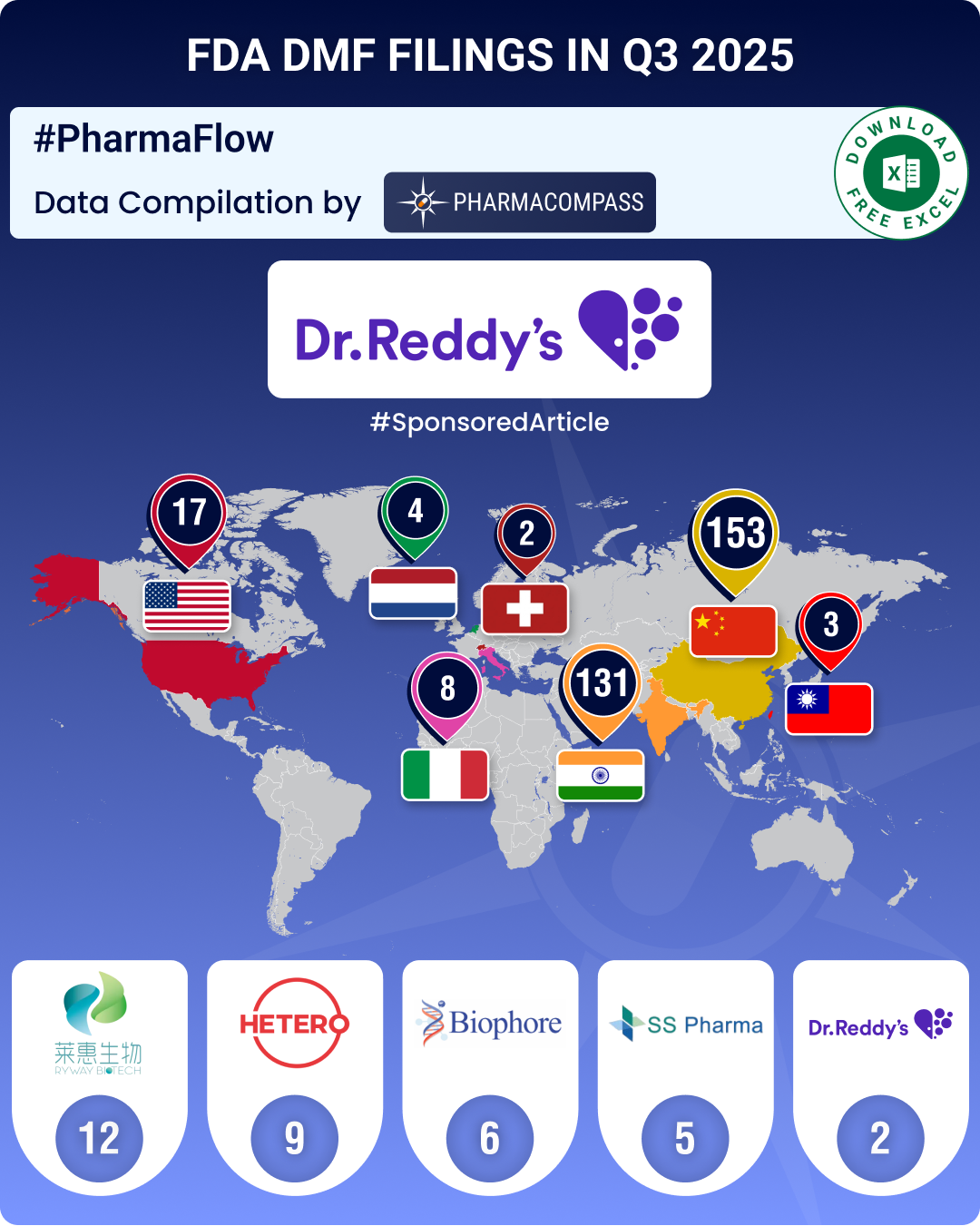

DMF filings rise 4.5% in Q3 2025; China holds lead, India records 20% growth in submissions

The

third quarter (Q3) of 2025 witnessed a steady rise in Drug Master File (DMF) submissions to the

