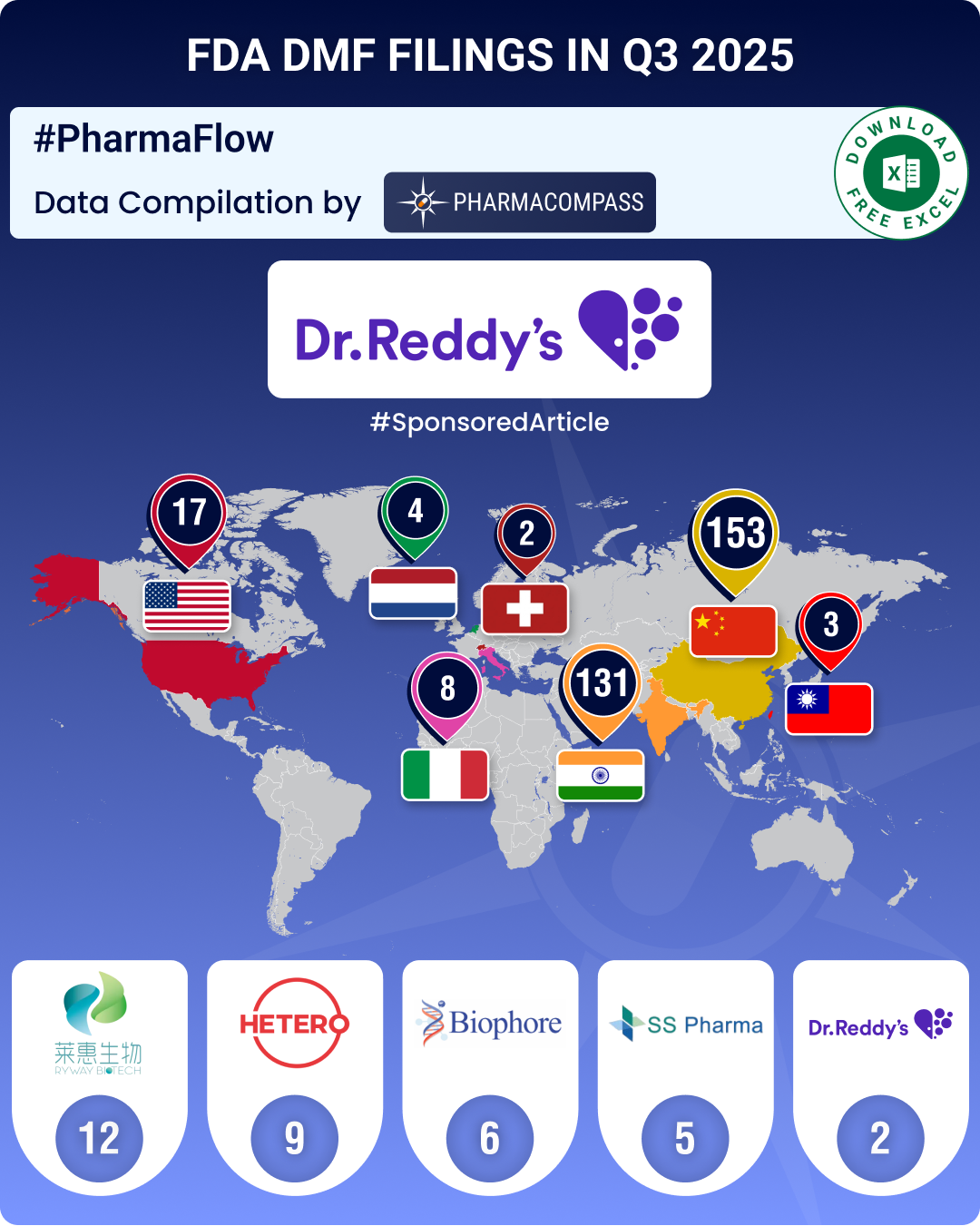

DMF filings rise 4.5% in Q3 2025; China holds lead, India records 20% growth in submissions

The

third quarter (Q3) of 2025 witnessed a steady rise in Drug Master File (DMF) submissions to the

