies’ discovery platform to find

and develop novel ONTs. GSK has also entered a discovery collaboration with Wave Life Sciences.Last July, Japanese drugmaker Astellas Pharma completed its

approximately US$ 5.9 billion buyout of New

Jersey-headquartered Iveric Bio. Iveric focuses on retinal diseases and the deal gives Astellas drug candidates to treat about 160 million people with eye ailments. Subsequently, in August, Iveric’s Izervay (avacincaptad pegol) was approved by the FDA as a new

treatment for geographic atrophy (GA) secondary to age-related macular

degeneration (AMD).After Novo Nordisk acquired RNAi technology company Dicerna Pharmaceuticals for US$ 3.3 billion in 2021, the latter’s once-monthly RNAi therapy Rivfloza (nedosiran) saw FDA approval last October. Rivfloza was

okayed for children nine years and older to treat a rare genetic condition that affects the kidneys,

known as primary hyperoxaluria type 1 (PH1).View Our Interactive Dashboard on Oligonucleotide Therapies (Free Excel Available) Ionis tees up NDAs for rare

disease treatments after two late-stage trial winsThe industry is looking for cures to a wide spectrum of diseases like cancer (such as melanoma, pancreatic, liver, glioblastoma, breast and ovarian cancer), cystic fibrosis, Alzheimer’s disease, Parkinson’s disease, hepatitis B, asthma, Rett syndrome, non-alcoholic steatohepatitis, and IgA nephropathy through its research on ONTs.In January, Ionis announced late-stage results wherein its

RNA-targeted hereditary angioedema (HAE) candidate, donidalorsen, significantly

reduced the rate of HAE attacks in patients

treated every four weeks and patients treated every eight weeks. The

California-based biotech is readying a new drug application (NDA) to submit to the FDA. HAE is a rare and life-threatening genetic disease that causes unpredictable and frequent severe swelling of the skin, gastrointestinal (GI) tract, upper respiratory system, face and throat. This year, Ionis’ olezarsen was granted fast track designation by

the FDA for the rare genetic disease familial chylomicronemia syndrome (FCS).

Last September, olezarsen had met its primary endpoint of reducing abnormally high

levels of triglycerides in a late-stage trial in patients with the metabolic disorder. Currently, there are no

FDA-approved treatments for this condition. If okayed, olezarsen is likely to

bring in US $849 million in sales for Ionis by 2032.In March, FDA’s Oncologic Drugs Advisory Committee (ODAC) voted 12 to two in favor of the clinical

benefit/risk profile of imetelstat for the treatment of transfusion-dependent (TD) anemia in certain adult patients with myelodysplastic syndromes. The agency assigned a Prescription Drug User Fee Act (PDUFA) target action date of June 16, 2024, for Geron’s NDA for imetelstat. It is among the most anticipated drug launches this year.View Our Interactive Dashboard on Oligonucleotide Therapies (Free Excel Available) Our viewDeveloping ONTs is a field fraught with challenges, such as toxicity and drug delivery. There are safety concerns as well as concerns around delivering the therapy. However, technological breakthroughs and collaborations between pharma firms and contract research organizations that focus on drug delivery are continuously working towards addressing these challenges. All in all, we foresee exciting times ahead for ONTs.

Impressions: 2101

The year 2023 was a rather

tough one for cell and gene therapy (CGT) companies. There was news about

smaller CGT players finding it difficult to get finance, with many drastically

downsizing their operations by laying off hundreds of employees. Many others

had to shut shop, making us wonder if innovation in the biopharma industry is

in for a setback.The new year began on a sour

note, with the FDA shooting off letters to six manufacturers of cancer

therapies that use CAR-T technology to add a boxed warning on their label after

the agency found a serious risk of developing secondary cancer. These therapies include Bristol-Myers Squibb’s Abecma and Breyanzi, Janssen Biotech’s Carvykti, Gilead’s Yescarta, Novartis’ Kymriah and Kite Pharma’s Tecartus. “Boxed warnings” or “black box warnings” are the highest safety warnings. A week later, FDA stepped in and finalized guidance

for companies and academic researchers working on CAR-T cell therapies.In this article, PharmaCompass looks at some of the

challenges being faced by CGT firms, and the growth prospects of this sunrise

sector.A field with complex manufacturing, high costs of developmentThere are several ways in

which CGTs can target a disease, giving

rise to various kinds of such therapies. These include gene addition, gene

silencing, gene editing, DNA therapy (such as DNA plasmids and viral vectors),

RNA therapy (ribosomal RNA, messenger RNA, microRNA, small interfering RNA and

transfer RNA), antisense oligonucleotides and gene-modified cell therapy (such

as CAR T-cell therapies and Treg cell therapies). CGTs are being deployed to treat several kinds of diseases, such as various types of cancers, including brain tumors, breast and colon cancers, as well as leukemia. Other major therapeutic areas CGTs are making an impact on are genetic and rare diseases like sickle cell disease (SCD), β-thalassemia, hemophilias, and paraplegia. CGTs are also being explored for treating Duchenne muscular dystrophy, Alzheimer's disease, Parkinson’s disease, multiple sclerosis, type 1 diabetes and macular edema.Going by FDA’s Purple Book, there are 35 CGT products

approved in the US. With three FDA approvals, bluebird bio tops the list (with

Lyfgenia, Zynteglo, and Skysona), followed by Bristol Myers Squibb (with Abecma and Breyanzi), Kite Pharma (with Tecartus and Yescarta), and Novartis (with Zolgensma and Kymriah). Recently, FDA approved Vertex Pharma-CRISPR Therapeutics’ Casgevy, the first gene-editing therapy that uses the Nobel-prize-winning CRISPR technology.Though CGTs are personalized

therapies, they come with potential risks, such as developing certain kinds of cancers, genotoxicity, allergic reactions, damage to the organs etc.Another challenge faced by

CGTs is costs. Apart from the high R&D costs, these biotechs face other challenges such as high costs of reagents like clinical-grade lentiviral vectors or gene editing reagents, as well as cell processing materials, GMP facilities and personnel costs.Little wonder then that the selling price of some of the CGTs run

into millions of dollars. CSL Behring and uniQure’s Hemgenix, a first-of-its-kind drug for hemophilia B, is the most expensive drug in the world. It costs a

whopping US$ 3.5 million. Similarly, bluebird bio’s Lyfgenia, a therapy that has

the potential to resolve vaso-occlusive events and is custom-designed to treat the underlying cause of SCD,

costs US$ 3.1 million.Smaller CGT firms get

strapped for funds, fail to land Big Pharma dealsTypically, innovation for CGTs happens at small

biotechs or universities. Many of the small firms get acquired by bigger

drugmakers or tie up with larger pharma companies so that volumes can be scaled

up once the therapy is approved.Last year, scores of biotechs announced

bankruptcies. Many smaller biotechs failed to land Big Pharma deals. They had

to contend with narrower funding options, forcing several startups in

the sector to shut shop. For example, Intergalactic Therapeutics shut down last year, after

being around for less than two years. The company said: “The current environment has led to challenging times for companies to raise capital,” even though Intergalactic’s programs have “shown promise”. Other CGT firms that shut shop last year were Locanabio, Vedere Bio II and CODA Biotherapeutics.Companies that laid off employees to cut costs are base editing biotech Beam Therapeutics, Editas Medicine, Sangamo Therapeutics, Graphite Bio, UniQure, Generation Bio, Candel Therapeutics, Lyell Immunopharma, BrainStorm Cell

Therapeutics and Nkarta. CRISPR Therapeutics, ElevateBio and Atsena also reportedly laid off employees. FDA lines up initiatives, to make 2024 ‘breakout’ year for gene therapiesThe “personalized nature” of CGTs makes them highly effective. But this trait also gives rise to multiple challenges. Acknowledging this, in January, FDA announced a pilot program called Collaboration on Gene Therapies Global Pilot (CoGenT Global) to streamline regulations pertaining to this sector. The agency has also addressed challenges such as the high cost of manufacturing, clinical development timelines, macroeconomic conditions (such as high interest rates), and operational issues being faced by CGTs. FDA is promising to make 2024 a “breakout” year for gene therapies, with a number of initiatives to promote clinical development, approvals and uptake. FDA’s Center for Biologics Evaluation and Research (CBER) is sponsoring research and encouraging collaboration with the National Institutes of Health’s Bespoke Gene Therapy Consortium. The agency has made gene editing therapies eligible for accelerated

approval and detailed the information that should be provided in an

investigational new drug (IND) application. It has also launched a pilot program Support for clinical Trials Advancing Rare disease Therapeutics (START), with the intention of speeding up development.Our viewIn 2022, Precedence Research estimated the CGT market at US$ 15.46

billion, expecting it to increase fivefold by 2032 to touch US$ 82.24 billion, with therapeutic areas such as oncology (US$ 10.4 billion) and genetic disorders (US$ 8.57 billion) expected to draw most revenues.FDA approved seven CGTs in 2023, including Casgevy. But this year, FDA and European regulators

may approve as many as 17 gene therapies. A McKinsey report says in 2024 alone, “up to 21 cell therapy launches and as many as 31 gene therapy launches—including more than 29 adeno-associated virus (AAV) therapies—are expected.” Given these estimates, we have little doubt that 2024 will be a “breakout year” for CGTs.

