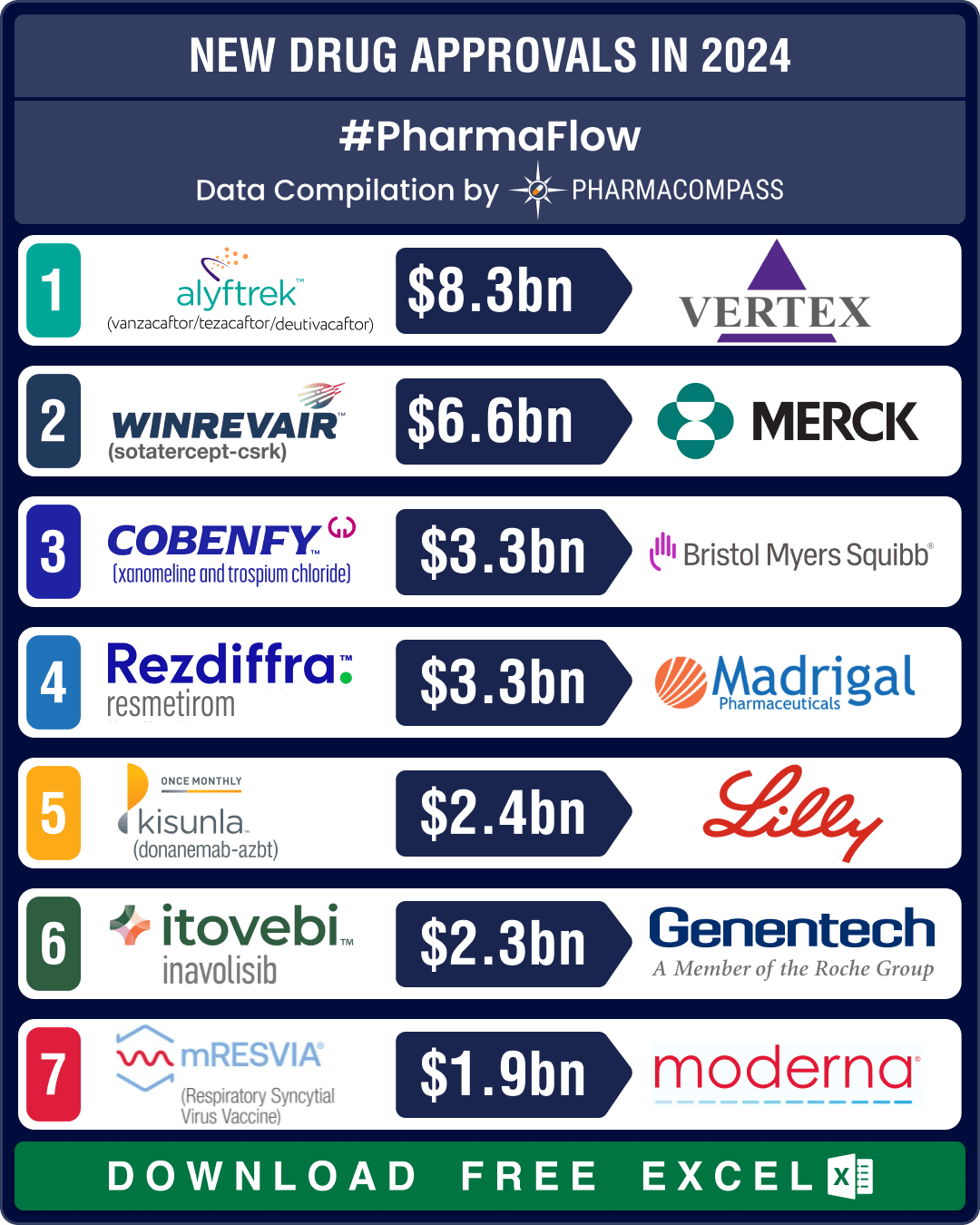

FDA okays 50 new drugs in 2024; BMS’ Cobenfy, Lilly’s Kisunla lead pack of breakthrough therapies