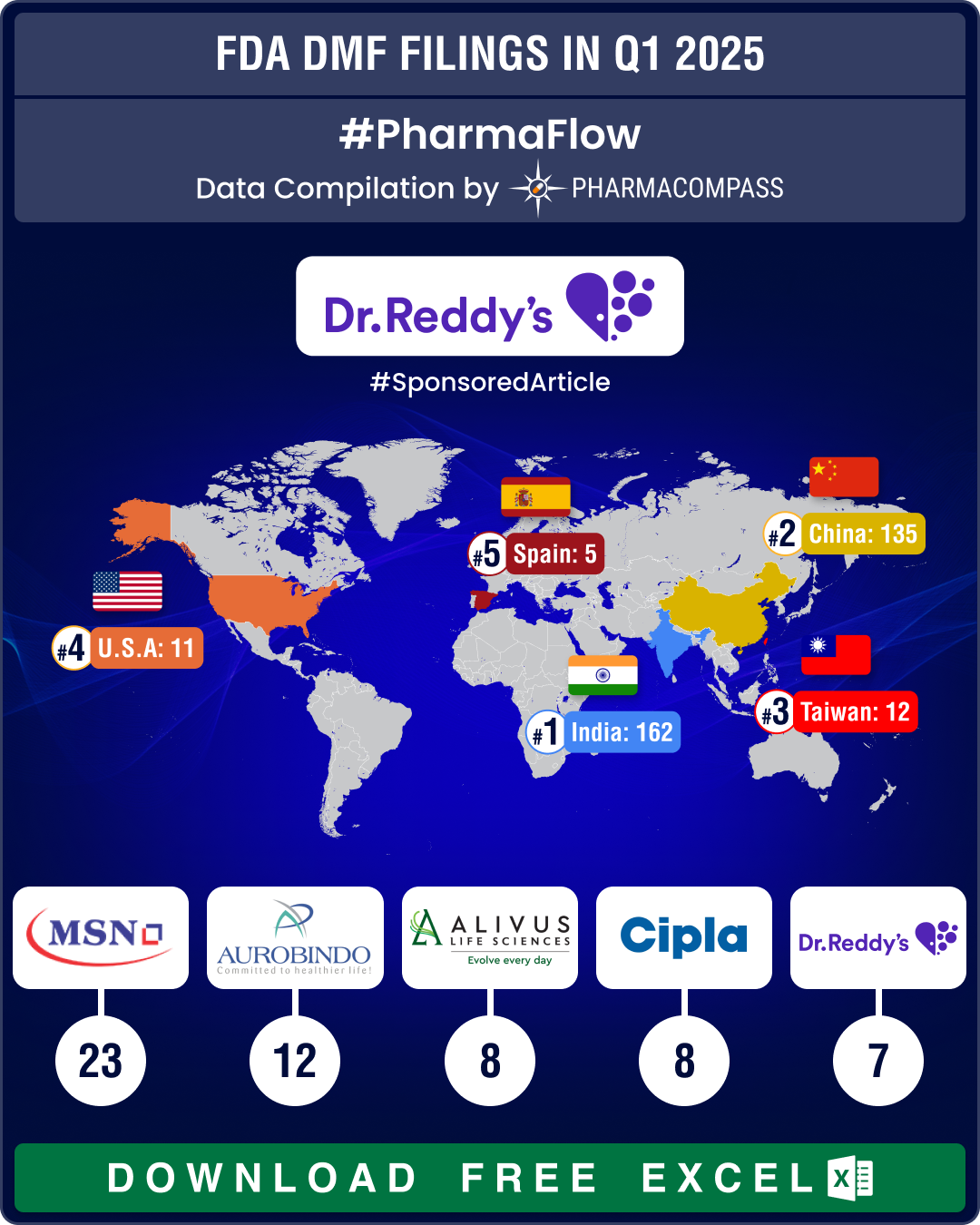

DMF filings surge 44% in Q1 2025; India tops list with 51% rise in year-on-year submissions

The first quarter (Q1) of 2025 witnessed an impressive surge in Drug Master File (DMF) submissions t