Impressions: 1886

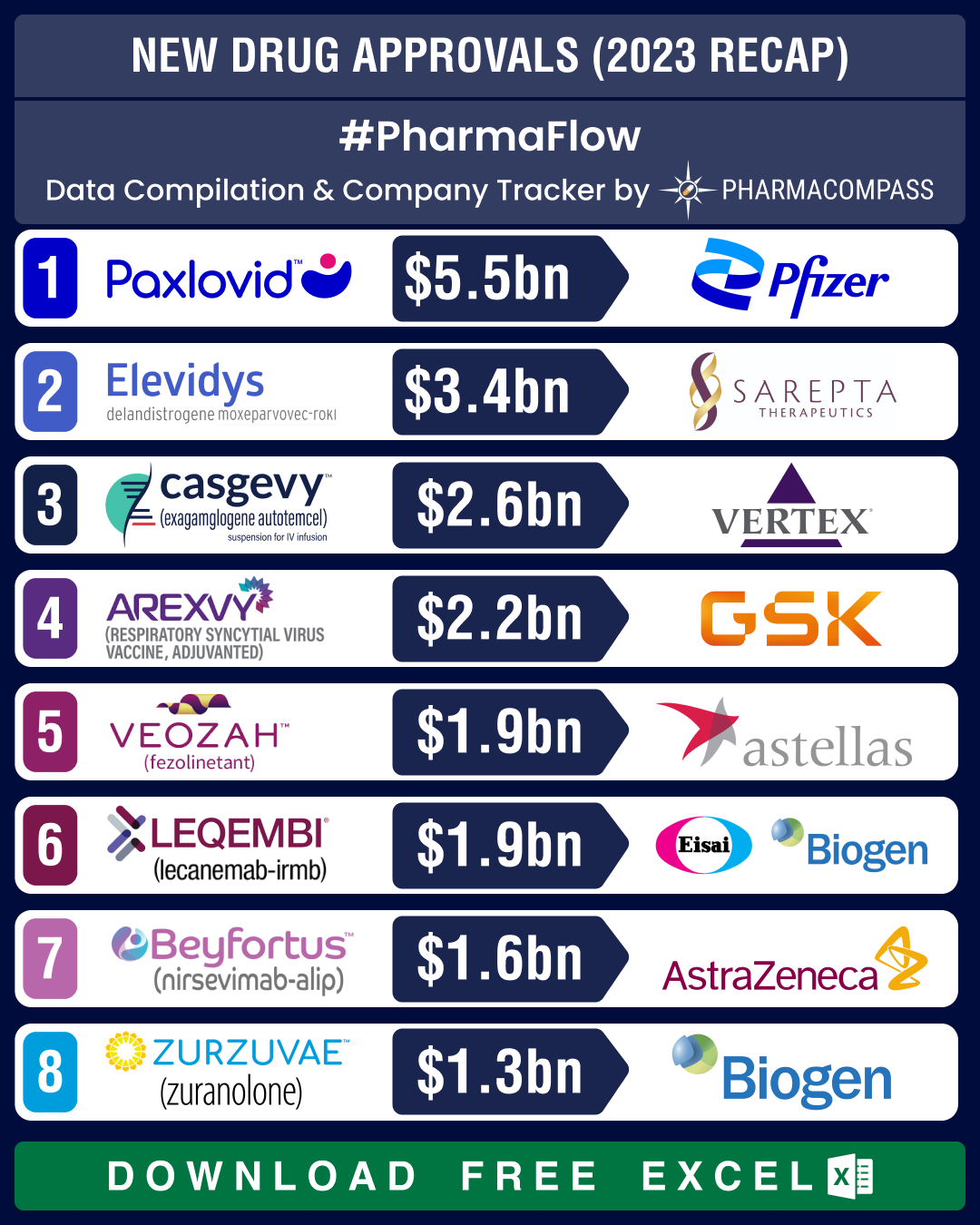

In 2022, when the

US Food and Drug Administration (FDA) was reeling under the impact of the

pandemic, new drug approvals by the agency dropped by 26 percent. But last year, FDA’s new drug approvals rebounded by an impressive 49 percent, with the Center for Drug Evaluation and Research (CDER) approving 55 new drugs in 2023. Of them, 36 percent were considered first-in-class, while small molecules made up for 62 percent of the total drugs approved (i.e. 34). FDA’s Center for Biologics Evaluation and Research (CBER) okayed 19 biologics in 2023 compared to eight in the previous year.The first half of

2023 saw the debut of vaccines for the all-too-common respiratory syncytial

virus (RSV). Among the other notable approvals in H1 was Biogen and Eisai’s

Alzheimer’s drug Leqembi (lecanemab). Out of the total 55 drug approvals, 29

came in H2 2023. This includes Vertex Pharmaceuticals and CRISPR Therapeutics’ Casgevy that relies on the Nobel Prize-winning CRISPR gene-editing technology. Casgevy has been approved as a treatment for sickle-cell disease (SCD) and β-thalassemia.While FDA witnessed a sharp rise in approvals in 2023, many other drug regulators didn’t. The European Medicines Agency (EMA) granted marketing authorization to 32 novel drugs in 2023, a fall from 33 in 2022. Similarly, Health Canada’s approvals in 2023 decreased to 38, compared to 45 in the previous year.As usual,

oncology topped the list of drug approvals by therapeutic area, at 39 (as

opposed to 35 in 2022). Rare diseases was the second most popular therapeutic

area for drug approvals. With drugmakers clearly paying heed to the unmet needs

of patients suffering from rare diseases, this therapeutic area sprinted from a

9 percent share and the fourth position among new approvals in 2022 to an

impressive 34 percent share in 2023. A quarter of the new drug approvals were

in infectious diseases, followed by immunology (19 percent) and neurology (7

percent).View New Drug Approvals in 2023 with Estimated Sales (Free Excel Available) Casgevy, postpartum depression drug Zurzuvae

emerge as potential blockbustersGene therapy

Casgevy, postpartum depression (PPD) med Zurzuvae, blood cancer med Elrexfio and ulcerative colitis drug Velsipity were some of the prominent approvals of 2023.Britain’s Medicines and Healthcare products Regulatory Agency was the first to okay Casgevy in November as a cure for SCD and β-thalassemia. Soon, the FDA approved it for SCD. In January this year, the American agency also approved it for transfusion-dependent β-thalassemia (TDT). Analysts estimate Casgevy to generate US$ 2.6 billion in peak sales, says Nature. Biogen and Sage’s PPD therapy Zurzuvae became the first and only FDA-approved pill for

the condition that can be life-threatening for both the mother and the child. Global sales of

Zurzuvae are forecast to hit US$ 1.28 billion by 2028.In August, Pfizer’s

Elrexfio (elranatamab) became the first “off-the-shelf” (ready-to-use) therapy in the US for multiple myeloma. The drug provides an option for patients with hard to treat or relapsed blood cancer and is estimated to bring in US$ 861 million in peak sales by 2028, says Nature.Pfizer also

bagged another significant approval in October — its drug Velsipity (etrasimod) was greenlit by the FDA to treat adults with ulcerative colitis, an

inflammatory bowel disease. Peak revenue for Velsipity is expected to come in at US$ 825 million, as per Evaluate.View New Drug Approvals in 2023 with Estimated Sales (Free Excel Available) Astra’s Truqap, GSK’s Ojjaara among top cancer therapies given FDA

nod in H2In November, FDA approved AstraZeneca’s

Truqap (capivasertib) in combination with the Anglo-Swedish drugmaker’s Faslodex (fulvestrant) for treating adult patients with hormone receptor (HR)-positive, HER2-negative locally advanced or metastatic breast cancer with one or more biomarker alterations. Evaluate Pharma forecasts peak Truqap sales to come in at about US$ 690 million.In September, FDA

approved GSK’s

Ojjaara (momelotinib) as the first and only treatment for myelofibrosis with anemia.

Nearly all myelofibrosis patients are estimated to develop anemia over the course of the disease. Ojjaara is taken orally once a

day.Other notable oncology treatments okayed by FDA in H2 2023 include Daiichi’s

Vanflyta (quizartinib) in July to treat an aggressive blood cancer known as acute myeloid leukemia (AML). In August, FDA approved Janssen’s

bispecific antibody Talvey (talquetamab-tgvs)

for difficult-to-treat blood cancer. The agency approved two cancer therapies in November — BMS’ Augtyro (repotrectinib) for ROS1-positive non-small cell lung cancer (NSCLC) and Takeda’s

targeted oral therapy Fruzaqla (fruquintinib) for adult patients with metastatic colorectal cancer (mCRC).View New Drug Approvals in 2023 with Estimated Sales (Free Excel Available) Rare disease drugs Santhera-Catalyst’s Agamree, Novo’s Rivfloza bag approval in H2In October, FDA

approved Santhera Pharmaceuticals and Catalyst Pharma’s Agamree (vamorolone), an oral suspension treatment for Duchenne muscular dystrophy (DMD)

in patients two years of age and older. This makes it the first drug fully approved in both the US and Europe for the muscle

degeneration disorder. Agamree acts in a manner similar to other steroids,

which are the standard of care for the inherited rare disease. However, it

causes fewer side effects.FDA also okayed Novo Nordisk’s

once-a-month injection Rivfloza (nedosiran) in October to treat a rare genetic condition — primary hyperoxaluria type 1 (PH1) — that causes recurring kidney stones.In November, the

agency approved Takeda’s Adzynma (ADAMTS13, recombinant-krhn) as the first treatment for both adult and pediatric patients with congenital thrombotic thrombocytopenic purpura (cTTP), a rare genetic blood disorder. Other noteworthy