In 2024, the biopharma industry continued to advance on its robust trajectory of innovation. Though

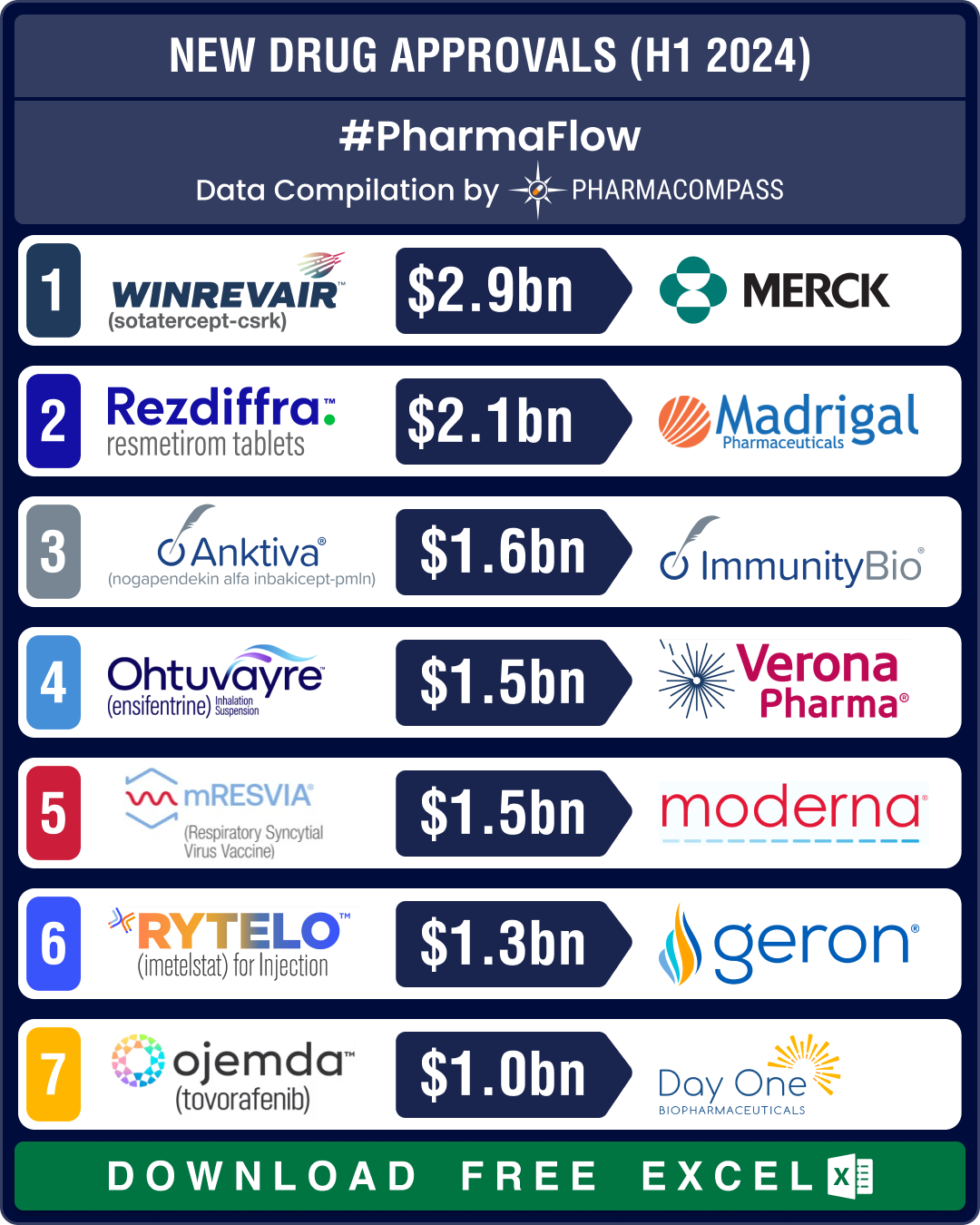

FDA approvals slump 19% in H1 2024; NASH, COPD, PAH get new treatment options

The first half of 2024 saw a significant slowdown in approvals of new drugs and biologics by the US