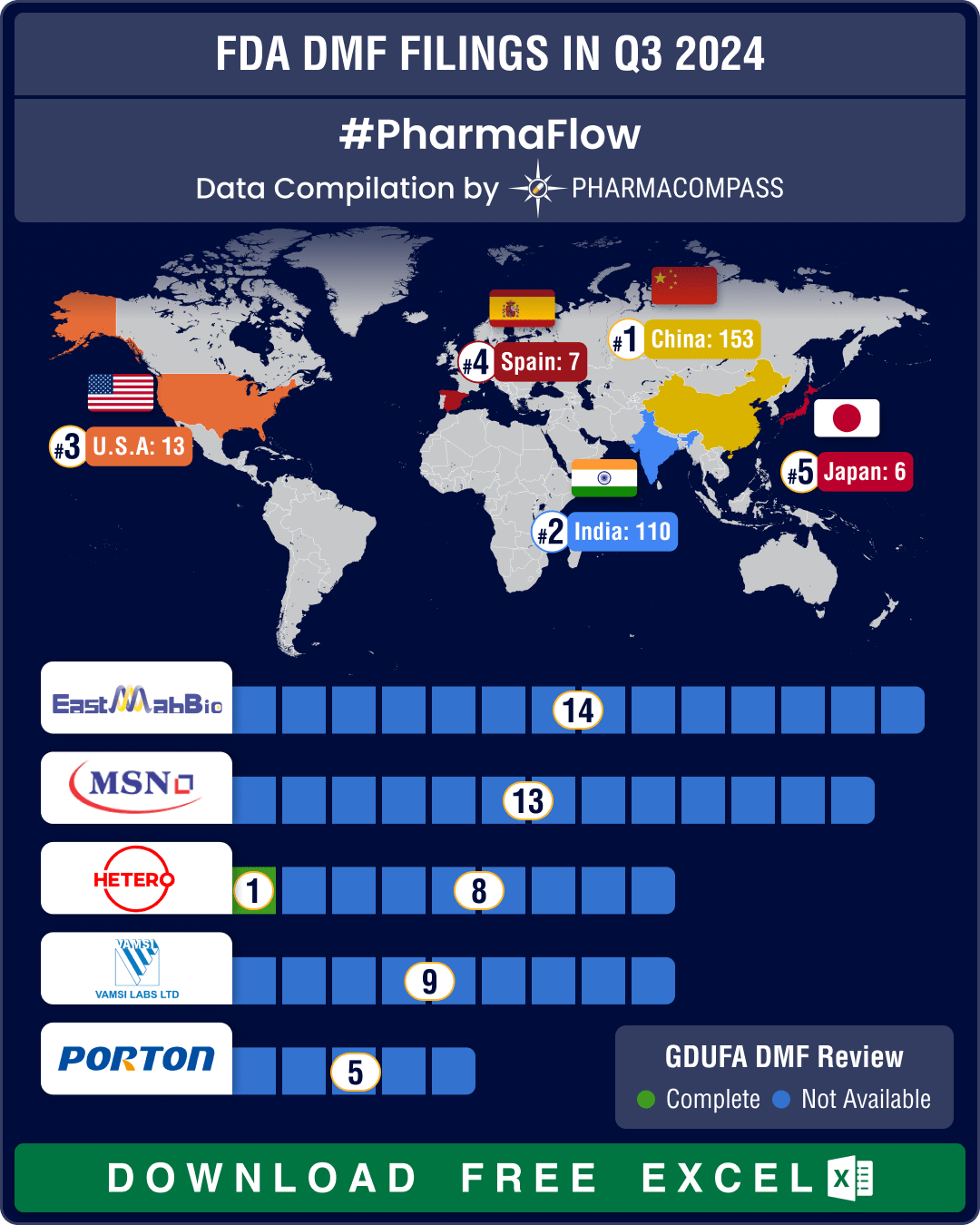

DMF filings hit all-time high in Q3 2024; China tops list with 58% increase in Type II submissions

Drug Master Files, or DMFs, are confidential documents that play a crucial role in the pharmaceutica