FDA approvals in H2 2023 for rare blood diseases include Novartis’ Fabhalta and bluebird bio's Lyfgenia. Fabhalta is the first oral monotherapy for the treatment of adults with paroxysmal nocturnal hemoglobinuria, a rare disease that causes symptoms such as hemolytic anemia, hemoglobinuria (excretion of hemoglobin in the urine), fatigue, shortness of breath etc. Lyfgenia is the first cell-based gene therapy for the treatment of SCD in patients 12 years and older. Similarly, another rare disease drug — Regeneron’s Veopoz — bagged FDA approval in August last. Veopoz treats CHAPLE disease, an

ultra-rare disease in which patients have severe gastrointestinal problems.View New Drug Approvals in 2023 with Estimated Sales (Free Excel Available) Our viewAfter a lull in

2022, new drug approvals have finally gathered momentum. The good news is that this year,

several pathbreaking drugs are coming up for approval, such as Madrigal Pharmaceuticals’ resmetirom (the first treatment for NASH with liver fibrosis), Merck’s sotatercept (a treatment for pulmonary arterial hypertension), Lilly’s donanemab for Alzheimer’s disease and Karuna Therapeutics’ drug to treat schizophrenia. Let’s hope 2024 turns out to be an even bigger year for new drug approvals.

Impressions: 2444

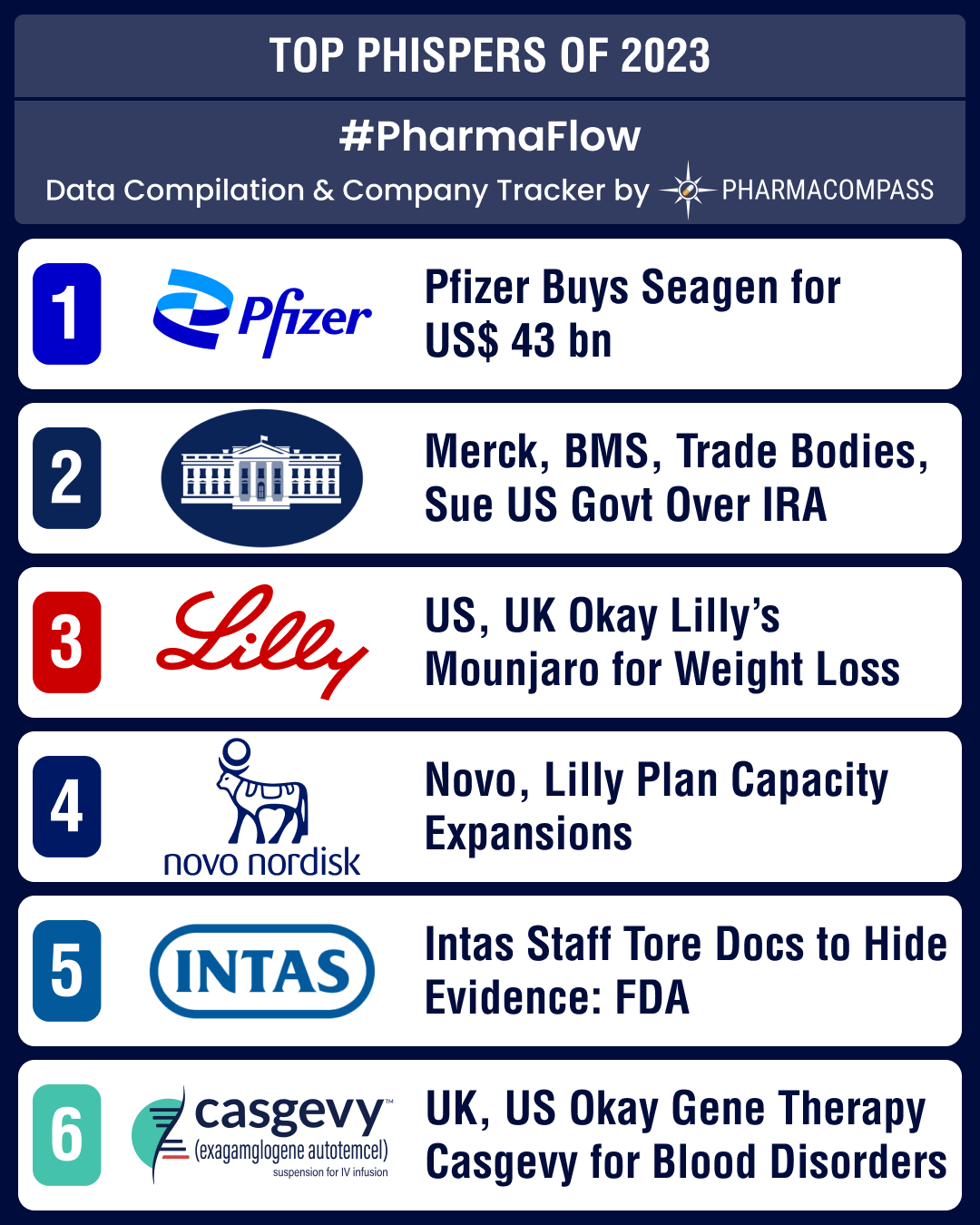

Every week,

PharmaCompass compiles important developments in the world of pharmaceuticals

and brings a compilation to you in the form of Phispers. Of the hundreds of

stories we carried in 2023, here are the top 10 stories, including some trends

and updates.I. Pfizer buys Seagen for US$ 43 billion to

bolster its oncology portfolioIn March, Pfizer said it is acquiring cancer treatment specialist Seagen for US$ 43 billion. Seagen is a pioneer in antibody-drug conjugates

(ADCs), or drugs that work like “guided missiles” to destroy cancer cells while sparing healthy cells. Another important deal in the field of ADCs took place in December when AbbVie picked up ImmunoGen for US$ 10.1 billion, giving it access to Elahere (mirvetuximab soravtansine-gynx), an ADC approved for platinum-resistant ovarian

cancer. Elahere is expected to achieve blockbuster status by 2030. II.

Merck, BMS, trade bodies, sue US government over IRA negotiationsIn June, Merck filed a lawsuit against the US government seeking to block Medicare from negotiating lower

prescription drug prices under the Inflation Reduction Act (IRA). Days later,

the US Chamber of Commerce, one of the most influential trade groups in the US, filed a separate lawsuit, arguing

that the negotiations violated drugmakers’ constitutional rights and granted

excessive control over prices to the government. They were joined by Bristol Myers Squibb (BMS) and lobby group PhRMA. Drugmakers and

the Biden administration appeared to be at each other’s throats. In December, the White House identified 48 drugs whose prices spiked faster than inflation in Q4.

These drugs may be subject to rebates starting January 2024. Biden

Administration also announced it is setting a new “march-in” policy that allows the government to seize medicine patents held by drugmakers for therapies whose

development was taxpayer-funded, if it believes they are not “reasonably available and affordable.”III. US, UK approve Lilly’s Mounjaro for weight management; to be

sold as ZepboundIn November, drug

regulators in the US and the United Kingdom approved Eli Lilly's Mounjaro (tirzepatide) for weight management, to be sold under the brand name Zepbound. The drug will pose strong competition

to Novo Nordisk’s Wegovy in a market that's expected to reach US$ 100 billion by the end of

the decade.IV. Novo, Lilly plan capacity expansions for

weight loss drugsBoth Novo Nordisk and Eli Lilly announced expanding their manufacturing capacities in

order to capitalize on the burgeoning market for weight loss drugs. Novo is

investing over DKK 42 billion (US$ 6 billion) in Kalundborg (Denmark), US$ 2.3 billion to expand its site in Chartres (France) and over € 2 billion (US$ 2.18 billion) in Dublin (Ireland) to boost production of its blockbuster diabetes

and weight-loss drugs, including Ozempic and Wegovy (both semaglutide). Similarly, Eli Lilly had announced a US$ 2.5 billion manufacturing facility in Germany in November to address the demand for its new obesity and diabetes therapies.V. FDA finds violations at Global Pharma’s eye drops plant in India; issues Form

483In April, FDA

found several violations in manufacturing processes and sterilization methods

used by India-based Global Pharma for its EzriCare Artificial Tears Eye Drop, which has been linked to

