This week, AbbVie’s Humira (adalimumab) saw its 20-year exclusive

run come to an end in the United States as Amgen launched its copycat — Amjevita. This is just the start of

the onslaught of Humira copycats, as seven other biosimilars are due to be

launched this year.In a press statement, Amgen said

Amjevita (40 mg) is available in the US at a list price (wholesale acquisition

cost) 55 percent below the current Humira list price. According to a Reuters report, Humira’s US list price is US$ 6,922 per month. The biosimilar is also available at a list price 5 percent below the current Humira list price.“Amgen’s goal is to provide broad access for patients by offering two options to health plans and pharmacy benefit managers,” the company said.Blockbuster that’s brought in US$ 200 billion so farHumira had bagged the US Food and Drug Administration’s approval in 2002. Back in those days, it was a part of Abbott. The drug had been developed

by a division of BASF Pharma, known as Knoll

Pharmaceuticals. Abbott had acquired Humira through its purchase

of Knoll in March 2001. In 2013, Abbott completed the separation of its research-based drugs business into an independent biopharmaceutical company — AbbVie.Humira is a tumor necrosis factor (TNF) blocker indicated for inflammatory diseases such as rheumatoid arthritis, juvenile idiopathic arthritis, psoriatic arthritis, ankylosing spondylitis, Crohn’s disease, ulcerative colitis, plaque psoriasis, hidradenitis suppurativa and uveitis. From 2012 to 2020, Humira was

the world’s top selling drug. In 2012, it ousted Pfizer’s cholesterol drug Lipitor from the number one

spot. AbbVie reported Humira revenues of US$ 19.2 billion in 2019 and US$ 19.8 billion

in 2020. The drug brought in US$ 2.7 billion for AbbVie in 2021. However, that year, it lost its top-selling drug status to Pfizer’s Covid-19 vaccine Comirnaty.Since its approval in December 2002, Humira has brought in over

US$ 200 billion for AbbVie. Last year alone, the drug had delivered sales of US$ 15.6 billion until September 30, accounting for approximately 36 percent of AbbVie’s total net revenues. It is still a top-seller among non-Covid drugs.Humira’s controversial patent thicketThe original patent that covers Humira expired in 2016. Post that, FDA approved eight biosimilars for Humira. These are Amgen’s Amjevita (approved in 2016), Boehringer Ingelheim’s Cyltezo (2017), Sandoz’s Hyrimoz (2018), Samsung Bioepis’ Hadlima (2019), Pfizer’s Abrilada (2019), Viatris’ (earlier Mylan) Hulio (2020),

Coherus BioSciences’ Yusimry (2021) and Fresenius Kabi USA’s Idacio (2022).At present, Cyltezo is the only FDA-approved interchangeable biosimilar, giving it an edge over others since it can be substituted for Humira without a doctor's advice. However, this advantage may be short-lived. FDA is reviewing applications for interchangeability of Abrilada, Pfizer's approved product, and AVT02, Alvotech’s biosimilar under review. FDA is

expected to announce its decision on AVT02 in April.Even though Amjevita was approved in 2016, it wasn’t launched in the US as AbbVie used a strategy known as a “patent thicket” wherein the company applies for multiple patents in addition to the original one. Post that, AbbVie faced class action and

antitrust lawsuits from grocery workers’ union and welfare-benefit plans. In 2019, welfare-benefit plans that pay for Humira sued AbbVie in Chicago federal court, alleging its patent collection created an illegal monopoly by scaring off potential competitors.In June last year, a bipartisan group of US senators asked the US

Patent and Trademark Office to look into curbing the patent thicket. However,

in September, a US appeals court ruled that AbbVie’s use of a patent thicket did not unlawfully block competition. Humira’s last patent will expire in 2037.Our viewPost the launch of Amjevita, several

analysts have talked about how cost savings due to the launch of biosimilars

are expected to be limited given the complicated system of insurance, middle

men and rebates in the US.According to a March 2021 report brought out by the National Bureau of Economic Research, “competitive forces yield important price reductions as the number of competitors increase.”With each biosimilar entry, weighted average price ratios can fall anywhere between four and 10 percentage points, the report adds. Often,

the originator drops its price. In Europe, AbbVie had offered up to 80 percent discounts in November 2018, a month after Humira went off patent. It will be interesting to see how AbbVie counters the onslaught of biosimilars in the US.

Impressions: 1495

Nearly every

year, drugmakers ring in the new year with drug price increases in the US. This

year too, prices of over 450 prescription

medicines increased by an average of around 5 percent at the start of January.

This, when high drug prices have been one of the biggest political issues in

the US over the last few years.

PharmaCompass decided to usher in 2022 with a review of the US Medicare Part D Prescription Drug data recently released by the Centers for Medicare and Medicaid Services (CMS) for calendar year 2019. Using the available data, we have developed our own dashboard to show recent trends in consumption of prescription drugs. With this analysis, we hope our readers will get a better understanding of the world’s largest market for pharmaceuticals, as also a fix on where it may be headed.

View US Medicare Part D 2019 Drug Spending (Free Excel Available)

Rising healthcare, drug spends in US

Over the

last several years, we have repeatedly heard political leaders in the US

complain about high drug prices. Yet, drug prices and healthcare spends have

risen unabated.

America’s National Health Expenditure Accounts (NHEA) includes annual expenditures on healthcare goods and services, public health activities, the net cost of health insurance, and investment related to healthcare. In 2019, America’s national health expenditure (NHE) grew by 4.6 percent to US$ 3.8

trillion, accounting for 17.7 percent of the gross domestic product (GDP).

During the year, prescription drug spend increased by 5.7

percent to US$ 369.7 billion. In comparison, Medicare spend grew 6.7

percent to US$ 799.4 billion.

President

Joe Biden recently stressed on the need to cap the prices of essential drugs,

and said that the average American pays the highest prices for prescription

drugs anywhere in the world. Americans pay 10 times as much as other countries for life-saving insulin — the top selling prescription drug covered by the Part D program.

Pharma

companies, on the other hand, have vehemently argued against any price cuts in

the US, saying price cuts would hinder drug research and development for all

diseases.

View US Medicare Part D 2019 Drug Spending (Free Excel Available)

Patented drugs account for 80.3 percent of total Part D spend

Medicare is the US federal government’s program that

provides health insurance to most people who are 65 years

or older. Medicare’s Part D plan provides outpatient drug coverage through private

insurance companies that have contracts with the federal government. Eligible

people have to choose and enroll in a private prescription drug plan for Part D

coverage. Medicare Part B, on the other hand, covers a wide variety of

medically necessary outpatient services and some preventative services.

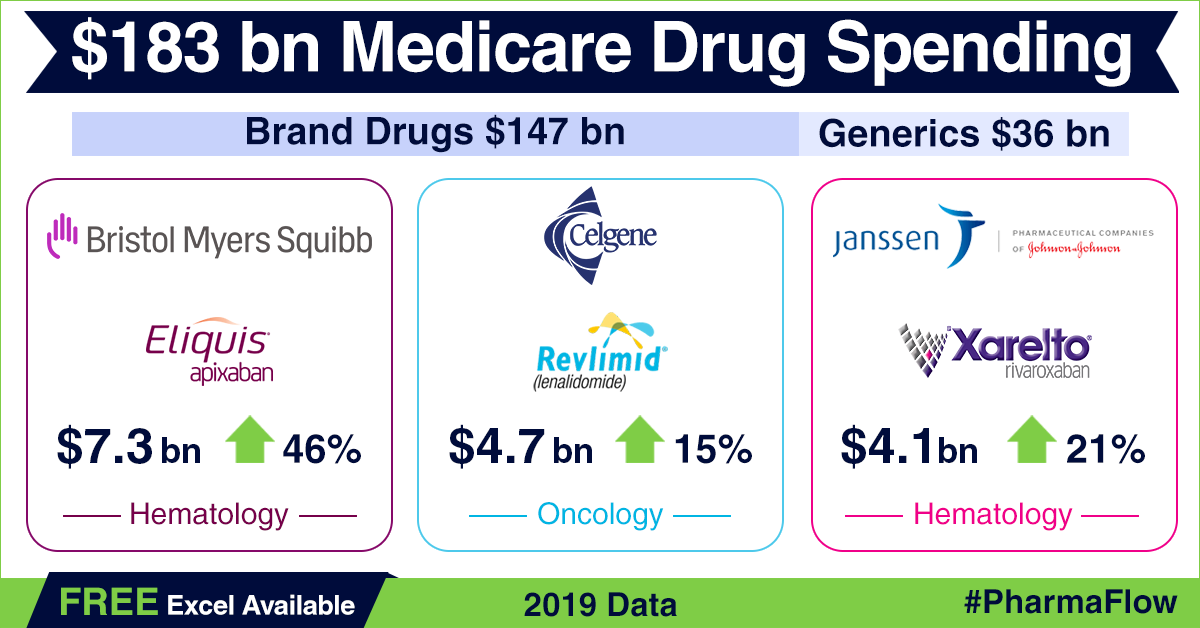

Prescription

drug coverage under Part D reached US$ 183 billion in 2019 — a growth of around 9 percent over 2018, when spending was US$ 168 billion. Spending

on patented drugs in 2019 accounted for around US$ 147 billion or 80.3 percent

of the total spend for the year. Generic drugs made up for the remaining 19.7

percent (approximately US$ 36 billion). In 2018, generic drugs worth US$ 35.8

billion were sold under Part D, accounting for 21 percent of the total spend

under the program.

