By PharmaCompass

2022-09-22

Impressions: 3476

Though the year 2021 was eclipsed by the Covid-19 pandemic, there was no let up in the speed at which generic active pharmaceutical ingredient (API) manufacturers were submitting drug master files (DMFs) to the US Food and Drug Administration (FDA). That trend has only gathered momentum this year.

The pace of submissions of type II DMFs to the FDA has been slightly higher in the first half (H1) of 2022 as compared to the first halves of the last three years. A total of 350 type II DMFs were submitted in H1 of this year, as opposed to 329 witnessed in H1 of 2021 and 293 submissions in H1 of 2020. In H1 of 2019, there were 321 type II DMF submissions.

DMFs are submissions made to the FDA by manufacturers who provide the agency with confidential, detailed information about facilities, processes or articles used in manufacturing, processing, packaging and storing of human drug products.

Overall, 2022 has so far seen a 10.8 percent rise in DMF submissions. A total of 493 DMFs (type II, III, IV and V) were submitted in the first half of this year. In comparison, the agency had received 445 DMF submissions in H1 of 2021, 432 in H1 of 2020 and 446 in H1 of 2019. The total DMF submissions were 913 during 2021, 931 in 2020 and 894 in 2019.

View FDA DMF Filings, Jan-June 2022 (Power BI Dashboard, Free Excel Available)