68 cases of eye infection in the US, including eight cases of vision loss and three deaths.VI. ‘Intas India staff tore documents, threw acid to destroy evidence’, notes FDAIn January, FDA

issued a Form 483 with 11 observations to Intas Pharma’s

drug manufacturing facility in Ahmedabad (Gujarat, India). A team of three FDA

drug regulators conducted an inspection of the manufacturing facility from

November 22 to December 2, 2022. The 36-page report issued by the FDA has alleged that employees at the

facility had destroyed documents related to manufacturing practices by tearing

them into pieces and disposing them inside the quality control lab and scrap

areas. Acid was used to destroy evidence, notes FDA.VII. GSK overtakes Pfizer in bagging first FDA

approval for RSV vaccineIn May, FDA

approved GSK’s

respiratory syncytial virus (RSV) vaccine for people aged 60 and above. Arexvy is the first RSV vaccine to be approved in the US

for the common condition that can be fatal for the elderly. Later that month,

Pfizer’s RSV vaccine Abrysvo also got approved. In July, Sanofi-AstraZeneca’s

RSV antibody therapy, Beyfortus (nirsevimab-alip), received approval from the FDA. It is a long-acting treatment that can be given

once per season. The approval is specifically developed for newborns and

infants.VIII. UK authorizes gene therapy Casgevy for

blood disorders, US follows suit In November, Britain’s Medicines and Healthcare products Regulatory Agency was first off the block in authorizing CRISPR Therapeutics and Vertex Pharmaceuticals’ Casgevy, a therapy that seeks to cure two blood disorders — sickle-cell disease (SCD) and β-thalassemia. The therapy is based on gene editing technology that had won its scientists the Nobel Prize in Chemistry in 2020.Less than a month

later, FDA not only approved Casgevy (exagamglogene autotemcel) for SCD, but also approved bluebird bio’s

Lyfgenia (lovotibeglogene autotemcel) for the treatment of SCD in patients aged

12 and older who have a history of vaso-occlusive events (when tissues become

deprived of oxygen).IX. Leqembi becomes first med to bag full

approval to treat Alzheimer’sEisai and Biogen’s Alzheimer’s drug Leqembi (lecanemab) had won FDA’s accelerated approval in January. It treats patients who are in the earliest

stages of the neurodegenerative disease. In July, it became the first treatment to receive full FDA approval to treat the condition.X. Bayer’s experimental anticoagulant fails late-stage

trialOne of the

biggest disappointments from clinical trials came when a major late-stage trial for Bayer’s experimental anticoagulant asundexian had to be discontinued due to its inadequate effectiveness. Bayer had expectations in excess of € 5 billion (US$ 5.5 billion) from this drug.

Impressions: 1949

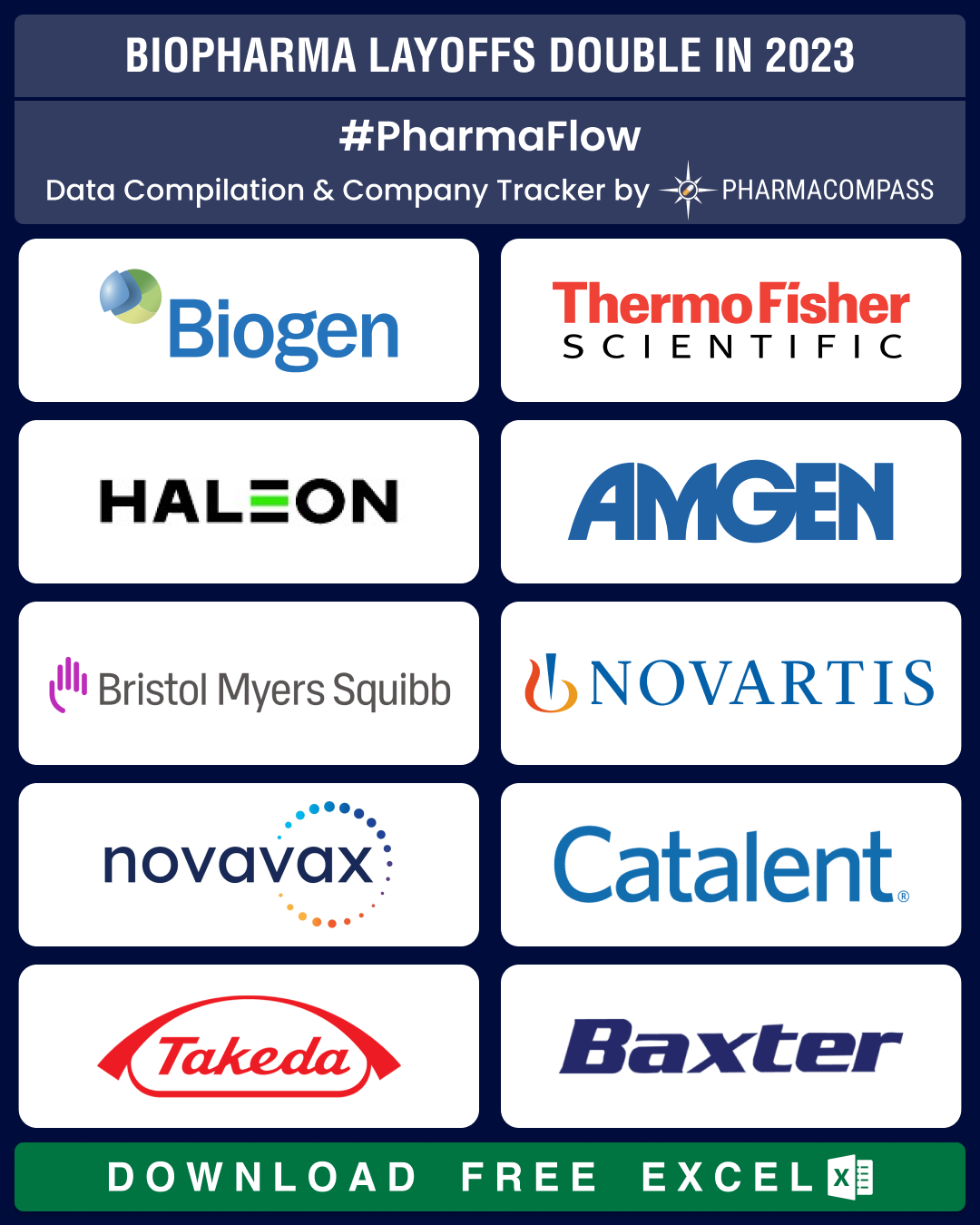

The year 2023 has

seen considerable job cuts by biopharmaceutical companies. While layoffs have

become commonplace since 2022, the exercise touched new heights this year. The reasons behind these job cuts have ranged from restructuring, drop in Covid sales, fall in quarterly revenues to shift in strategy and mergers and acquisitions.In 2022, over 100

biopharma companies had announced workforce reductions. That number has doubled in 2023. And the year has not ended as yet.In Q1 2023, the

number of companies that had announced layoffs surpassed 50 and included

companies like Biogen and Thermo Fisher. Between mid-April and November, this

figure rose even further, with approximately 140 pharmaceutical companies

disclosing workforce reductions.View Our Interactive Dashboard on Biopharma Layoffs in 2023 (Free Excel Available)Biogen, Amgen, layoff staff post mergers;

low Q2 sales trigger job cuts at BMSIn

our Q1 2023 update, we had mentioned that both Novartis and Biogen plan to cut jobs worldwide

to save US$ 1 billion in costs. Starting November, Novartis will retrench over 100 employees at its US headquarters in East Hanover (New Jersey). Similarly, Biogen

announced plans to layoff around 113 employees from Reata Pharmaceuticals’ Plano, Texas site in the US. Biogen had acquired Reata for US$ 7.3 billion in July this year, and the job cuts were announced promptly after the acquisition.Another company

that announced post-merger retrenchments is Amgen, which had acquired Horizon Therapeutics in December 2022 for US$ 27.8 billion. Amgen has been aggressively cutting

costs. Earlier this year, it had laid off 750 employees due to intensifying pressure on drug

prices and inflation. And now, it is issuing pink slips to 350 former Horizon employees.The going has

also been tough for Bristol-Myers Squibb (BMS) — it reported low Q2 revenues and had to cut its full-year forecasts

as two of its top drugs, blood cancer treatment Revlimid and blood thinner Eliquis, saw a drop in sales due to competition

from generics. As a result, BMS laid off 48 employees in New Jersey in May, and plans to do away with another 100-odd employees soon.Nearly a year

after GSK spun off its consumer healthcare

business to create Haleon, there are reports that hundreds in the

United Kingdom and potentially thousands working globally for Haleon are at the risk of losing their jobs.

The restructuring is likely to save GBP 300 million (US$ 393 million) over the next three years.View Our Interactive Dashboard on Biopharma Layoffs in 2023 (Free Excel Available)Pfizer, Thermo Fisher, Novavax announce

layoffs due to declining Covid salesIn October, Pfizer had significantly lowered its full-year revenue forecast for 2023 due to reduced demand for its Covid products. The drug behemoth has also announced cost-cutting measures such as layoffs and expense cuts that will help save US$ 3.5 billion.During the same

month, Pfizer announced plans to retrench 791 employees at its Gladstone site in the US. A month

later, the company announced 800 job cuts, by reducing staff at its Kent (the UK), Michigan (the US), and Newbridge, Kildare (Ireland) sites.Thermo Fisher Scientific has been downsizing its workforce at

different locations since last year. The company manufactures Covid testing

kits. In our Q1 2023 update, we had mentioned that the company laid off around 500 employees across various locations in California between January 2022 and mid-April 2023.In a fresh wave

of job cuts announced in November, Thermo Fisher will layoff 97 employees in January 2024. The company plans to

close its facility in Alabama. Earlier in August, the company fired 205 staffers across two separate sites in Alachua, Florida, due to the relocation of development, manufacturing, and production activities from this site to their new Plainville, Massachusetts site.In November,

Covid vaccine maker Novavax announced second round of cost cuts for 2023 in order to reduce spending by US$ 300 million. In May, Novavax had reduced its

headcount by 25 percent to align its spending with the diminishing size of the Covid opportunity.Similarly, in

June, contract manufacturer Catalent said it plans to retrench 150 employees at its Bloomington, Indiana plant.