View US Medicare Part D 2019 Drug Spending (Free Excel Available)

Eliquis ranks highest on Medicare’s brand drug spend

Under Part

D, endocrinology and oncology were the two therapeutic areas that generated

maximum revenue for pharma companies, driving home sales of over US$ 31.8

billion and US$ 23.5 billion, respectively. Neurology drugs generated sales of

around US$ 22.9 billion.

Among branded

drugs, Bristol Myers Squibb’s anticoagulant Eliquis (apixaban) was the most selling drug in 2019 under Part D, notching up about US$ 7.3 billion in sales — a rise of US$ 2.3 billion or 46 percent over 2018.

Celgene’s cancer drug Revlimid (lenalidomide) roped in US$ 4.7 billion (up

by 14.6 percent), while another anticoagulant drug Xarelto (rivaroxaban) by Janssen Pharma — a unit of Johnson & Johnson — fetched US$ 4.1 billion (up 20.6 percent) in sales through Part D. AbbVie’s anti-rheumatic drug Humira and Sanofi’s diabetes drug Lantus saw sales of around US$ 3.7 billion each

under the program.

Amongst

generics, the largest selling drug under Part D (by dosage units) was metformin (diabetes), followed by gabapentin (seizure), PEG3350 with

electrolyte (gastroenterology), metoprolol (hypertension) and atorvastatin (cholesterol). In 2019, the

overall dosage units sold also jumped higher by 2.25 billion units to 111.35

billion.

The sales

ranking of Part D does bare some similarities with the global ranking of

highest selling drugs. In 2020, Humira had retained its position as the highest

selling drug in the world, generating sales of US$ 20.4 billion. Both

Eliquis and Revlimid had retained their ranking as the third and fourth most

selling drugs, bringing home US$ 14.1 billion and US$ 12.1 billion in global

sales in 2020.

View US Medicare Part D 2019 Drug Spending (Free Excel Available)

Medicare’s inability to negotiate prices costs American taxpayers billions of dollars

Over the

years, drug companies have used Medicare’s

inability to negotiate prices under Part D to increase the prices of their

drugs significantly and rip off huge profits, a three-year-long US House

Oversight Committee investigation has revealed.

US taxpayers could have saved over US$ 25 billion in five years if the prices of just seven drugs — Humira, Imbruvica, Sensipar, Enbrel, Lantus, NovoLog and Lyrica — were negotiated by Medicare. Another US$ 16.7 billion could have been saved between

2011 and 2017 on insulin products manufactured by Eli Lilly, Novo Nordisk and Sanofi, which control 90 percent of the insulin market in the US, the committee’s report revealed.

Elsewhere in

the world, the same drugmakers are bending over backwards to get into medical

insurance programs. For instance, China reported that several international

pharma firms, many of them headquartered in the US, slashed the prices of their

drugs by up to 94 percent to get into the country’s national medical insurance coverage.

In the US — which accounted for around 46 percent of the global share of drugs in 2020 — senior citizens may have to pay more for medicines as the government announced a large hike in Medicare premiums for 2022

if an expensive Alzheimer’s drug, Aduhelm, is included in the list.

In order to

ensure inclusion in Medicare, Biogen slashed the price of Aduhelm by half — from US$ 56,000 to US$ 28,200 — just weeks before a crucial meeting called by the CMS. Clearly, this has set a precedent in an industry which is known for rampant price hikes and rarely for any price cuts. This could also be put forth as an example of what Medicare could achieve if it receives negotiation rights.

View US Medicare Part D 2019 Drug Spending (Free Excel Available)

Our view

President

Biden's Build Back Better legislation,

which the House passed last month, is up for vote in the Senate. The

legislation contains provisions that would allow Medicare to negotiate the

prices of some expensive drugs, penalize drugmakers who raise prices faster

than inflation and cap out-of-pocket costs for insulin at US$ 35 per month.

However, chances of the bill being passed in its present form are slim.

Even if the

Senate passes the bill, Medicare would be able to negotiate the prices of only 10 prescription drugs and insulin products in 2025.

The number would increase over the years, reaching 100 in six years, and hence

forth grow by 20 drugs a year.

It seems like 2022 won’t be the last year when January 1 will be braced with price hikes in the US by drugmakers. Looks like they will continue to make hay while the sun shines.

View US Medicare Part D 2019 Drug Spending (Free Excel Available)

Impressions: 2619

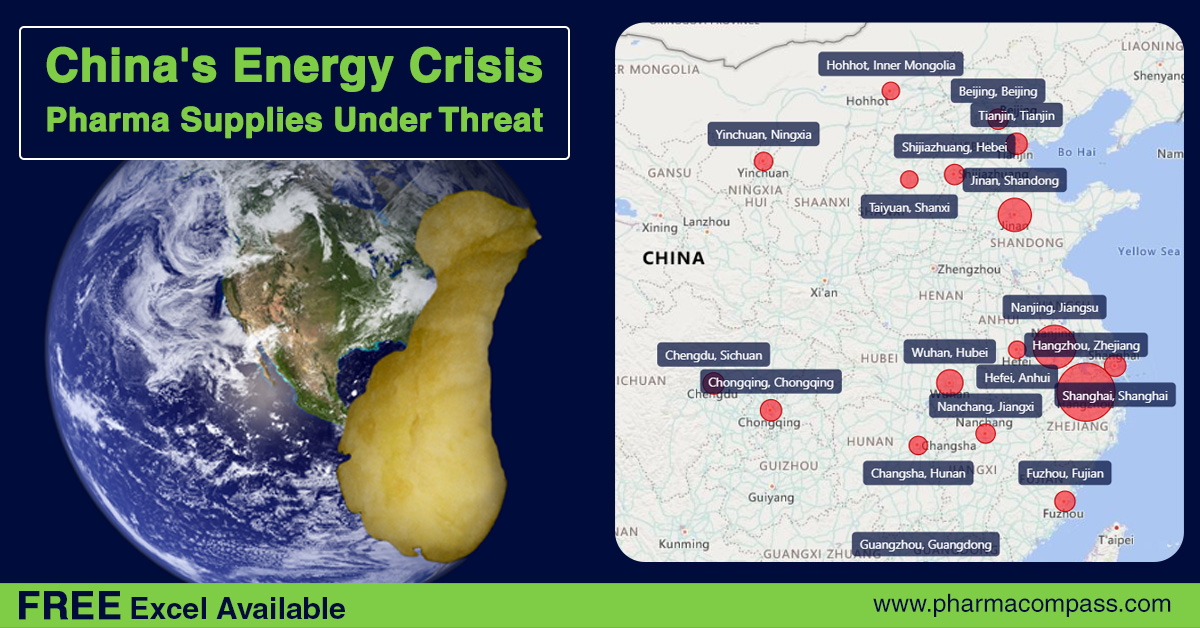

This

week, PharmaCompass looks at the energy crunch in China and its likely fallout

on the global pharmaceutical supply chains.

Till not so long ago, there was an adage — ‘when America sneezes, the world catches a cold’. These days, the same holds true of China, which is today the world’s second largest economy. It is also the largest exporter of goods in the world, supplying consumer electronics, cars, textiles, chemicals and a plethora of other goods to several countries across the world. The country is striving to emerge as the world’s next superpower by dethroning the US.

The

pandemic has shown us that the interconnectedness of supply chains can lead to

widespread shortages and interruptions in production across the world. Today,

China is in the midst of a serious energy crunch. The blackouts may be limited

to China, but their impact will be felt along the global supply chains for all

products, including pharmaceuticals.

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Curbs on power usage

The energy

crunch in China is triggered by factors such as a

shortage of coal supplies, tougher emissions standards and strong demand from

manufacturers and industry. These factors have led to widespread curbs on the usage of electricity.

China is the world’s top-most consumer of electricity. As the world’s top producer of carbon dioxide and other polluting gases, China’s ability to cut emissions is seen as critical in the global fight against climate change. The country has said it aims to bring carbon emissions to a peak by 2030 and to net zero by 2060. Recently, the country

banned cryptocurrency mining, a highly energy-intensive activity that has stoked a surge

in illicit coal extraction.

According to the country’s main planning agency, the National Development and Reform Commission (NDRC), only 10 out of 30 mainland Chinese regions achieved their energy reduction targets in the first six months of 2021.

To make matters worse, Beijing is contending with an ongoing trade dispute with Australia, the world’s second-largest coal exporter, which has greatly curbed coal shipments to China.

“The electricity shortages in China are worsening, and widening geographically. It’s getting so bad Beijing is now asking some food processors (like soybean crushing plants) to shut down,” Bloomberg’s chief energy correspondent said on Twitter.

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Factories

halts production

Since

mid-August, 20 provinces have implemented power cuts, including the manufacturing hubs of Guangdong, Zhejiang and Jiangsu, putting pressure on companies’ earnings. The impact on industries is broad and includes power-intensive sectors like

aluminum smelting, steel-making, cement manufacturing and fertilizer production.

According to Reuters, China’s factory activity unexpectedly shrank in September due to wider curbs on electricity use and elevated input prices. According to data from the National Bureau of Statistics, the official manufacturing Purchasing Manager's Index (PMI) was at 49.6 in September as against 50.1 in August, slipping into contraction for the first time since February 2020.