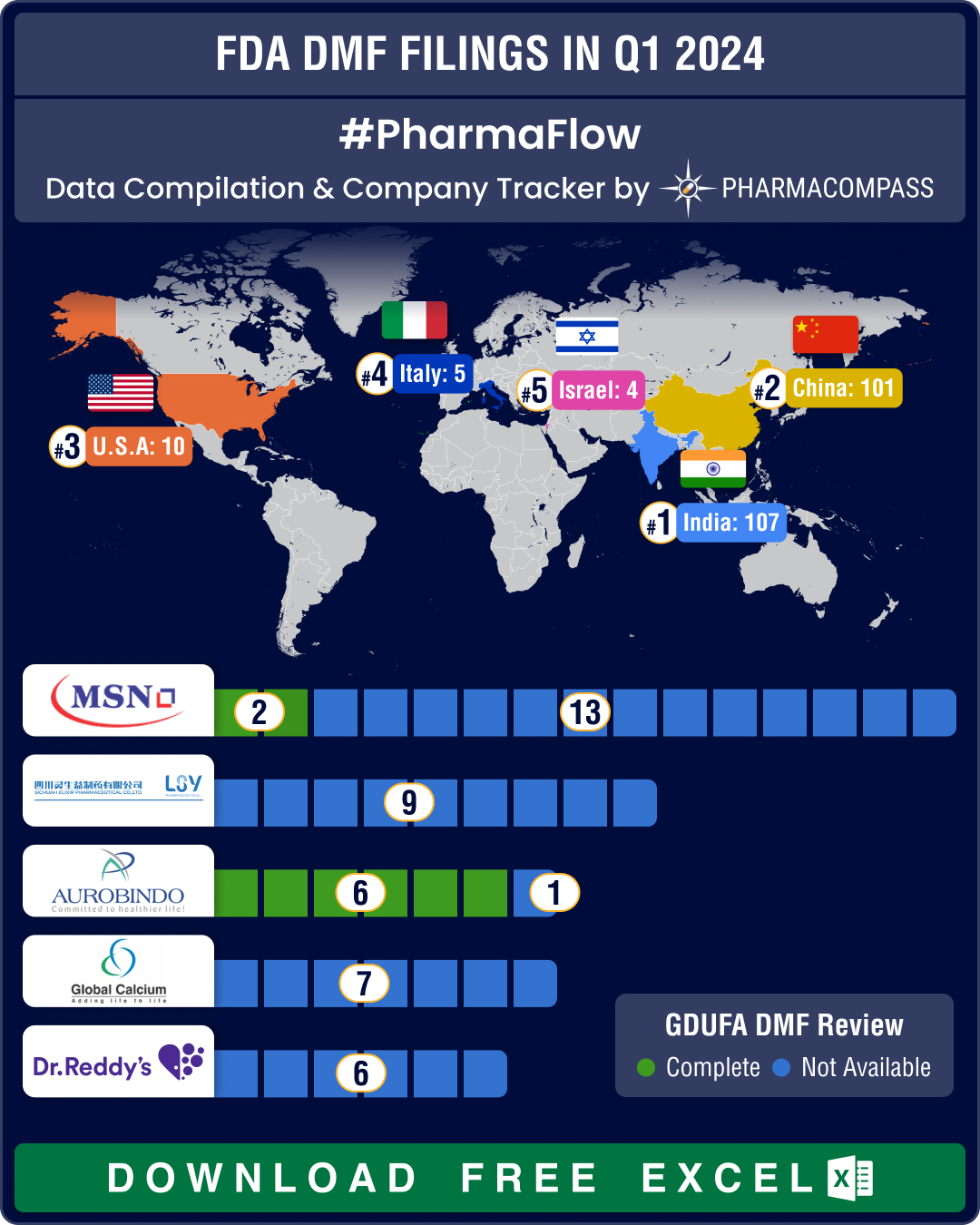

DMF submissions from China jump 42% as India continues to top list in Q1 2024

Generic drugs play a crucial role in providing access to life-saving drugs at affordable prices. To

Market Place

Market Place Sourcing Support

Sourcing Support