Catalent has been working closely with drugmakers to manufacture Covid vaccines

and therapies, and the job cuts are part of its post-pandemic restructuring

exercise.View Our Interactive Dashboard on Biopharma Layoffs in 2023 (Free Excel Available)Shifts in strategy, restructuring trigger layoffs at Takeda, PTC Therapeutics, ApellisIn May, Takeda had announced a shift in its R&D strategy, leading to 186 layoffs in Massachusetts and an additional 27 in San Diego. This announcement follows Takeda’s decision to discontinue discovery and pre-clinical efforts in AAV (adeno-associated virus) gene therapy and rare hematology.In a similar move

announced in September, rare disease drugmaker PTC Therapeutics announced retrenchment of 25 percent of its workforce as part of a broader restructuring initiated in May, involving discontinuation of several early-stage gene therapy development programs to focus on high-potential R&D programs. PTC plans to complete the process by January 15. In August, Apellis announced its plan to layoff

approximately 225 employees and divest two preclinical assets to

achieve US$ 300 million in savings as part of a significant corporate

restructuring program. This move aims to drive the growth of Syfovre, an

injectable form of pegcetacoplan that received FDA approval for geographic atrophy (GA) in February.During the same

month, Sage Therapeutics, a company working on novel therapies

for brain health disorders, announced 188 job cuts. These were part of a restructuring plan announced soon after FDA rejected its

drug Zurzuvae (developed along with Biogen) for major depressive disorder (MDD). The agency has approved the pill for postpartum depression, which is a much smaller market as compared to MDD.In September, 2seventy bio (a company spun out of bluebird bio) had announced plans to layoff about 40 percent of its workforce (i.e. axe 176 jobs) in order to lower costs and focus on the biotech firm’s cancer cell therapy — Abecma.In August, Emergent BioSolutions decided to cut 400 jobs and scale back operations at some of its

facilities, in an effort to move away from its CDMO business and pivot its focus on core products, such as

nasal spray Narcan and anthrax vaccines.View Our Interactive Dashboard on Biopharma Layoffs in 2023 (Free Excel Available)Our viewThe

biopharmaceutical industry is still grappling with the disruptions caused by

Covid. Some of the layoffs reflect a correction, as demand moves back to

pre-pandemic days. The others are either a fallout of disappointing quarterly

results, or the outcome of normal business restructuring and strategy shifts.While this

article was going to print, there was news that Kite Pharma, a subsidiary of Gilead focusing on cell therapies, is letting

go off 7 percent of its staff, or around 300 employees in order to improve

operational efficiency. Similarly, another genetic medicines company Generation Bio is firing 68 employees. Both these updates follow news that FDA is investigating the “serious risk” of cancer patients developing secondary blood cancer after undergoing chimeric antigen receptor T-cell (CAR-T) therapies. Incidentally, several startups focusing on cell and gene therapies (such as

Summation Bio, Oncurus Inc, Intergalactic Therapeutics), have had to shut operations due to lack of finance.As we bid

farewell to 2023, there are larger concerns of a slowdown in the global economy. For now, it seems

like 2024 may not be very different from 2023.

Impressions: 6160

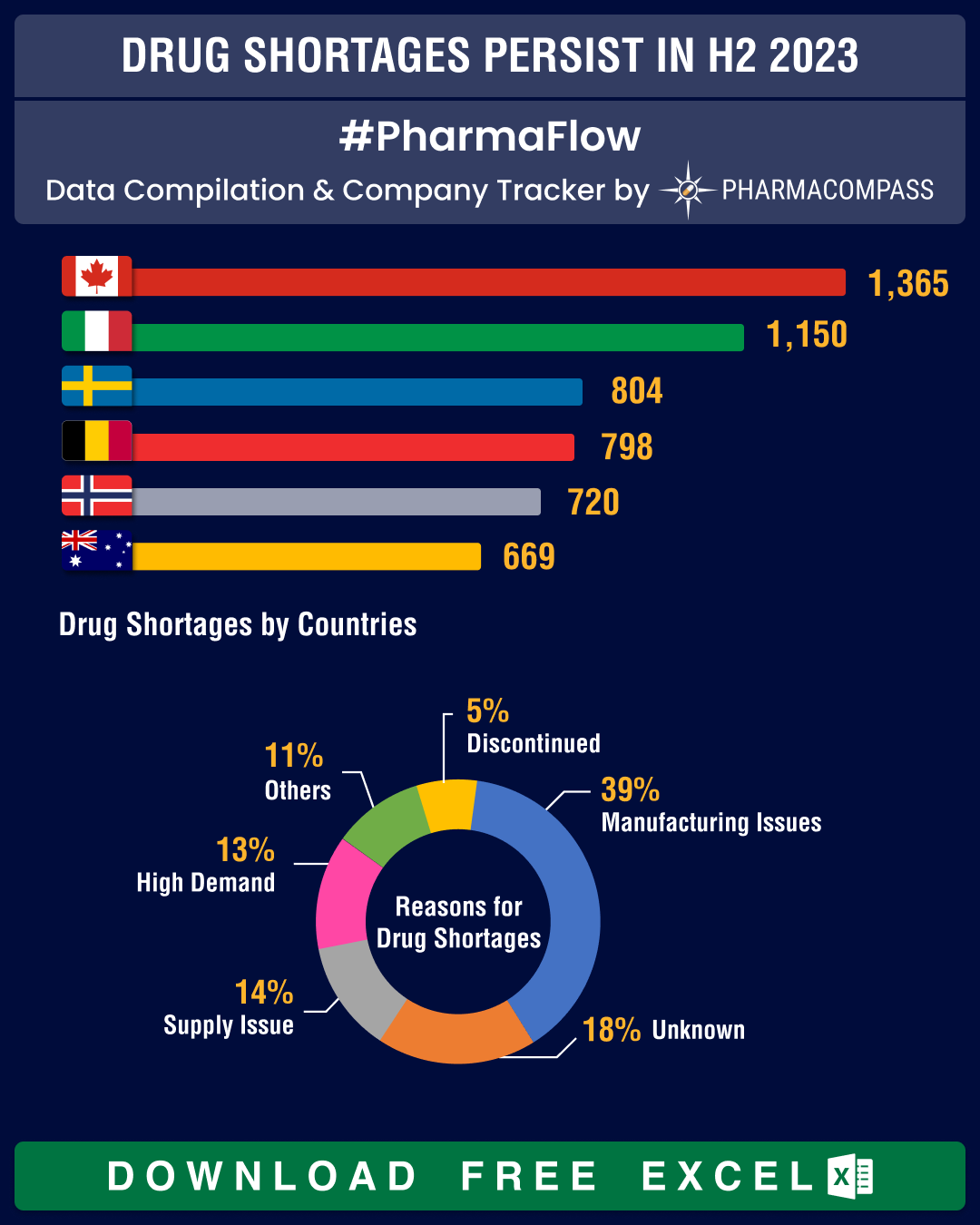

Both the US and Europe have been grappling with acute drug shortages since the start of the pandemic.Despite efforts,

drug shortages are persisting and affecting a range of medicines, such as those

used to manage body weight, cancer drugs, drugs that treat attention

deficit/hyperactivity disorder (ADHD), antibiotics and cardiac medications. The

latest to join this list is the recently approved therapy for respiratory syncytial virus

(RSV) from AstraZeneca and Sanofi — Beyfortus (nirsevimab).Over the last five to six years, shortages of over 25 new molecules have been reported in the US

each year. By June 2023, a total of 160 new drug shortages had been documented,

but only 51 of them had been resolved. The US Food and Drug Administration

(FDA) has been working closely with drug manufacturers to overcome this ongoing problem.The scenario is much the same in Europe where there has

been a 20-fold increase in drug shortages over the last 20 years. Given

the continued shortages of antibiotics, the European Medicines Agency (EMA) is undertaking steps to oversee critical tasks, such

as monitoring and reporting drug shortages to EU countries, coordinating

responses, and managing the supply and demand of medicinal products.

Additionally, EMA plans to collaborate with the Health Emergency Preparedness and

Response Authority (HERA) to ensure the availability of antibiotics for

respiratory infections through collaborations with concerned drugmakers.View Our Interactive Dashboard on Drug Shortages in H2 2023 (Free Excel Available)Astra-Sanofi’s RSV med faces overwhelming demand; CDC prioritizes availability According to the Centers for Disease Control and Prevention (CDC), about 58,000 to 80,000 children under the age of five years are

hospitalized in the US each year and up to 300 die from RSV. These numbers explain the higher-than-expected demand for AstraZeneca and Sanofi’s jointly developed RSV drug Beyfortus (nirsevimab), which has resulted in its shortage.