According to Morgan Stanley, about 7 percent of aluminum production

capacity has been suspended and 29 percent of cement production has been

affected by the power crunch. Paper and glass could be the next industries to

face supply disruptions, they said.

Numerous factories have halted production, including

many supplying Apple and Tesla. Some shops in the northeast are relying on

candles, while malls are closing early to

save energy.

China is already grappling with curbs on the property and tech sectors, and there are concerns around the future of its cash-strapped real estate giant — Evergrande.

As a result, Goldman Sachs and Nomura have revised downwards their projections for China’s economic growth. For Q3, Goldman’s new growth forecasts has shrunk to 0 percent quarter-on-quarter (4.8 percent year-on-year). Nomura has cut its Q3 and Q4 China

GDP growth forecasts to 4.7 percent and 3.0 percent, respectively, from 5.1

percent and 4.4 percent previously, and its full-year forecast to 7.7 percent

(from 8.2 percent).

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Pharma

supply chain concerns

According to Fitch Ratings, China is the world’s largest exporter of active pharmaceutical ingredients (APIs) exporter and its two largest export destinations — India and the US — accounted for 16.8 percent and 12.5 percent of China’s total API export value, respectively, in 2019.

Over the

last few years, both India and the US have been concerned about their high

dependence on China for APIs and other drug inputs. Back in December 2019, Chuck Schumer (who is currently the Senate majority leader) had expressed serious concern over the grave national security and

public health risks posed by the United States’ growing reliance on China for production of

a wide range of life-saving drugs used by the US military and hospitals across

the country. Schumer had requested the Government

Accountability Office (GAO) to investigate the capability of the US to

manufacture finished drug products and APIs.

India too has repeatedly expressed concerns over its huge dependence on China for APIs — nearly 70 percent of the country’s APIs are imported from China

with dependence as high as 90 percent for certain life-saving drugs. This year,

in February, the Indian government had rolled out the Production Linked Incentive (PLI) scheme

for drugs and had chosen 11 pharmaceutical companies to make key starting

materials, drug intermediates and APIs to reduce its dependence on Chinese

imports.

Since then, India has levied anti-dumping duties on various chemicals

and APIs being imported from China. In March, India had imposed anti-dumping duty on the antibacterial drug — ciprofloxacin hydrochloride and in August an anti-dumping probe was initiated against a chemical (ATS-8) used to produce

the commonly used cholesterol lowering

drug atorvastatin. And just

this month, India recommended the imposition of anti-dumping duty on vitamin C being

imported from China.

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Our view

PharmaCompass’ database on generic drug manufacturers registered with US Food and Drug Administration (FDA) tells us that there are 155 generic facilities in China that supply generic drugs to the US. Out of this, over half, or 80 facilities are situated in the three provinces of Jiangsu, Zhejiang and Guangdong that are worst hit by the power crunch. Given this, the energy crunch in China definitely poses a risk to

the global supply chains for drugs and APIs.

The PharmaCompass

compilation does not include many Chinese companies that manufacture key

intermediates that are used by companies around the world to produce APIs.

In

October-end, Glasgow (Scotland) would host the 26th United Nations Climate

Change Conference (COP26). According to news reports, none of the largest

greenhouse gas emitting countries are on track to meet their climate goals.

In this

scenario, coupled with rising instances of extreme weather conditions and fears

of more pandemics in the future, the power crunch in China might just be

another reason after Covid-19 for countries to rework their pharma supply

chains. Given the volatilities and uncertainties, nations have realized they

need to reduce their dependence on countries like China and India in order to

keep their economic growth engine moving.

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Impressions: 4639

In case you thought Covid-19 had slowed down US Food and Drug Administration’s New Drug Approvals, you’re in for a pleasant surprise — the FDA appears to be more active than ever before. By the end of June, the FDA had already approved 33 new drugs which put the approval activities within the ballpark of the past two years — 62 novel drugs were approved in 2018, while 54 were approved in 2019.

FDA’s Center for Drug Evaluation and Research (CDER) approved 25 new molecular entities and new therapeutic biological products, of which almost half — 12 out of 25 — were oncology drugs, while the rest of

the novel therapies were approved by the Center for Biologics Evaluation and Research.

The European Medical Agency (EMA) was also busy as the regulator issued a positive opinion for 41 drugs, of which 27 were classified as novel treatments.

View New Drug Approvals by June 2020 with Estimated Sales (Free Excel Available)

Conditional Approval for Gilead’s Remdesivir

Gilead’s Remdesivir has

certainly been one of the most talked about drugs

this year. While it is still under clinical evaluation, the FDA, EMA and the

Japanese Ministry of Health, Labour and Welfare (MHLW) found ways of providing

market access to this drug as a treatment against Covid-19.

On May 1, 2020, based on the totality of

scientific evidence available to the FDA, the

agency issued an Emergency Use Authorization (EUA), as it believed

that remdesivir may be effective

in treating Covid-19 and that the known and

potential benefits of remdesivir, when used to

treat Covid-19, outweigh the known and potential risks of such products.

On June 25, 2020, EMA’s Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion, recommending the granting of conditional marketing authorization for Veklury (remdesivir).

The demand for remdesivir is such that the US bought more than 500,000 doses, which is all of Gilead’s production for July and 90 percent of production for August and September, leaving almost

no stock of remdesivir for the UK and Europe.

In 127 poor or middle-income countries, Gilead

is allowing generic drugmakers to supply remdesivir. It has signed non-exclusive voluntary licensing

agreements with generic pharmaceutical manufacturers based in Egypt, India and

Pakistan to further expand the supply of the antiviral drug.

View New Drug Approvals by June 2020 with Estimated Sales (Free Excel Available)

Vertex’s Kaftrio bags EMA approval

Earlier this year, PharmaCompass published its compilation of the sales forecasts for the new drugs approved by the FDA in 2019. The list was led by Vertex’s cystic fibrosis treatment — Trikafta — which is expected to have sales of US$ 3.935 billion by 2024.

Trikafta is a combination of ivacaftor, tezacaftor and elexacaftor and its stellar clinical data made the FDA approve the drug within three months of Vertex’s application filing and five months before FDA’s action date.

In June 2020, EMA’s CHMP adopted a positive opinion, recommending the granting of a marketing authorization for Vertex’s combination which will be marketed as Kaftrio.

EMA also adopted positive opinions on other

drugs which were previously approved by the FDA in

2019, such as Novartis’ Zolgensma and Piqray, Pfizer’s Staquis and Daurismo among many

others.

Immunomedic’s antibody-drug conjugate (ADC) — Trodelvy (sacituzumab govitecan-hziy) — was approved by the FDA for the treatment of adult patients with metastatic triple-negative breast cancer who have received at least two prior therapies for metastatic disease. Trodelvy follows remdesivir in our list of FDA approved drugs in 2020 with the highest sales potential. The current forecast for Trodelvy sales is US$ 2.151 billion by 2026.

FDA’s approval of Lundbeck’s Vyepti (eptinezumab) and Biohaven’s Nurtec ODT (rimegepant) for migraine

headaches brought additional CGRP-targeted products to the market. It will be

interesting to see how Nurtec ODT is accepted given it is a small molecule

drug, which makes administration easier. It was

recently promoted on social media by Khloe Kardashian.

View New Drug Approvals by June 2020 with Estimated Sales (Free Excel Available)

Covid-19 impacts drug launches

The pandemic has, however, started taking a

toll on drug launches. One of the most anticipated drug approvals of the year, Bristol-Myers Squibb’s multiple sclerosis (MS) treatment — Zeposia (ozanimod) — was approved in both the US and Europe. However, the launch of the drug would

be delayed due to the coronavirus outbreak.

The drug was added to BMS’s portfolio through its US$ 74 billion acquisition of Celgene last year. Its

approval was one of the three conditions set for a potentially higher payout

for Celgene investors.

Analysts have high hopes from ozanimod. Its

average peak sales for 2024 have been predicted to be at US$

1.62 billion by Cortellis, though the Covid-19 pandemic may weigh in there

as well.

View New Drug Approvals by June 2020 with Estimated Sales (Free Excel Available)

First non-statin cholesterol drug bags

FDA approval

This year also witnessed the first non-statin

treatment to be cleared for sale in the US in nearly 20 years. The drug, bempedoic acid, is made by Esperion Therapeutics Inc. This cholesterol-lowering drug is aimed at

helping millions of people who can’t tolerate or don’t get enough help from widely used statin pills like Lipitor and Crestor.

This new drug is to be used as an add-on treatment with statins. It lowers bad

cholesterol or low-density lipoprotein (LDL) by inhibiting its synthesis in the

liver. It targets patients with high cardiovascular risk.

Esperion also won approval of bempedoic acid

in combination with ezetimibe, another

cholesterol-lowering drug.

In January last year, Daiichi Sankyo Europe had entered into an exclusive licensing agreement with Esperion Therapeutics for Daiichi Sankyo Europe to market

bempedoic acid and bempedoic acid/ezetimibe combination tablet in the European

Economic Area and Switzerland.

View New Drug Approvals by June 2020 with Estimated Sales (Free Excel Available)

Approvals not granted to almost 20 drugs

There were setbacks too, and not everything

rolled smoothly. This year, almost 20 drug approvals were not granted. Among

the major setbacks were Bristol Myers Squibb and bluebird bio, Inc announcing

that they have received a Refusal to File letter from the FDA regarding the Biologics License

Application (BLA) for their CAR-T therapy, idecabtagene vicleucel (ide-cel), for patients with heavily pre-treated

relapsed and refractory multiple myeloma, which was

submitted in March 2020.