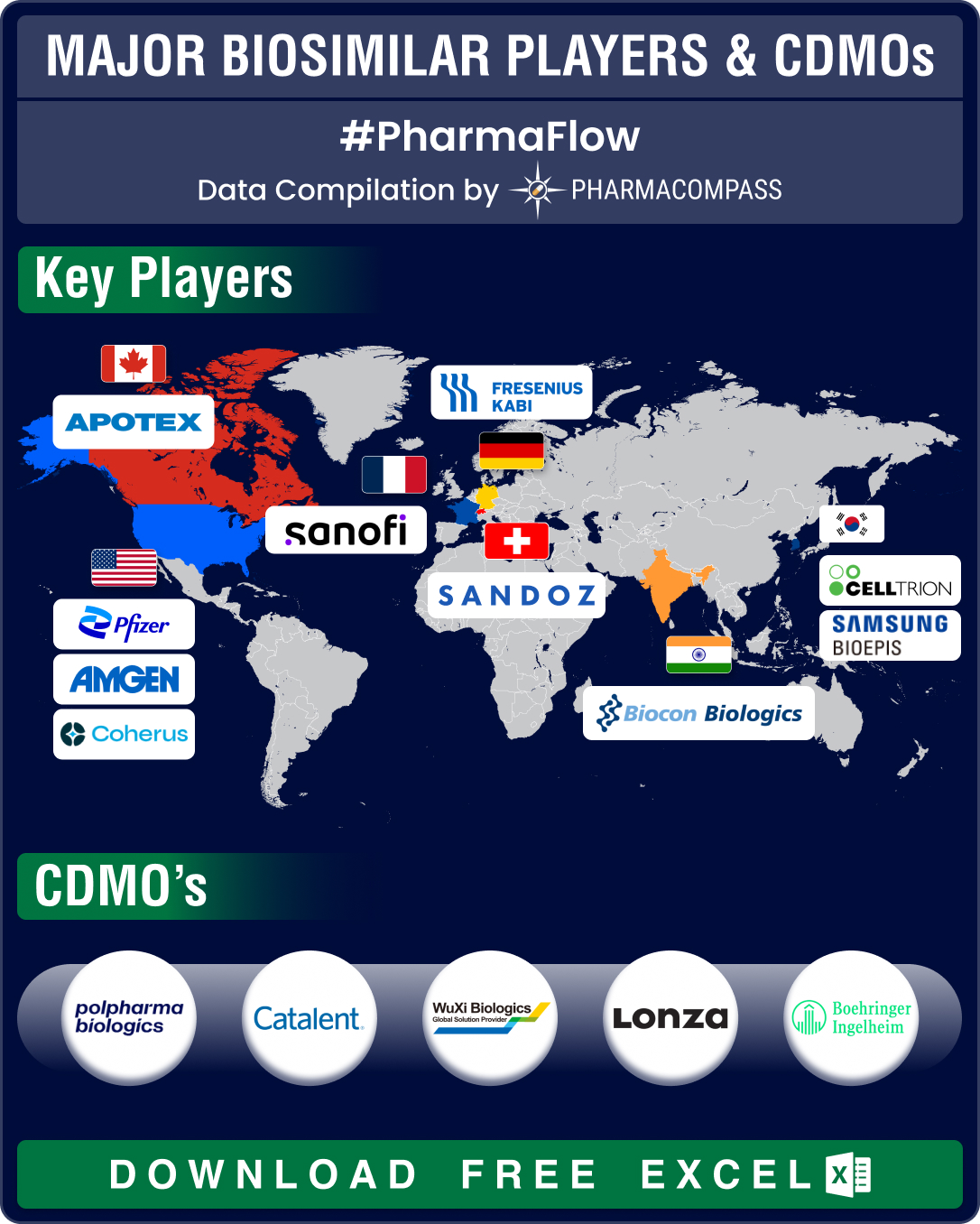

Market Place

Market Place Sourcing Support

Sourcing Support