Beyfortus is a monoclonal antibody and the first preventive option approved in July to protect infants in the US.Moreover, CDC has recommended that

available doses of Beyfortus be prioritized for infants at the highest risk of

severe RSV disease. The organization has also expedited the release of over 77,000 additional doses of

Beyfortus and is in close contact with manufacturers to step up

supplies through late 2023 and early 2024. In an interview with Reuters, AstraZeneca’s CEO Pascal Soriot said it is prioritizing the US market for additional doses of Beyfortus.View Our Interactive Dashboard on Drug Shortages in H2 2023 (Free Excel Available) Rising

demand, production delays lead to shortages of diabetes, obesity medsThe US and several European countries such as Belgium,

Germany and Hungary continue to face

shortages of diabetes and obesity drugs. Resulting largely from

increased demand and production delays, these drugs include Novo Nordisk’s semaglutide (sold under brand names Wegovy,

Ozempic and Rybelsus) and liraglutide (Victoza and Saxenda) and Eli Lilly’s tirzepatide (Mounjaro) and dulaglutide (Trulicity).So acute is the problem that Belgium has limited the use of Novo’s semaglutide and GLP-1 drugs to individuals with type 2 diabetes and weight-loss patients meeting specific body mass index criteria. And Germany is considering restricting the export of Novo’s Ozempic.With Goldman Sachs estimating obesity

drugs to attain a market size of US$ 100 billion by 2030, both Novo and Lilly are busy expanding their manufacturing capacities.

Novo is investing over Danish kroner 42 billion (US$ 6 billion) to enhance

production in Kalundborg, Denmark, and Lilly will be building its first plant in western Germany for € 2.3 billion (US$ 2.5 billion) to meet the soaring demand for its diabetes and weight loss drugs. Novo has also brought Thermo Fisher onboard as a contract manufacturer for

its weight loss drug Wegovy.View Our Interactive Dashboard on Drug Shortages in H2 2023 (Free Excel Available) Shortages

of critical cancer drugs persist; FDA steps in to increase suppliesIn our last update, we had captured a severe shortage of

cancer drugs that was deemed a national emergency by oncologists in the US. FDA's drug shortage database tells us that as of November 18, the shortage of cancer drugs

persists in the US. The drugs in short supply include cisplatin, carboplatin, methotrexate, capecitabine, clofarabine, leucovorin calcium, and azacitidine.As part of its push to alleviate shortages, FDA has partnered with Chinese drugmaker Qilu Pharmaceutical and Canadian company Apotex to temporarily import cisplatin. Also, it has worked closely with manufacturers to boost production capacity.In September, the White House issued a

statement that said its

efforts to resolve the shortage of cisplatin have borne fruit, as the US supply

of the chemo drug has been restored to nearly 100 percent of the pre-shortage

levels. Recently, Accord

Healthcare (the US unit

of Intas) announced it has restarted

the production of cancer drugs cisplatin and methotrexate.View Our Interactive Dashboard on Drug Shortages in H2 2023 (Free Excel Available) High

demand, manufacturing issues lead to scarcity of ADHD drugsDuring 2020 and 2021, the US experienced a notable

increase in the diagnosis of ADHD, leading to over 10 percent rise in stimulant

prescriptions across diverse age groups. Record-high demand and manufacturing issues have

led to a shortage of ADHD drugs, such as Takeda’s Vyvanse (lisdexamfetamine dimesylate)

and methylphenidate hydrochloride (a

stimulant sold under several brand names, such as Ritalin, Concerta, Methylin

etc).In an attempt to ease the shortages, FDA has approved generics to Takeda’s Vyvanse capsules earlier this summer after its patent expired in August. The other drugs in short supply include statins,

antibiotics, and cardiac drugs. The US has grappled with a surge in

demand for liquid Amoxicillin, essential for the treatment of

infections in children. Manufacturers like Teva, Sandoz, and Alembic have made the API available on an ‘allocation basis’ to meet the demand.Similarly, cardiovascular drugs like adenosine and lidocaine (used to treat arrhythmias) and

medications to lower cholesterol, such as rosuvastatin and atorvastatin, are also experiencing shortages.View Our Interactive Dashboard on Drug Shortages in H2 2023 (Free Excel Available) Our

viewThe geopolitical and economic situations coupled with

thinning of margins in the generics industry are continuing to impact the

biopharma industry. However, our analysis tells us that governments are able to

address drug shortages. For instance, in the US, the list of drug facing

shortages had 90 drugs on it during January to mid-June 2023. This number has come down to 68 in FDA’s latest update. Similarly, Canada has brought down shortages from 454 to 441 during the same period.However, in Europe, drug shortages have been worsening

over the last six months, owing to several factors such as

increased demand, inflation and geopolitical unrest. In Italy, drug shortages

have increased from 423 to 541, in Norway from 320 to 370, and in Spain from

295 to 342.Let’s hope the situation improves in 2024.

Impressions: 2876

Every year, the

US Food and Drug Administration (FDA) publishes the user fee amounts it will

collect from manufacturers of pharmaceuticals, generic drugs, biosimilars and

medical devices in the coming financial year. The fiscal year 2024 fee under the Generic Drug User Fee Act (GDUFA) was

published on July 28, 2023.

The facility

payments list under the GDUFA has revealed that as of October 30, 2023, 1,320 facilities had paid their registration fee for financial year 2024.

Out of this, 663 or 50.2 percent are active pharmaceutical

ingredients (API) facilities, 395 or 30 percent are finished dosage forms (FDF)

facilities, 68 (5.15 percent) are facilities that produce both APIs and FDFs,

and 194 (14.7 percent) are contract manufacturing services (CMO) sites.

Teva Pharmaceuticals led the list of companies by

facility registrations, followed by Aurobindo Pharma and Viatris. Teva has 26 facility registrations, including 16 for FDFs, nine for APIs, and one for both APIs and FDFs.

Aurobindo Pharma has 22 facility registrations, including

12 for FDFs, eight for APIs, one for CMO, and one facility that is engaged in

both API and FDF activities. Viatris has registered 18 facilities, including 13

for FDFs and four for APIs, and one facility that is engaged in both API and

FDF activities.

Generic Drug Facilities Registered with the USFDA in FY2024 (Free Excel Available)

India

tops with 376 facility registrations, US comes second at 317

India continues to dominate the list of total facility registrations with the FDA — it registered 376 facilities for FY2024, including 200 API facilities and 134 FDF facilities, 21 facilities engaged in both API and FDF activities, and 21 CMO facilities.

The United States followed India with 317 facilities and

China held the third position with 169 facilities.

At 200, India continues to have the largest share of API

facilities, which is almost equal to the API sites registered together by both

China (112) and the US (76). Amongst European drugmakers, Italy leads with the

54 API manufacturing sites, followed by Spain (30) and Germany (29).

The largest number of facilities for FDFs are in the US

(143 sites), followed by India (134) and China (38).

Country

API

FDF

Both

CMO

Total

India

200

134

21

21

376

USA

76

143

12

86

317

China

112

38

11

8

169

Italy

54

2

2

18

76

Germany

29

4

1

17

51

Spain

30

9

1

4

44

Canada

7

13

12

32

France

16

1

7

24

Taiwan

10

5

6

2

23

Switzerland

15

3

4

22

Japan

19

1

20

Generic Drug Facilities Registered with the USFDA in FY2024 (Free Excel Available)

GDUFA

III reauthorization and FDA user fee rates for FY 2024

The GDUFA is a law designed to speed up the access to safe

and effective generic drugs for Americans and reduce the costs to the

industry. The GDUFA was reauthorized on

September 30, 2022 (as GDUFA III), with provisions that came into effect on October 1, 2022, and will last until September 30, 2027.

In July 2023, FDA published user fee rates for FY 2024 for prescription drugs, generic drugs, biosimilars and medical device user fee programs, as well as for outsourcing facilities.

Fiscal year

Facility Registrations

2013

1390

2014

1414

2015

1450

2016

1425

2017

1442

2018

1269

2019

1286

2020

1300

2021

1340

2022

1385

2023

1394

2024

1320

Last year, FDA had reduced the fee for API facilities and

CMOs. However, the FY2024 fee for FDF facilities, both

domestic and foreign, has gone up by over 3 percent. Similarly, the fee for

large-, medium- and small-sized drug applicants has gone up by over 7 percent.

Generic Drug Facilities Registered with the USFDA in FY2024 (Free Excel Available)

46

new facilities registered in FY24; India leads with 20 new units, 11 set up in

China

Out of the total 1,320 facilities registered for FY2024,

46 were new. Out of these, 20 were registered in India, followed by 11 in China

and six in the USA.

Out of the 46 new facilities, 22 are FDF facilities,

including units of Alembic Pharmaceuticals (in

Karkhadi, Gujarat, for injectables and

ophthalmic products and in Jarod, Gujarat,

for oral solids), Amneal, Aspen (in Gqeberha, South Africa, for oral solids, eye drops and

sterile manufacturing), Aurobindo Pharma (in North Carolina, USA, for R&D and manufacturing of inhalation, topical and transdermal products), Novartis (in Ljubljana,

Slovenia, for aseptic products, non-aseptic solutions, biosimilars, and nasal

spray), Lupin (injectables), Torrent, and Granules India.

There are 13 API units among the list of new registrants

(including facilities of players like Global Calcium, Hikal, and Ipca Laboratories), and 11 CMO facilities

(including units of Bora Pharmaceuticals and

the Hetero Group).

Among the new registered CMOs is Bora Pharmaceuticals’ Mississauga (Canada) facility that produces a range of dosage forms, including oral

solid dose (OSD), liquid and semi-solid therapeutics (creams and ointments).

Bora had acquired this facility

from GSK in 2020.

In FY2024, there were 135 facilities that did not renew their registration. Amongst these were facilities owned by Akorn Pharma, which had shutdown its US operations in early 2023. In fact, 45 of the 135 facilities that did not renew their registrations were from the US.