Upon preliminary

review, the FDA determined that the Chemistry, Manufacturing and Control (CMC)

module of the BLA requires further detail to complete the review. No additional

clinical or non-clinical data have been requested or are required.

Two years after Intarcia Therapeutics received

a CRL for its matchstick-sized, long-term drug

implant for type 2 diabetes, the FDA issued a second CRL to the company for its ITCA-650 implant. The

implant is designed to be a small, osmotic pump which can be slipped under the

skin and deliver a continuous, six-month dose of the

GLP-1 agonist exenatide.

The FDA also did not approve Intercept Pharmaceuticals’ obeticholic acid to treat NASH (or

nonalcoholic steatohepatitis, a liver condition in

which the buildup of fat

progressively scars the organ), as it wasn’t convinced that its benefits outweighed the potential risks.

After acquiring Allergan for US$ 63

billion, one of the first drugs which AbbVie was expecting

approval for was Abicipar pegol, their experimental DARPin therapy for patients with neovascular (wet) age-related macular degeneration (nAMD). However, FDA’s review indicated the rate of intraocular inflammation observed following administration of Abicipar pegol 2mg/0.05 mL

results in an unfavorable benefit-risk ratio in the treatment of wet AMD.

View New Drug Approvals by June 2020 with Estimated Sales (Free Excel Available)

Our view

While everyone’s attention is on the Covid-19 pandemic, the industry is certainly busy working towards getting new drugs to market. At the halfway mark, the FDA and EMA seem to be on track to set approval records this year, since the number of drugs approved by June are almost twice the number that were approved at the same time last year.

However, it remains to be seen how companies adapt their sales and marketing strategies in a world where mobility is likely to get restricted and interpersonal contact is set to reduce dramatically.

View New Drug Approvals by June 2020 with Estimated Sales (Free Excel Available)

Impressions: 69874

Acquisitions and spin-offs dominated headlines in 2019 and the tone was set very early with Bristol-Myers Squibb acquiring

New Jersey-based cancer drug company Celgene in a US$ 74 billion deal announced on

January 3, 2019. After factoring

in debt, the deal value ballooned to about US$ 95 billion, which according

to data compiled by Refinitiv, made it the largest healthcare deal on

record.

In the summer, AbbVie Inc,

which sells the world’s best-selling drug Humira, announced its acquisition of Allergan Plc, known for Botox and other cosmetic

treatments, for US$ 63 billion. While the companies are still awaiting

regulatory approval for their deal, with US$ 49 billion in combined 2019

revenues, the merged entity would rank amongst the biggest in the industry.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

The big five by pharmaceutical sales — Pfizer,

Roche, J&J, Novartis and Merck

Pfizer

continued

to lead companies by pharmaceutical sales by reporting annual 2019 revenues of

US$ 51.8 billion, a decrease of US$ 1.9 billion, or 4 percent, compared to

2018. The decline was primarily attributed to the loss of exclusivity of Lyrica in 2019,

which witnessed its sales drop from US$ 5 billion in 2018 to US$ 3.3 billion in

2019.

In 2018, Pfizer’s then incoming CEO Albert Bourla had mentioned that the company did not see the need for any large-scale M&A activity as Pfizer had “the best pipeline” in its history, which needed the company to focus on deploying its capital to keep its pipeline flowing and execute on its drug launches.

Bourla stayed true to his word and barring the acquisition of Array Biopharma for US$ 11.4 billion and a spin-off to merge Upjohn, Pfizer’s off-patent branded and generic established medicines business with

Mylan, there weren’t any other big ticket deals which were announced.

The

Upjohn-Mylan merged entity will be called Viatris and is expected to have 2020

revenues between US$ 19 and US$ 20 billion

and could outpace Teva to

become the largest generic company in the world, in term of revenues.

Novartis, which had

followed Pfizer with the second largest revenues in the pharmaceutical industry

in 2018, reported its first full year earnings after spinning off its Alcon eye

care devices business division that

had US$ 7.15 billion in 2018 sales.

In 2019,

Novartis slipped two spots in the ranking after reporting total sales of US$

47.4 billion and its CEO Vas Narasimhan continued his deal-making spree by buying New

Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7

billion to acquire a late-stage cholesterol-lowering

therapy named inclisiran.

As Takeda Pharmaceutical Co was

busy in 2019 on working to reduce its debt burden incurred due to its US$ 62

billion purchase of Shire Plc, which was announced in 2018, Novartis also purchased

the eye-disease medicine, Xiidra, from the Japanese drugmaker for US$ 5.3 billion.

Novartis’ management also spent a considerable part of 2019 dealing with data-integrity concerns which emerged from its 2018 buyout of AveXis, the

gene-therapy maker Novartis had acquired for US$ 8.7 billion.

The deal gave Novartis rights to Zolgensma,

a novel treatment intended for children less than two years of age with the

most severe form of spinal muscular atrophy (SMA). Priced at US$ 2.1 million,

Zolgensma is currently the world’s most expensive drug.

However,

in a shocking announcement, a month after approving the drug, the US Food and

Drug Administration (FDA) issued a press release on

data accuracy issues as the agency was informed by AveXis that

its personnel had manipulated data which

the FDA used to evaluate product comparability and nonclinical (animal)

pharmacology as part of the biologics license application (BLA), which was

submitted and reviewed by the FDA.

With US$

50.0 billion (CHF 48.5 billion) in annual pharmaceutical sales, Swiss drugmaker

Roche came in at number two position in 2019

as its sales grew 11 percent driven by

its multiple sclerosis medicine Ocrevus, haemophilia drug Hemlibra and cancer medicines Tecentriq and Perjeta.

Roche’s newly introduced medicines generated US$ 5.53 billion (CHF 5.4 billion) in growth, helping offset the impact of the competition from biosimilars for its three best-selling drugs MabThera/Rituxan, Herceptin and Avastin.

In late 2019, after months of increased

antitrust scrutiny, Roche completed

its US$ 5.1 billion acquisition of Spark Therapeutics to strengthen its presence in

gene therapy.

Last year, J&J reported almost flat worldwide sales of US$ 82.1 billion. J&J’s pharmaceutical division generated US$ 42.20 billion and its medical devices and consumer health divisions brought in US$ 25.96 billion and US$ 13.89 billion respectively.

Since J&J’s consumer health division sells analgesics, digestive health along with beauty and oral care products, the US$ 5.43 billion in consumer health sales from over-the-counter drugs and women’s health products was only used in our assessment of J&J’s total pharmaceutical revenues. With combined pharmaceutical sales of US$ 47.63 billion, J&J made it to number three on our list.

While the sales of products like Stelara, Darzalex, Imbruvica, Invega Sustenna drove J&J’s pharmaceutical business to grow by 4 percent over 2018, the firm had to contend with generic competition against key revenue contributors Remicade and Zytiga.

US-headquartered Merck, which is known as

MSD (short for Merck Sharp & Dohme) outside the United States and

Canada, is set to significantly move up the rankings next year fueled by its

cancer drug Keytruda, which witnessed a 55

percent increase in sales to US$ 11.1 billion.

Merck reported total revenues of US$ 41.75 billion and also

announced it will spin off its women’s health drugs,

biosimilar drugs and older products to create a new pharmaceutical

company with US$ 6.5 billion in annual revenues.

The firm had anticipated 2020 sales between US$ 48.8 billion and US$ 50.3 billion however this week it announced that the coronavirus pandemic will reduce 2020 sales by more than $2 billion.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

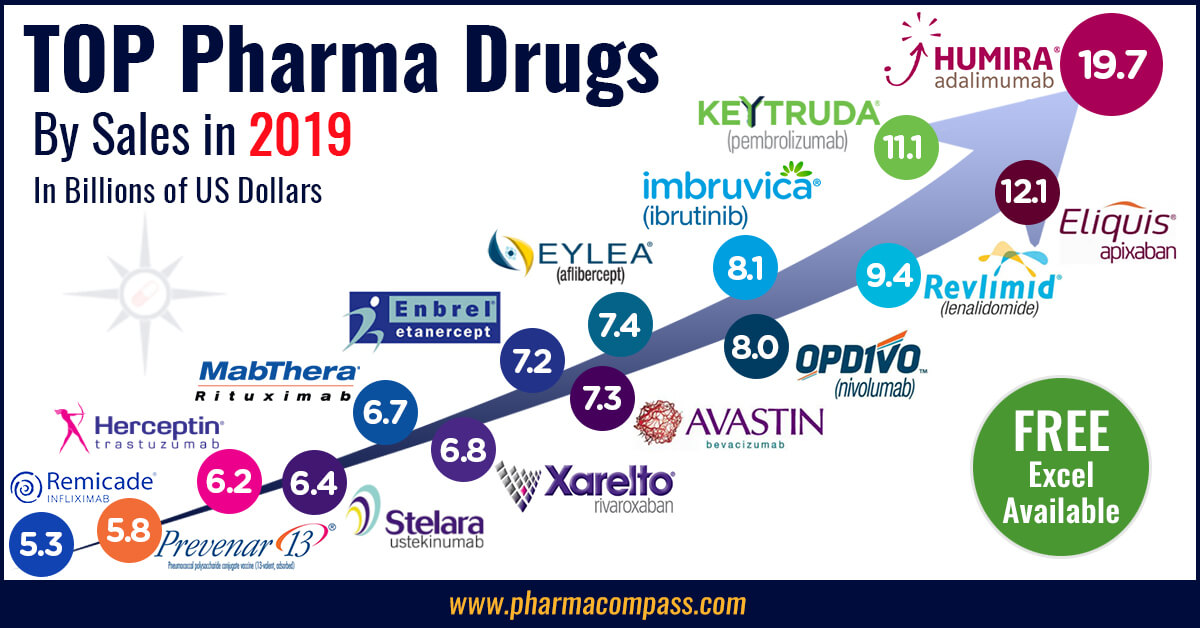

Humira holds on to remain world’s best-selling drug

AbbVie’s acquisition of Allergan comes as the firm faces the expiration of patent protection for Humira, which brought in a staggering US$ 19.2 billion in sales last year for

the company. AbbVie has failed to successfully acquire or develop a major new

product to replace the sales generated by its flagship drug.