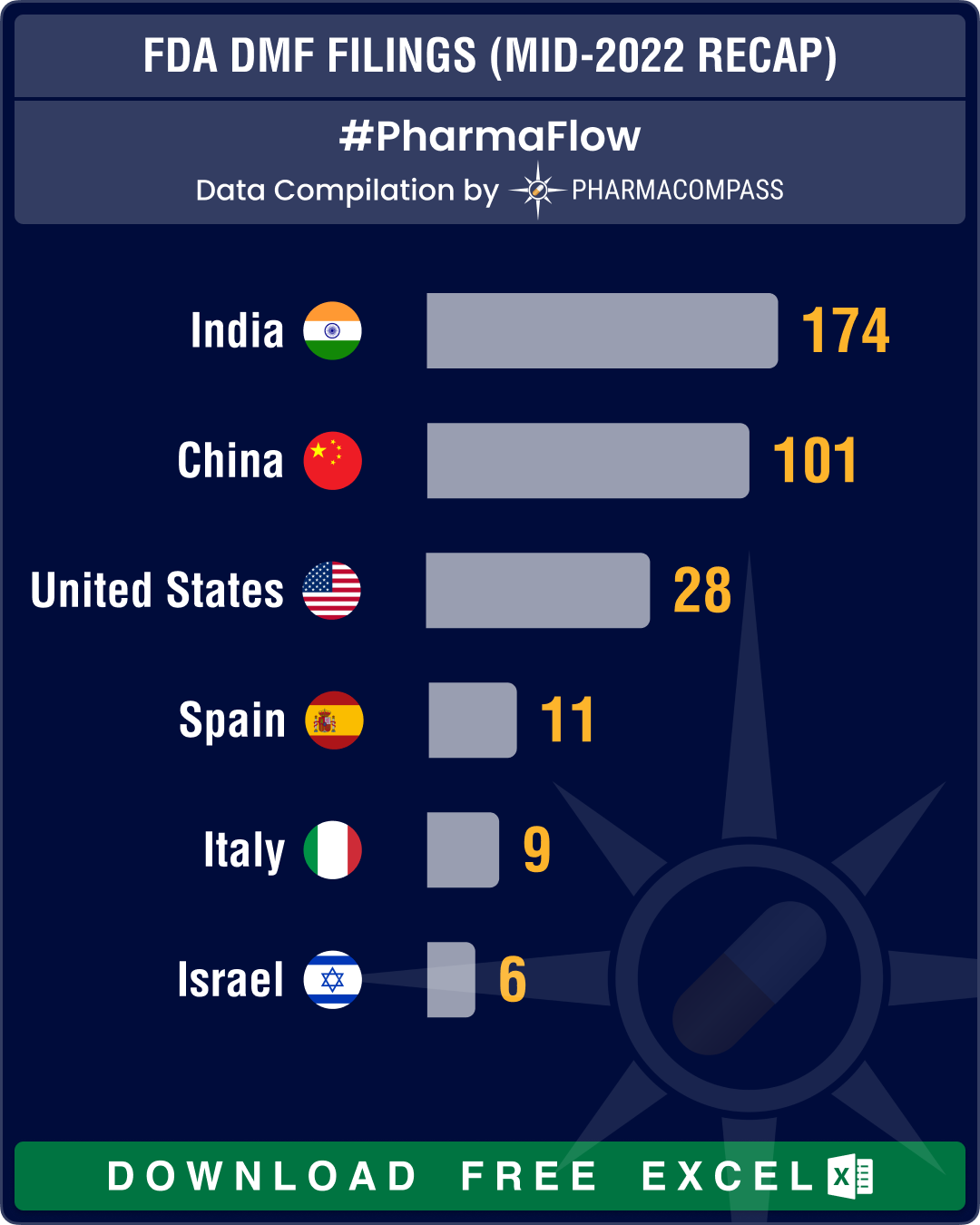

India continues to lead DMF filings, followed by China

Country-wise data on DMF filings at the FDA tells us the potential of a country in the field of pharmaceuticals. At the company level, with each DMF filing, a firm commits itself to manufacturing drugs in a facility that is aligned to the FDA’s rules and regulations.

For the last several years, DMFs filed from India and China have been significantly higher than those from other countries, since these two nations have the maximum number of API manufacturing facilities registered with the FDA. The trend continued, as India led with 174 DMF filings, followed by China at 101, the United States at 28, Spain at 11, Italy at 9 and Israel at six DMF filings.

There were 39 products for which a DMF was filed for the first time. Among the patented products, those that are expected to face competition from generic products are revefenacin (five filings), migalastat hydrochloride (three), ivosidenib (two) and larotrectinib sulfate (two). Upadacitinib, gilteritinib fumarate, voxelotor, pitolisant hydrochloride and risdiplam have one filing each. In fact, DMFs were also filed for products that are yet to receive an FDA approval. Some of these products are benserazide HCl, danofloxacin mesylate, exatecan mesylate and midazolam maleate.

View FDA DMF Filings, Jan-June 2022 (Power BI Dashboard, Free Excel Available)

India’s MSN Labs leads DMF count

As always, MSN Labs (India) led the list of companies with the highest number of DMF submissions at 16, followed by two other Indian companies — Metrochem API at 12 and Hetero Group at seven. The only Chinese company in the top 10 by DMF count was Wuhan Hzymes Biotechnology with six DMF submissions, followed by Indian drugmakers Aurobindo Pharma (five), Lupin (five), Mankind Pharma (five) and Optimus Drugs (five), Italy-based Olon SpA (five) and US-based Cambrex Corporation (five).

The maximum number of DMF filings were for elagolix sodium (eight), followed by revefenacin (five), cannabidiol (four), mirabegron (four) and sitagliptin phosphate (four).

Going forward, DMF filings for cannabidiol

API are likely to increase, as

the global market for

cannabinoids is growing at a fast clip of 22.2 percent. According to industry predictions, the cannabis-based

drug opportunity is predicted to be over US$ 25 billion by 2025.

View FDA DMF Filings, Jan-June 2022 (Power BI Dashboard, Free Excel Available)

Our view

Although there were 350 type II DMFs filed with the FDA, only 118 had their review completed. The FDA user fee programs for prescription drugs, medical devices, generic drugs and biosimilars, or the user fees that drug industry pays FDA for timely reviews of new and generic drugs over five-year periods, needs to be reauthorized for the next five years by September 30. The FDA uses the fee to fund its technology and workforce, speed up reviews of product applications and bring new products quickly to the market.

If the user fee program is not reauthorized by the end of the month, reviews and approvals will grind to a halt, and thousands may lose their jobs at the FDA. According to an FDA spokesperson, “more than 3,500 PDUFA-funded employees would be impacted, leaving fewer than 1,000 full-time employees at CDER and half that many at CBER.”

At the time of writing this article, lawmakers in the US were still working to hammer out a deal to reauthorize FDA user fee programs. Senate Republicans are pressing for a clean five-year bill, but policy riders are still in play.

With the working of the FDA getting severely impacted during the pandemic, one hopes that the agency doesn’t have to go through more disruptions, and that the US Congress reauthorizes the FDA user programs before the September 30 deadline.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : FDA DMF Filings (MID-2022 RECAP) by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”