Generic Drug Facilities Registered with the USFDA in FY2024 (Free Excel Available)

Our

view

Over the last few years, the US drug regulator has been contending with regulatory compliance and quality issues of Indian drug manufacturers. America has also been trying to reduce its reliance on China. But the GDUFA facility payments list for FY2024 reveals that not much has changed, and it will business as usual in the coming year.

Impressions: 4643

The third quarter (Q3) of 2023 was marked by deals and capacity expansions in the contract development and manufacturing organization (CDMO) space. Moreover, the trend of CDMOs increasing their exposure to advanced therapies, such as biologics, cell and gene (C&G) therapies, and highly potent active pharmaceutical ingredients (HPAPIs) continued unabated.

Some of the key players in the CDMO space are Lonza, Catalent, Recipharm AB, Thermo Fisher, Seqens, Curia, Siegfried, Samsung Biologics, Fujifilm Diosynth Biotechnologies, Quotient Sciences and, Piramal Pharma Solutions.

View CDMO Activity Tracker of Q3 2023 (Free Excel Available)

Novo taps Patheon to meet Wegovy supply;

Samsung Biologics-BMS expand deal

Novo Nordisk has been struggling to ramp up supplies

of its popular weight-loss drug, Wegovy. Back in October 2021, there were quality issues at the Brussels facility of its key CDMO

Catalent that fills Wegovy injection pens. The two companies are hoping to resolve the quality issues at the Brussels facility soon. For now, Novo and Catalent have expanded their supply agreement — Catalent’s Bloomington, Indiana plant will now fill injection pens for Wegovy. According to reports, Novo has also struck a deal with Thermo Fisher's CDMO subsidiary Patheon for manufacturing Wegovy at its

Greenville, North Carolina facility.

Samsung Biologics has expanded its strategic agreement with Bristol Myers Squibb (BMS) for large-scale manufacturing of the latter’s commercial antibody cancer drug substance. This drug substance will be manufactured at Samsung Biologics’ facility in Songdo, South Korea.

Polpharma has signed two agreements with Poland’s clinical-stage drug development firm — Ryvu Therapeutics — for manufacturing an active substance (RVU120) used for

phase 2 clinical studies in hematology.

In July, French

drugmaker Biophytis signed a master agreement with Seqens to produce the active compound in Sarconeos (BIO101), Biophytis’ main drug candidate developed for three indications — severe forms of Covid-19, sarcopenia and Duchenne muscular dystrophy.

A month later,

Biophytis signed an agreement with Skyepharma for the production of finished product

batches of Sarconeos for severe forms of Covid-19.

Another CDMO, Recipharm, has partnered with start-up Ahead

Therapeutics to develop a ground-breaking treatment for myasthenia

gravis, a rare autoimmune disease.

View CDMO Activity Tracker of Q3 2023 (Free Excel Available)

WuXi launches standalone plant for jabs

in China; Bora opens new facility in Taiwan

WuXi Biologics’ immunization-focused subsidiary WuXi Vaccines has launched its first standalone vaccines contract manufacturing facility in Suzhou, China. This new

plant will focus on drug substance and drug product capacity for projects in

various stages of development.

Bora Pharmaceuticals has opened a state-of-the-art facility

in Taoyuan City, Taiwan, that provides its customers access to extensive ophthalmic

manufacturing services. The facility will specialize in ophthalmic products

such as sterile solutions, emulsions, creams, ointments and gels.

Skyepharma and clinical-stage biotech MaaT Pharma have completed construction of what will be Europe’s largest manufacturing facility for microbiome ecosystem therapies.

Aurigene Pharmaceutical

Services,

a subsidiary of Dr Reddy’s Laboratories, will invest US$ 40 million to build a specialized development and manufacturing facility in Hyderabad

(India), targeting therapeutic proteins, antibodies, and viral vectors.

View CDMO Activity Tracker of Q3 2023 (Free Excel Available)

EUROAPI acquires BianoGMP; Syngene buys Stelis’ biologics facility

In mergers and

acquisitions, EUROAPI bought Germany-based contract manufacturer BianoGMP for €10 million (US$ 10.6 million) to strengthen its expertise in the

high-growth oligonucleotide market. SK pharmteco announced it is acquiring a controlling

stake in Center for Breakthrough Medicines (CBM), a Philadelphia-based cell and gene therapy CDMO. The move will expand SK pharmteco’s technical expertise, production capacity, and geographic reach.

Syngene is acquiring a manufacturing facility in Bengaluru, India, from Stelis Biopharma for INR 7.02 billion (US$ 86 million),

to enhance its biologics drug substance manufacturing capacity. And Sharp, a leader in pharmaceutical packaging

and clinical trial supply services, has acquired Berkshire Sterile Manufacturing, a

specialized CDMO focusing on sterile injectable products.

View CDMO Activity Tracker of Q3 2023 (Free Excel Available)

AGC Biologics augments C&G capacities; CordenPharma upgrades peptide unit

The quarter saw

several CDMOs expand their facilities, including AGC Biologics, Fermion, Porton Pharma Solutions and Evonik.

AGC Biologics expanded its program to provide

lentiviral vector (a type of retrovirus) support for advanced therapies to drugmakers focused

on rare diseases. The company added three new cell therapy suites to its Colorado

facility. It also expanded its C&G therapy facility in Milan, Italy, to meet demands for GMP viral vector manufacturing projects.

After bagging a

potential US$ 1 billion, multi-year contract to manufacture large-volume

peptide at its Colorado facility earlier this year, CordenPharma has upgraded its commercial peptide production capacity. This unit is now the world’s largest solid-phase peptide synthesis (SPPS) manufacturing facility.

Meanwhile,

Fermion has increased its manufacturing capacity for APIs at its Hanko site in

Finland and Porton Pharma Solutions has expanded its capabilities in New

Jersey, with a new 40,000-square-feet drug development facility under its US subsidiary, J-Star Research.

CDMO Axplora has announced the installation of a new cGMP pilot flow chemistry unit at its Leverkusen

site (Germany). Additionally, Evonik and Heraeus Precious Metals have tied up to expand their range of services for

HPAPIs.

View CDMO Activity Tracker of Q3 2023 (Free Excel Available)

Curia, Touchlight tie-up for doggybone

DNA; MilliporeSigma opens new mRNA sites

Several CDMOs

advanced their messenger RNA (mRNA) drug substance facilities during the last

quarter. Leading CDMO Curia has tied up with Touchlight, a company that specializes in making DNA using enzymes. This collaboration will offer Curia’s clients access to Touchlight’s special DNA vector, known as “doggybone DNA” (dbDNA), which can be used as a template for making mRNA therapies. The pact expands Curia’s existing mRNA production offerings with another differentiated source of DNA raw material that’s “immediately” available to its customers.

MilliporeSigma inaugurated two new mRNA drug substance manufacturing sites in Germany — at Darmstadt and in Hamburg. The two sites will tackle a full range of mRNA services, from preclinical to commercial-scale projects. Similarly, Ardena and RiboPro have forged a strategic alliance to provide solutions for the production

of advanced mRNA and lipid nanoparticles. And American CRO and CDMO PackGene

BioTech and an mRNA CDMO Kudo Biotechnology have tied up to provide customized mRNA manufacturing services for drug and vaccine development.

View CDMO Activity Tracker of Q3 2023 (Free Excel Available)

Our view

The start of Q4

saw leading CDMO Lonza strengthen its collaboration with a key biopharmaceutical partner to scale up the filling of antibody-drug conjugates. Moreover, Advent International and Warburg Pincus completed their US$ 4.25 billion acquisition of Baxter’s BioPharma Solutions business, which will

now be known as Simtra BioPharma Solutions.

Overall, the year’s developments have strengthened our belief that the global CDMO market will grow considerably in the coming

years. Research and Markets puts that number at US$ 246.6 billion by

2026,

up from US$ 172.7 billion in 2022.

Impressions: 2857

This week, PharmaCompass analyzes the market for excipients, or inactive ingredients used in pharmaceuticals. Excipients don’t have a therapeutic effect, but serve various purposes. They are used in drugs as fillers, diluents, binders, suspending and viscosity agents, coating agents, flavoring agents, sweeteners, disintegrates, preservatives etc. Some excipients also help in drug delivery.The overall pharmaceutical excipient market is

expected to grow at a compounded annual growth rate of 7.93 percent to touch

US$ 13.49 billion by 2028, from US$ 9.21 billion in 2023.Excipients are of two types — organic and inorganic. Organic chemicals are compounds with carbon-hydrogen bonds (such as starch, cellulose, povidones) and inorganic chemicals are derived from minerals, metals, or other non-living sources (such as metallic oxides, calcium sulfate).The organic category dominates the market with the largest market share driven by robust demand from oral pharmaceuticals.Popular organic excipients used in pharmaceuticals are microcrystalline cellulose

(MCC), lactose monohydrate, povidones, starch, and mannitol. MCC is excellent for tablet and

capsule compressibility, while lactose serves as a binder and diluent.

Povidones function as tablet binders and enhance viscosity in liquid forms.