In 2019, Humira’s US revenues increased 8.6 percent to US$ 14.86 billion while internationally, due

to biosimilar competition, the sales dropped 31.1 percent to US$ 4.30 billion.

Bristol Myers Squibb’s Eliquis, which is also marketed by Pfizer, maintained its number two position

and posted total sales of US$ 12.1 billion, a 23 percent increase over 2018.

While Bristol Myers Squibb’s immunotherapy treatment Opdivo, sold in partnership with Ono in Japan, saw sales increase from US$ 7.57 billion to US$ 8.0 billion, the growth paled in comparison to the US$ 3.9

billion revenue increase of Opdivo’s key immunotherapy competitor Merck’s Keytruda.

Keytruda took the number three spot in drug sales that

previously belonged to Celgene’s Revlimid, which witnessed a sales decline from US$ 9.69 billion to US$ 9.4 billion.

Cancer treatment Imbruvica, which is marketed

by J&J and AbbVie, witnessed a 30 percent increase in sales. With US$ 8.1

billion in 2019 revenues, it took the number five position.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Vaccines – Covid-19 turns competitors into partners

This year has been dominated by the single biggest health emergency in years — the novel coronavirus (Covid-19) pandemic. As drugs continue to fail to meet expectations, vaccine development has received a lot of attention.

GSK reported the highest vaccine sales of all drugmakers with

total sales of US$ 8.4 billion (GBP 7.16 billion), a significant portion of its

total sales of US$ 41.8 billion (GBP 33.754 billion).

US-based Merck’s vaccine division also reported a significant increase in sales to US$ 8.0 billion and in 2019 received FDA and EU approval to market its Ebola vaccine Ervebo.

This is the first FDA-authorized vaccine against the deadly virus which causes

hemorrhagic fever and spreads from person to person through direct contact with

body fluids.

Pfizer and Sanofi also reported an increase in their vaccine sales to US$ 6.4

billion and US$ 6.2 billion respectively and the Covid-19 pandemic has recently

pushed drugmakers to move faster than ever before and has also converted

competitors into partners.

In a rare move, drug behemoths — Sanofi and GlaxoSmithKline (GSK) —joined hands to develop a vaccine for the novel coronavirus.

The two companies plan to start human trials

in the second half of this year, and if things go right, they will file

for potential approvals by the second half of 2021.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Our view

Covid-19 has brought the world economy to a grinding halt and shifted the global attention to the pharmaceutical industry’s capability to deliver solutions to address this pandemic.

Our compilation shows that vaccines and drugs

for infectious diseases currently form a tiny fraction of the total sales of

pharmaceutical companies and few drugs against infectious diseases rank high on

the sales list.

This could well explain the limited range of

options currently available to fight Covid-19. With the pandemic currently infecting

over 3 million people spread across more than 200 countries, we can safely

conclude that the scenario in 2020 will change substantially. And so should our

compilation of top drugs for the year.

View Our Interactive Dashboard on Top drugs by sales in 2019 (Free Excel Available)

Impressions: 54728

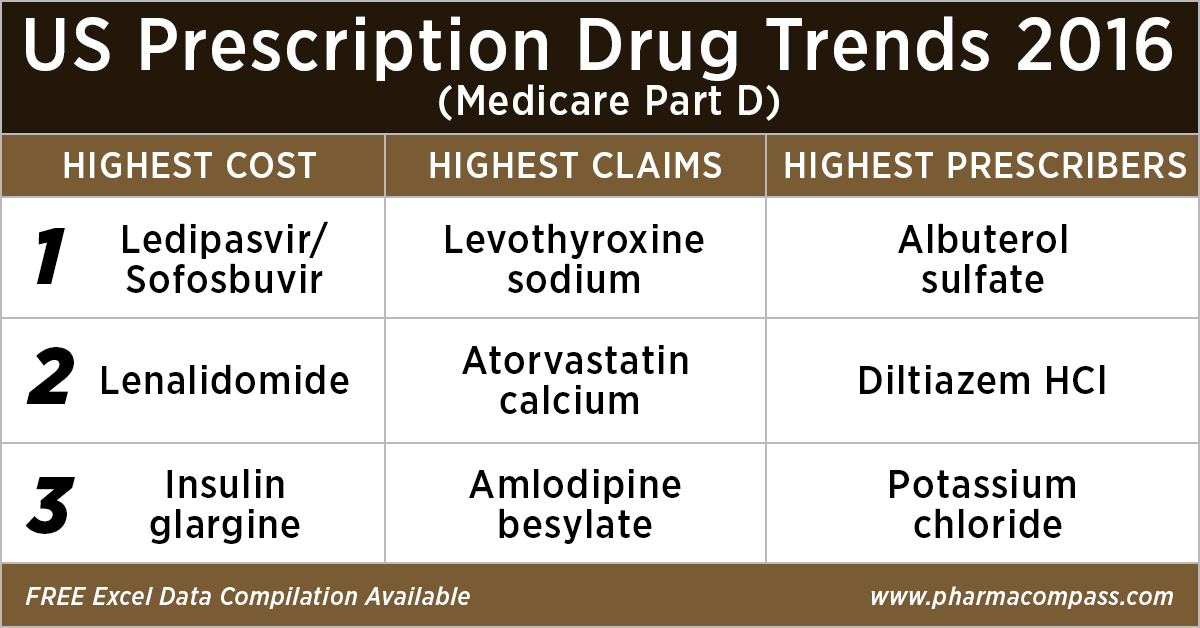

This week, PharmaCompass

reviews the recently released data on prescription drugs paid for under the

Medicare Part D Prescription Drug Program in the United States in calendar year

2016.

But first, let’s understand what is Medicare.

Medicare is the federal health insurance program in the US. In 2017, it covered 58.4 million people — 49.5 million aged 65 and older, and 8.9 million disabled.

Prescription drug coverage under this

program was started in 2006, and is known as Medicare Part D.

As part of this

coverage, the Centers for Medicare & Medicaid Services (CMS) contracts insurance

companies and other private companies, known as plan sponsors, that offer

prescription drug plans to their beneficiaries with varying drug coverage and

cost-sharing requirements.

In

2017, the Congressional Budget Office (CBO) had estimated that spending on

Medicare Part D would reach US$ 94 billion, or about 16 percent of all Medicare

expenditures for the year.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

According

to the CBO, Medicare Part D is the most significant expansion of the Medicare

program since it was created by Congress in 1965.

With

more than 1.48 billion claims from beneficiaries enrolled under the Part D

prescription drug benefit program under its umbrella, our analysis of Medicare

Part D provides valuable insights into how elderly Americans use prescription

drugs.

Top 10 drugs by

cost: The ones that bore the highest cost burden for Medicare

As in 2015, in 2016

too Gilead’s Hepatitis C treatment — Ledipasvir/Sofosbuvir (Harvoni) — remained the single drug highest payout under the Medicare Part D Prescription Drug Program with a total cost of US$ 4.4 billion.

As Gilead continued

to face competition from AbbVie and Merck in the Hepatitis C space, the spending on Harvoni was down

37 percent from US$ 7.03 billion in 2015.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Celgene’s cancer treatment, Lenalidomide (Revlimid), Sanofi and Merck’s diabetes treatments and AstraZeneca’s Crestor (Rosuvastatin Calcium) for

cholesterol followed Harvoni. All together, they cost the Medicare program over US$ 10 billion.

Generic Name

Number of Medicare Part D Claims

Number of Medicare Beneficiaries

Number of Prescribers

Aggregate Cost Paid for Part D

Claims (In USD)

LEDIPASVIR/ SOFOSBUVIR (HARVONI)

141,665

52,782

12,097

4,398,534,465

LENALIDOMIDE

239,049

35,368

10,382

2,661,106,127

LANTUS SOLOSTAR (INSULIN

GLARGINE, HUM.REC.ANLOG )

5,028,485

1,075,248

245,447

2,526,048,766

SITAGLIPTIN PHOSPHATE

4,742,505

864,442

206,223

2,440,013,513

ROSUVASTATIN CALCIUM

6,012,444

1,560,050

249,981

2,322,724,007

FLUTICASONE/SALMETEROL

5,194,391

1,196,007

275,442

2,319,808,482

PREGABALIN

4,940,115

852,497

267,532

2,098,953,250

RIVAROXABAN

4,403,332

807,820

252,141

1,954,748,890

APIXABAN

4,455,782

826,969

231,631

1,926,107,484

TIOTROPIUM BROMIDE

4,153,162

903,494

235,564

1,818,857,361

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Top 10 drugs by claims: The most commonly

used drugs of 2016

With 46.6 million claims, the thyroid hormone deficiency treatment — Levothyroxine Sodium — retained its position of being the most claimed product under Medicare’s Part D Prescription Drug Program in 2016.

The number of

Medicare Part D claims includes original prescriptions and refills.

Following Levothyroxine Sodium was the lipid-lowering agent — Atorvastatin Calcium — which had 44.5 million Medicare Part D claims that

were filed by almost 9.4 million beneficiaries.

Generic

Name

Number

of Prescribers

Number

of Medicare Part D Claims

Number

of Medicare Beneficiaries

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

ATORVASTATIN CALCIUM

494,973

44,595,686

9,435,633

AMLODIPINE BESYLATE

497,017

39,913,468

7,802,905

LISINOPRIL

490,452

39,469,840

8,009,954

OMEPRAZOLE

492,951

32,909,236

7,001,160

METFORMIN HCL

611,700

31,007,932

6,394,014

SIMVASTATIN

380,560

29,687,947

6,201,911

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

FUROSEMIDE

488,352

27,878,243

5,421,598

GABAPENTIN

555,997

27,627,466

5,363,382

Click here

to access the compilation of Medicare Part D Prescriber Summary Report

Top 10 drugs by prescribers: Medicines that were most popular with

doctors

Among the prescribers, albuterol sulfate (salbutamol) and Diltiazem had

over 900,000 unique providers (or

doctors) prescribing the drug.

Albuterol (salbutamol) is

used to provide quick relief from wheezing and shortness

of breath while Diltiazem is used to prevent chest

pain (angina).

Also

on the list of popular drugs with prescribers is Hydrocodone-Acetaminophen.

With more doctors prescribing Hydrocodone-Acetaminophen (an

opioid) than commonly used antibiotics, such as Cephalexin, Ciprofloxacin and Amoxicillin, the

series of new FDA initiatives to combat the epidemic of opioid misuse and abuse

should change the position of opioids in the top 10 drugs by prescribers in the

coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Generic

Name

Number of

Prescribers

Number of

Medicare Part D Claims

Number of

Medicare Beneficiaries

ALBUTEROL SULFATE

985,427

13,100,354

5,417,718

DILTIAZEM HCL

931,159

8,142,004

1,982,550

POTASSIUM CHLORIDE

879,491

18,945,969

4,278,000

PEN NEEDLE, DIABETIC

677,210

5,281,778

1,795,046

LEVOTHYROXINE SODIUM

669,999

46,617,109

8,091,785

HYDROCODONE/ACETAMINOPHEN

660,617

28,595,150

7,265,882

METFORMIN HCL

611,700

31,007,932

6,394,014

CEPHALEXIN

597,647

5,603,879

3,933,373

CIPROFLOXACIN HCL

594,129

7,000,081

4,851,657

AZITHROMYCIN

591,028

7,958,625

5,734,122

What does the

future hold?

Although the Part D Prescriber PUF (public use file) has a wealth of information on payment and utilization for Medicare Part D prescriptions, the dataset has a number of limitations. Of particular importance is the fact that the data may not be representative of a physician’s entire practice or all of Medicare as it only includes information on beneficiaries enrolled in the Medicare Part D prescription drug program (i.e., approximately two-thirds of all Medicare beneficiaries).

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Last

month, the Office of the Inspector General (OIG)

reviewed

the Part D claims data for the years 2011 to 2015 for brand-name drugs.

The OIG’s report found that the total reimbursement for all brand-name drugs in Part D increased 77 percent from 2011 to 2015, despite a 17-percent decrease in the number of prescriptions for these drugs.

With soaring drug prices being an issue for

regular debate in the Unites States and President Trump announcing that his

team will use strategies to strengthen the negotiating powers under

Medicare Part D and Part B, it remains to be seen how the data on prescription drugs paid for under

the Medicare Part D Prescription Drug Program will change in the coming years.

Click here to access the compilation of Medicare Part D

Prescriber Summary Report

Impressions: 2492

In Phispers this week, there is news on how alternatives to Mylan’s EpiPen have eaten into its US sales. Warning letters posted by the FDA revealed that it considers seven of Wockhardt’s sites out of compliance and there is more trouble in the works for the former Ranbaxy promoters. And, Novartis faces punitive action in South Korea. Read on.

Mylan’s EpiPen sees drastic drop in market share in Jan-Feb 2017

Last year, Mylan was in

the news for hiking the price of EpiPen by

500 percent. At that time, there were no generic avatars of the

life-saving anti-allergy medicine available in the US market. But now, the

scenario has changed. Data from athenahealth network shows that prescriptions for alternatives of Mylan’s EpiPen have “quadrupled since the beginning of 2017”.

More than 60,000 prescriptions

for epinephrine auto-injectors, written for 50,000 patients by more than 1,400

healthcare providers in the US, were evaluated by researchers at athenahealth

between January 2016 and February 2017. The share of alternatives to

EpiPen have significantly increased in the last two months, as opposed to the

end of 2016.

“At the end of 2016, EpiPen alternatives made up only 5.3 percent of prescriptions for epinephrine auto-injectors. By the last full week of February, that figure had grown to 28.9 percent,” athenahealth said.

The key reason for this sudden and significant shift is the lower price tags of the EpiPen alternatives. Most of these alternatives are priced at a fraction of the cost of Mylan’s EpiPen. Moreover, insurers could also be affecting the prescription patterns. In January this year, health insurance company Cigna began to cover only generic options to EpiPen.

Seven of your facilities are out of compliance, FDA tells

Wockhardt

This week, US FDA posted

the warning letter issued to Wockhardt's US-based Morton Grove facility. The concerns raised by the investigators ranged from Wockhardt's “investigations into out-of-specification (OOS) test results” that were found to be neither thorough, nor timely, nor based on scientific rationales” to the “original results” that were “invalidated without scientific justification under the protocol and only re-test results were reported as part of batch release decisions.”

Of serious concern is the fact that in the warning letter the FDA has said: "At this time, seven Wockhardt facilities (including Morton Grove) are considered out of compliance with cGMP. These repeated failures at multiple sites demonstrate your company’s inadequate oversight and control over the manufacture of drugs. In your responses to the various actions listed above, including during multiple meetings with FDA, you have repeatedly discussed and promised corporate-wide corrective actions. Yet, when FDA inspects or returns to other Wockhardt facilities, similar violations are shown to persist.”

Second FDA warning letter to Megafine over "calibration records in trash”

Megafine

Pharma received its second

FDA warning letter in less than a year for its facility which manufactures active pharmaceutical ingredient (API) intermediates. The Megafine plant in Vapi (Gujarat) was inspected last September and once again data

integrity was the primary cause of concern raised by the FDA.

The facility was “issuing analysts with blank controlled document forms that had already been approved and signed”. Moreover, FDA investigators found torn, partially complete Quality Assurance-signed calibration records in the trash and saw QA staff shredding documents without reason.

In another observation, "analysts reprocessed data up to 12 times, and only included the final result in the report for review by Quality Assurance. Your Deputy Manager, Quality Control stated that it is common practice to ‘play with parameters’ to get the proper integration."

FDA investigators also noticed that the interior surfaces of the

drug manufacturing equipment were not as clean as required.

Megafine's API plant in Lakhmapur, Nashik, was placed on FDA's Import

Alert list in 2015.

Ghosts of Ranbaxy continue to haunt Singh brothers

Former promoters of Ranbaxy — Malvinder and Shivinder Singh — were directed by the Delhi High

Court to seek its permission before selling any of their unencumbered assets. This puts in jeopardy reported plans of the brothers to sell their stakes in companies like Fortis Healthcare and Religare, although the court hasn’t passed an outright injunction against such an exercise.

The Singh brothers have also

been directed to furnish details of all unencumbered assets in order to ascertain

that they have enough funds to cover an arbitration payment of more than US$

3.74 billion (Rs 250 billion) granted to Daiichi Sankyo by a Singapore tribunal

last year.

The brothers have been engaged

in a legal battle with Daiichi Sankyo, which bought out Ranbaxy in 2008 for US$

4.1billion. Daiichi had accused the Singh

brothers of misrepresenting the problems facing Ranbaxy when it acquired the

firm. In 2014, Daiichi sold Ranbaxy to Sun Pharma.

Investors demand cut in new GSK CEO’s prospective pay package

A number of investors in Britain’s largest drug company — GlaxoSmithKline (GSK) — are reportedly putting pressure on its board to reduce a proposed multi-million pound pay deal for its

new CEO, Emma Walmsley. They want Walmsley’s package to be sufficiently lower than the one awarded to her predecessor — Sir Andrew Witty — who is slated to retire later this month. His base salary is US$ 1.34 million (£1.1million) a year, while Walmsley’s proposed base salary is US$ 1.22 million (£1 million) a year, said news reports.

Some shareholders don’t think her proposed pay package fits Walmsley’s work experience. She is set to become Big Pharma’s first female CEO. But her resume is heavily tilted towards consumer products. Till recently, she was heading GSK’s consumer health joint venture. And prior to 2010 (a year when she joined GSK), she spent 17 years at cosmetics company — L’Oreal.