Starch serves as a diluent, disintegrate or binder and mannitol enhances the

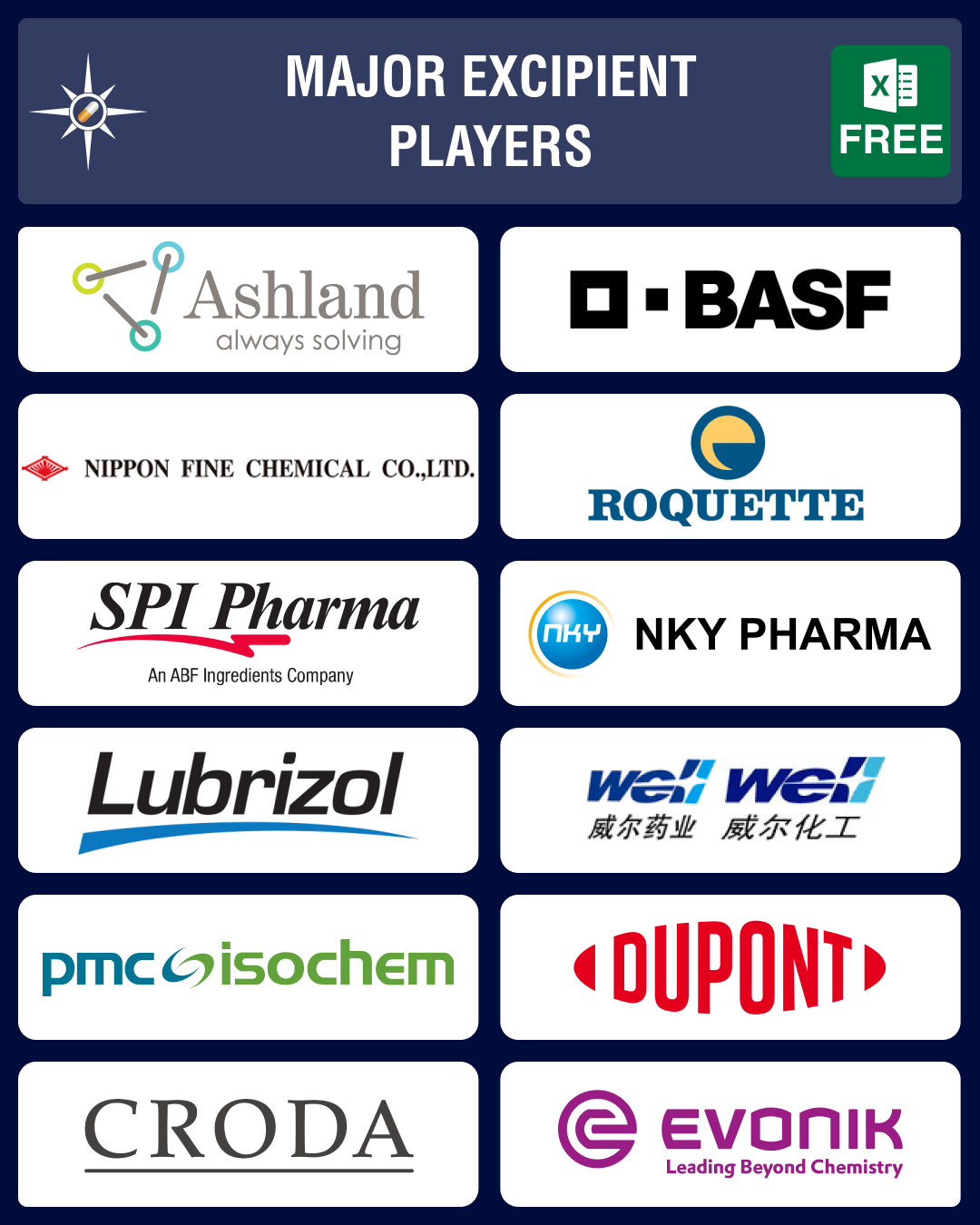

stability, taste, and quality of drugs.Major excipient

manufacturers are Ashland Global, BASF, Evonik, DuPont, Roquette Frères, SPI Pharma, Croda International, Lubrizol, Boai NKY Pharmaceuticals, Nanjing Well Pharmaceutical, PMC Isochem, Nippon Fine Chemical, and Seqens.View our Dashboard to know more about Leading Excipient Companies (Free Excel Available)Demand for MCC surges post pandemic;

Asahi Kasei, Nitika invest in new plantsSince the start

of the pandemic, we have seen a surge in demand for drugs, and this has

significantly boosted the demand for MCC. In January 2023, Asahi Kasei completed the construction of a ¥13 billion (US$ 98 million) pharma excipient manufacturing plant in Japan. This is Asahi’s second plant dedicated to manufacturing MCC under the Ceolus brand. This month, India-based Nitika Pharmaceutical

unveiled an MCC manufacturing plant, which is India’s largest and most advanced facility with an installed capacity of 1200 metric ton.In a strategic investment, France-based Roquette acquired India-based Crest

Cellulose, a manufacturer of excipients like MCC and magnesium stearate. This acquisition will help

Roquette meet the increasing global demand for

high-quality plant-based excipients. And in March

2023, SPI Pharma secured sole distribution rights for

Cellets (MCC pellets) and TAP (tartaric acid pellets)

from Switzerland-based Ingredientpharm.View our Dashboard to know more about Leading Excipient Companies (Free Excel Available) Evonik,

Croda address delivery of biologics by investing in lipid-based excipientsApart from these traditional inactive ingredients, the

market is witnessing an increase in adoption of lipid-based excipients that address the challenge of

delivering biopharmaceuticals. Many drugmakers are actively exploring lipid nanoparticles (LNPs) as a safe and effective means of delivering biologics into target cells.The growing focus on biologics is spurring increased investments

in biologic excipients.In March 2023, specialty chemicals company Evonik opened a

new facility for pharmaceutical lipids at a site in Hanau, Germany.

During the same month, Evonik announced it has begun construction of

a US$ 220 million plant in Indiana, United States. These facilities are crucial

as they will produce essential lipid-based excipients used in the manufacturing

of a wide range of messenger RNA and gene therapy products. In 2022, Evonik had

bolstered the global supply of pharma-grade, plant-derived

cholesterol (PhytoChol), to be used in mRNA vaccines and gene therapies.In July 2023, UK-based Croda completed the acquisition of Solus Biotech. With this buyout, Croda has

acquired a portfolio of phospholipids. In May 2023,

Croda invested in a new 23,680 square-foot facility in Clinton County,

Pennsylvania, to manufacture ingredients for drug delivery systems used in

novel therapeutic drugs (mRNA vaccines and gene editing therapies). Last year,

the company received around US$

92.5 million from the UK and US government to expand its manufacturing capacity

for lipid systems.In June 2023, Seqens revealed its commitment to invest € 15 million

(US$ 15.85 million) in expanding its production capabilities for pharmaceutical

polymers and lipids at its Aramon plant in France. This facility is poised to

meet the increasing demand for lipid-based RNA delivery.View our Dashboard to know more about Leading Excipient Companies (Free Excel Available) Roquette

launches excipient to stabilize probiotics; Lubrizol in deal with WeltonIn May 2023, Roquette launched its novel excipient – Pearlitol ProTec — to protect and

stabilize moisture sensitive active ingredients such as probiotics. Back in

November 2022, the company had also launched two groundbreaking excipients,

Pearlitol CR-H and Pearlitol 200 GT, designed

to address formulation challenges.In June 2023, Lubrizol announced it has licensed its novel

solubility-enhancing, parenteral excipient, Apisolex, to Welton Pharma for the

formulation of its pipeline drug SN-38, intended for the treatment of

colorectal and related gastrointestinal cancers. Apisolex was launched in

May 2022.Meanwhile, ANP Technologies' innovative nano-encapsulating

polymer-based drug excipient, ANP001B, has received DMF (drug master file) acceptance.

ANP001B has been effectively employed to enhance drug delivery in Fulgent Pharma’s pipeline product, FID-007

(polyethyloxazoline encapsulated paclitaxel), intended for the treatment of solid tumors in cancer patients who have undergone prior treatments.View our Dashboard to know more about Leading Excipient Companies (Free Excel Available) Post

cough syrup deaths, WHO updates guidelines; FDA revises regulation In March 2023, the World Health Organization (WHO) had proposed updated good manufacturing practices (GMPs) to assist pharmaceutical manufacturers in assessing the quality of excipients. This proposal comes after episodes of cough syrups containing excipients that were contaminated with diethylene glycol (DEG) and ethylene glycol (EG), causing over 300 deaths in three countries (The Gambia, Indonesia, Uzbekistan) last year.The US Food and Drug Administration (FDA) has also

undertaken significant changes in the regulation of excipients over the past

three years. These revisions began with adjustments to the

inactive ingredient database as part of the Generic Drug User Fee Amendments

(GDUFA) reauthorization for fiscal years 2018-2022. Additionally, in 2021, FDA

launched its first pilot program to evaluate the quality and

toxicological data associated with novel excipients before their inclusion in

drug formulations.View our Dashboard to know more about Leading Excipient Companies (Free Excel Available) Our

viewInnovation and rising demand for pharmaceuticals has led

to growth in the market for excipients. However, post the cough syrup deaths

caused by contaminated excipients, there is pressure on manufacturers to improve

quality control. This week, Reuters

carried news that FDA has reprimanded 28

companies for failing to prove adequate test of ingredients used in

over-the-counter drugs and consumer products for EG and DEG. With new

excipients entering the market, stricter regulations will ensure that growth of

these inactive ingredients comes with better quality.

Impressions: 2540