GSK is in “active consultations with shareholders” and is “acutely aware of the need for a balanced and responsible approach to remuneration,” a spokesperson said.

Children with AIDS write to India’s PM about Cipla’s Lopinavir

When the Indian government

failed to clear its dues, Cipla — the only manufacturer of Lopinavir syrup (a child-friendly HIV drug) — stopped

production of the drug. As a

result, children living with HIV (CLHIV) have written to Prime Minister

Narendra Modi for help.

The letter dated March 4 is

signed by 637 children ranging from ages three to 19. “The pharmaceutical company Cipla has in various forums cited delay in payments by the national program for the HIV medicines by several years and even non-payment of its dues in many cases. Profits on child doses of HIV medicines are small and delayed payments are having a chilling effect on the ability of the National AIDS Control Organization (NACO) to convince the company to participate in the bids it invited annually,” the letter said.

Cipla is the dominant player in

the Indian market across the HIV segment. Even though the Indian government has

failed to pay Cipla for consignments it had sent back in 2014, the company has

not stopped participating in government tenders.

The Health Ministry, on the other hand, says it has instructed State AIDS Control Societies (SACS) to purchase the drug from local markets. “An emergency tender has been placed but we have instructed SACS and state governments to purchase from local markets,” Arun Panda, Additional Secretary, Health Ministry, said.

Novartis faces drug ban in

South Korea over bribe issue

Novartis is

due to face additional

punitive measures from the health

ministry of South Korea later this month for allegedly providing illegal bribes

to local doctors in exchange for prescribing its drugs.

Last week, the Korean Ministry

of Health and Welfare said it is reviewing its own administrative actions

against Novartis Korea, which could take the form of a fine or a lifting of

insurance benefits on drugs sold by the company in South Korea. Novartis is

headquartered in Basel, Switzerland.

Last week, the Korean Ministry

of Food and Drug Safety had slapped Novartis Korea with a fine of US$ 174,937 (200 million won) and a three-month sales ban on 12 drugs, including variations of the company’s flagship dementia drug Exelon.

According to

the ministry, this 200 million-won fine is equivalent to a three-month ban on 30

drugs, including Novartis’ top-selling diabetes drug — Galvus.

Korea’s punitive measures against Novartis Korea have come a year after Seoul prosecutors began a probe into a massive bribery scam that involved the company’s executives and employees.

In August last year, six former and current Novartis employees in South

Korea were indicted over illegal practices to boost sales of the company's

drugs.

Samsung Bioepis wins high-stakes case against AbbVie’s Humira

There is more news from South

Korea. The Seoul-headquartered Samsung Bioepis, a biopharmaceutical company, won a high-stakes court case last week against US drug firm AbbVie for a biosimilar of the world's best-selling drug — Humira.

Samsung

is keen to sell a version of this

arthritis treatment in Europe sometime early next year. The biosimilar version

of Humira is pending approval by the European Medicines Agency (EMA).

This ruling of the England and Wales High Court Chancery Division of the Patents Court, while determining that the two patents covering AbbVie’s Humira are invalid, also said that AbbVie's indications pertaining to rheumatoid arthritis, psoriasis and psoriatic arthritis were unpatentable.

The other

claimant in this case is Tokyo-based Fujifilm Kyowa Biologics. In 2015, Humira

displaced Pfizer’s anti-cholesterol drug Lipitor by crossing US$ 14 billion in

sales.

Impressions: 3061

In less than three weeks, Donald Trump will assume office as the

President of the United States. He has mentioned that he wants Medicare (a

national social insurance program) to directly negotiate the price it pays for prescription drugs.

Medicare provides health insurance to Americans aged 65 or more, who

have worked and paid into the system through the payroll tax. It also provides

health insurance to younger people with some disabilities or end-stage renal

disease and amyotrophic lateral sclerosis.

In 2015, Medicare provided health insurance to over 55 million Americans — including 46 million people aged 65 or more, and nine million younger people.

As we flag off the New Year, PharmaCompass

provides insights into drug prices and prescription patterns in the US in order

to help professionals make informed decisions. We believe that the cost of

medicines in the US, which have been a subject of much public outcry and

discussions in the recent years, will continue to be scrutinized during 2017.

Medicare data for 2014

Medicare Part D, also known as the Medicare prescription drug benefit — the program which subsidizes the costs of prescription drugs and prescription drug insurance premiums for Medicare beneficiaries — published a data set (for calendar year 2014) which contains information from over one million healthcare providers

who collectively prescribed approximately US $121 billion worth of prescription

drugs paid for under this program.

For each prescriber and drug, the dataset

includes the total number of prescriptions that were dispensed (including

original prescriptions and any refills), and the total drug cost.

The total drug cost includes the ingredient cost of the medication, dispensing fees, sales tax, and any applicable administration fees. It’s based on the amounts paid by the Part D plan, the Medicare beneficiary, other government subsidies, and any other third-party payers (such as employers and liability insurers).

The total drug cost does not reflect any manufacturer rebates paid to Part D plan sponsors through direct and indirect remuneration or point-of sale rebates. In order to protect the beneficiary’s privacy, the Centers for Medicare & Medicaid Services (CMS) did not

include information in cases where 10 or fewer prescriptions were dispensed.

Top

Ten Drugs by Cost, 2014 [Most expensive for Medicare]

Drug Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Sofosbuvir

109,543

33,028

7,323

$3,106,589,192

Esomeprazole Magnesium

7,537,736

1,405,570

286,927

$2,660,052,054

Rosuvastatin Calcium

9,072,799

1,752,423

266,499

$2,543,475,142

Aripiprazole

2,963,457

405,048

130,933

$2,526,731,476

Fluticasone/Salmeterol

6,093,354

1,420,515

281,775

$2,276,060,161

Tiotropium Bromide

5,852,258

1,211,919

253,277

$2,158,219,163

Lantus

Solostar

(Insulin Glargine)

4,441,782

972,882

224,710

$2,016,728,436

Sitagliptin Phosphate

4,495,964

789,828

190,741

$1,775,094,282

Lantus

(Insulin Glargine)

4,284,173

787,077

223,502

$1,725,391,907

Lenalidomide

178,373

27,142

9,337

$1,671,610,362

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Top

Ten Drugs by Average Cost per Claim, 2014 [Most expensive drugs]

Drug Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Average Cost Per Claim

Adagen

13

$1,224,835

$94,218

Elaprase

100

$6,560,225

$65,602

Cinryze

1,820

194

196

$96,155,785

$52,833

Carbaglu

60

$2,901,115

$48,352

Naglazyme

129

$6,189,045

$47,977

Berinert

538

73

68

$25,685,311

$47,742

Firazyr

1,568

269

232

$70,948,143

$45,248

H.P. Acthar

9,611

2,932

1,621

$391,189,653

$40,702

Procysbi

314

41

47

$12,542,911

$39,946

Folotyn

15

$598,210

$39,881

Top

Ten Drugs by Claims, 2014 [Most Commonly Used by Patients]

Generic Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Lisinopril

38,278,860

7,454,940

464,747

$281,614,340

Levothyroxine Sodium

37,711,869

6,245,507

416,518

$631,855,415

Amlodipine Besylate

36,344,166

6,750,062

451,350

$303,779,661

Simvastatin

34,092,548

6,768,159

387,651

$346,677,118

Hydrocodone-Acetaminophen

33,446,696

8,005,790

677,865

$676,296,988

Omeprazole

33,032,770

6,707,964

475,122

$529,050,385

Atorvastatin Calcium

32,603,055

6,740,061

419,327

$747,635,818

Furosemide

27,133,430

5,176,582

456,047

$135,710,772

Metformin HCl

23,475,787

4,509,978

364,273

$203,948,989

Gabapentin

22,143,641

4,298,609

486,754

$492,557,255

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Top

Ten Drugs by Prescribers, 2014 [Most Popular with Doctors]

Generic Name

Total Claim Count

Beneficiary Count

Prescriber Count

Total Drug Cost

Hydrocodone/Acetaminophen

33,446,696

8,005,790

677,865

$676,296,988

Ciprofloxacin HCl

7,253,018

4,926,835

568,201

$46,728,353

Amoxicillin

6,298,980

4,384,899

557,614

$31,193,739

Cephalexin

5,040,219

3,529,303

557,048

$36,987,401

Azithromycin

7,339,954

5,274,010

544,625

$70,699,119

Prednisone

11,032,986

4,505,821

536,108

$86,537,932

Tramadol HCl

14,250,227

4,272,724

515,816

$125,343,514

Sulfamethoxazole /Trimethoprim

4,833,758

3,090,944

500,790

$29,231,511

Gabapentin

22,143,641

4,298,609

486,754

$492,557,255

Amoxicillin/Potassium Clav

3,551,452

2,710,244

478,361

$61,713,432

The findings from CMS

data

The CY 2014 data represented a 17 percent

increase compared to the 2013 data set and a substantial part of the total estimated prescription drug spending (as estimated by the Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation, or ASPE) in the United States — at about US $ 457 billion in 2015, which was 16.7 percent of the overall personal healthcare services.

Of that US $ 457 billion, US $ 328 billion (71.9 percent) was for retail

drugs and US $ 128 billion (28.1 percent) was for non-retail drugs.

The drug pricing process in the US is complex and

reflects the influence of numerous factors, including manufacturer list prices,

confidential negotiated discounts and rebates, insurance plan benefit designs,

and patient choices.

An IMS study found that across 12 therapy classes widely used in Medicare Part D,

medicine costs to plans and patients in Medicare Part D are 35 percent below

list prices.

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

While the CMS does not

currently have an established formulary, Part D drug coverage excludes drugs

not approved by the US Food and Drug Administration, those prescribed for off-label

use, drugs not available by prescription for

purchase in the US, and drugs for which payments would be available under Parts

A or B of Medicare.

Part D coverage

excludes drugs or classes of drugs excluded from Medicaid coverage,

such as:

Drugs used for anorexia, weight loss, or weight gain

Drugs used to promote fertility

Drugs used for erectile dysfunction

Drugs used for cosmetic purposes (hair growth, etc.)

Drugs used for the symptomatic relief of cough and colds

Prescription vitamins and mineral products, except prenatal vitamins and fluoride preparations

Drugs where the manufacturer requires (as a condition of sale) any associated tests or monitoring services to be purchased exclusively from that manufacturer or its designee

Our view

The Medicare program is designed such that the

federal government is not permitted to negotiate prices of drugs with the drug

companies, as federal agencies do under other programs.

For instance, the Department of Veterans Affairs — which is allowed to negotiate drug prices and establish a formulary — has been estimated to pay (on an average) between 40 to 58 percent less for drugs, as opposed to Medicare Part D.

If Trump administration kick starts direct

negotiations on Medicare drug prices with drug companies, 2017 will surely turn

out to be a year for the pharmaceutical industry to remember.

View the Medicare Part D National Prescriber Summary Report, Calendar Year 2014 (Excel version available) for FREE!

Impressions: 7914

Compliance Wrap: Heparin quality concerns re-emerge in China, more trouble at Sun Pharma & Wockhardt

PharmaCompass looks at recent compliance concerns highlighted by the US FDA at drug manufacturers like India’s Sun Pharmaceuticals, Srikem Labs, Wockhardt’s UK subsidiary and China’s Dongying Tiandong. This is not the first time most of these companies have been on the regulatory radar for exactly the same manufacturing lapses.Sun

PharmaSun Pharmaceutical Industries Ltd’s efforts to exorcise the compliance troubles which plagued Ranbaxy for almost a decade indicate that more work needs to be done. News reports

of the recent inspection

at the facility based in Mohali (Punjab) state that the US FDA Form 483 issued had seven observations of shortcomings in manufacturing standards at Sun Pharma’s formulations plant in Mohali.The site,

which belonged to Ranbaxy Laboratories, used to ship generic versions of

the popular cholesterol drug atorvastatin to the US.The FDA

investigators found that the company failed to thoroughly review the reasons

for an out-of-specifications (OOS) batch of drugs and that the laboratory

records did not include complete data derived from all tests necessary to

assure compliance with established specifications and standards.In addition, appropriate controls were not exercised over computers as “laboratory analysts have the ability to change instrument settings including date and time on the instrument”.Ranbaxy had

been acquired by Sun Pharma as part of a US $ 4 billion deal completed last year. Ranbaxy’s manufacturing sites in India at Paonta Sahib, Dewas, Toansa and Mohali were put under an import alert as part of drawn-out

investigations. In 2013, Ranbaxy paid US $ 500 million to settle the dispute

with the US FDA.Besides

struggling to resolve compliance issues at the Ranbaxy facilities, Sun

Pharma is also contending with compliance issues at its own manufacturing facilities at Halol and Karkhadi in Gujarat. Regulatory issues, particularly at its Halol unit in Gujarat, have dented the company’s sales in the US. In 2015-16, its US sales were US $ 2.07 billion, down 8 percent from the previous year.Srikem Labs, IndiaAn FDA

inspection at Srikem Laboratories’ Taloja facility in Maharashtra (India) uncovered data-integrity concerns such as inconsistently-dated

laboratory records, where sample testing reports were available days before the

record log showed that the sample had even entered the laboratory.Investigators also found a printed chromatogram which was dated August 26, 2014, while the data saved to the computer system from the analysis was dated December 28, 2013 — nearly eight months before the date on the printed chromatogram.In another instance, a stability testing result was stated to be in compliance. However, when the “investigator asked you to reprocess the chromatograms using appropriate integration parameters, the results were out-of-specification for unknown impurity content,” the FDA letter said.“Your quality system does not adequately ensure the accuracy and integrity of data to support the safety, effectiveness, and quality of the drugs you manufacture. We strongly recommend that you retain a qualified consultant to assist in your remediation,” the letter said.Wockhardt’s UK subsidiaryWockhardt’s UK subsidiary CP Pharmaceuticals

received an FDA warning letter for

inspections conducted in October 2015. The investigators found poor practices

during aseptic set-up and filling and repeated failure to create a robust

personnel monitoring program of its aseptic production operation. “Your firm failed to follow appropriate written procedures that are designed to prevent microbiological contamination of drug products purporting to be sterile, and that includes validation of all aseptic and sterilization processes,” the letter said.Wockhardt’s UK facility had received a warning letter previously (dated

October 29, 2010), where the same concerns were highlighted.Dongying

Tiandong, ChinaIn early 2008, ‘fake’ heparin-based medicines caused deaths in the US and other parts of the world. In a bid to realize cost-saving opportunities, Chinese producers had added a potentially toxic substance called ‘over-sulphated chondroitin sulphate’ to

pharmaceutical grade heparin. The counterfeit

product was cheaper to make, did not offer the intended therapeutic effect and

was difficult to differentiate with the existing test methods.In the warning letter

issued to Dongying Tiandong Pharmaceutical in China, FDA investigators found

that the firm had repeatedly, and without justification, resampled and retested

crude heparin batches when results exceeded the established specification

limit. As a result, the firm used crude heparin batches that potentially were

out-of-specification to manufacture heparin sodium API for the US market.The letter adds: “You neither evaluated the initial sample OOS, nor conducted retesting of the initial original sample to confirm it. Instead, you resampled until you obtained a passing result.”The FDA

warning letter to Dongying Tiandong follows a non-compliance report issued by European authorities

earlier this year.Our viewThis isn’t the first time that companies like Ranbaxy, Wockhardt and Dongying have had a problem with the

regulators. These recent warning letters make us wonder if turning the corner

on quality issues is easier said than done.

Impressions: 2985

The proposed new 21st Century Cures Act could

herald in a new era of drug development, with the search for a new drug

shifting from research laboratories to computer systems.Last week, we analyzed the

impact of the new Act on accelerating drug development through biomarker

based approvals. This week we share how generic pharmaceutical companies could

create new sources of revenue through the use of Big Data.The ability to conduct successful clinical research is what

differentiates innovator pharmaceutical companies from generic manufacturers.

However, the proposed 21st Century Cures Act , which has been passed by the US House of Representatives and awaits clearance from the Senate, may level the playing field to some extent with measures that seek to shift drug development from research laboratories to computer systems.However, what seems imminent is a Big Data revolution that

could be a boon for the generic business.The proposed legislation includes a number of directives related

to electronic health records (EHR) and health information

exchange. The relevant sections of the

Bill are designed to help drive medical innovations and create better

information flow, by increasing incentives to foster interoperability between

different electronic medical record systems. Adequate focus on privacy

and data sharing The Bill aims to accelerate the development and regulatory

approval of medical innovations. According to the proposed Act, electronically

accessible health information and health information technology systems must

also allow for secure transfer of information and allow complete access to

exchange of such information. In its current form, the Bill includes several health IT and

interoperability provisions. If the vendors are not able to confirm that their

EHR software complies with these interoperability provisions by January 2018,

they run the risk of having their software decertified for use.For instance, there are provisions

on the pricing of transmitting data, on having application programming

interfaces that provide instructions on how to access EHR data to outside users

and developers; and provisions on meeting The US Department of Health and Human

Services (HHS) standard of allowing "everyday" data exchange. The big, Big Data

opportunityElectronic health records are becoming a gold mine to

discover ways in which existing drugs can be repositioned or repurposed to find

new indications for them. Last week, a Big Data study

conducted by researchers from the Regenstrief Institute and Indiana University,

found that the combination of two drugs, both available as generics, could

consistently amplify blood pressure reduction in patients. Using information from EHR of 17,291 hypertensive patients,

who were prescribed the diuretic drug hydrochlorothiazide

with or without triamterene,

the researchers are the first to demonstrate triamterene's ability to enhance

the blood pressure lowering effect of hydrochlorothiazide.Similarly, another study which analyzed the EHR data of more

than 110,000 patients suggests the

commonly used anti-diabetic metformin was associated with decreased mortality

after a cancer diagnosis, indicating its potential as a

chemotherapeutic regimen. Another study

suggests the bestselling cholesterol lowering medicine, atorvastatin

can be positioned as a new therapeutic for organ transplantation based on the

retrospective analysis of EHRs of 2,515 renal transplant patients followed for

up to 22 years.Additional therapeutic benefits for existing generic drugs,

is a natural extension of the current generic pharmaceutical business model

which has been struggling of late to find new opportunities as more and more

biologics have been getting approved. EHRs to accelerate

drug repositioningFinding new uses for existing drugs—a process referred to as drug repurposing or repositioning – is an area which will get accelerated as more EHRs become available for computer-aided analysis. Perhaps the most recognizable example of successful repositioning