Pipeline Prospector July 2022: Indices continue to climb as drugmakers post better than expected Q2 results

After a tough first five months, biotech stocks finally began to look up in June this year. And July only strengthened that trend, with the Nasdaq Biotechnology Index (NBI) rising by 2 percent to US$ 3,902. In June, it had gained 2 percent. Similarly, the S&P Biotechnology Select Industry Index (SPSIBI) rose by 6 percent to US$ 6,303. In June, it had risen by 10 percent. Moreover, the SPDR S&P Biotech ETF (XBI) rose by 6.5 percent in July, compared to an 11 percent rise in June.

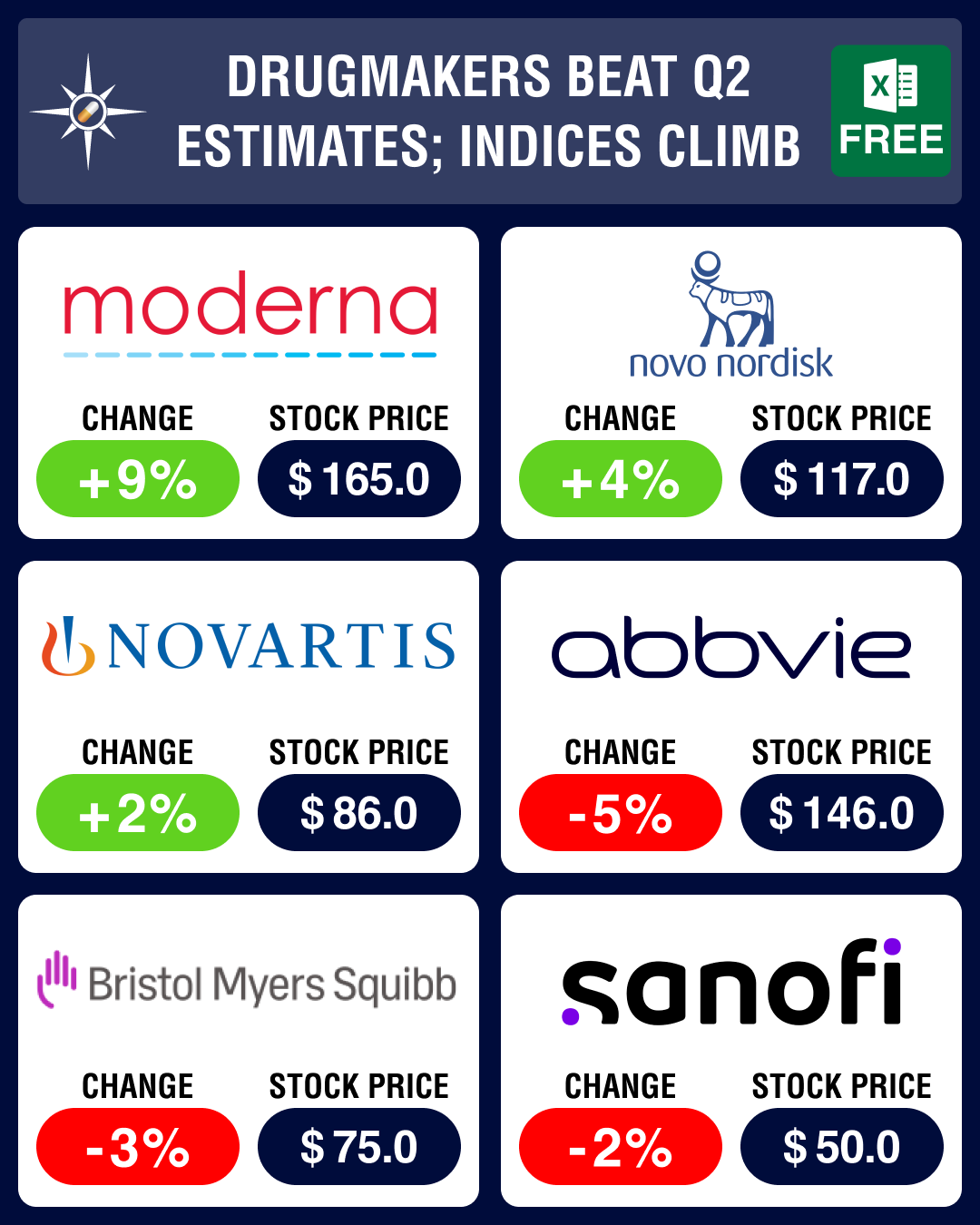

What was even more heartening about July was the fact that several drugmakers announced their second quarter (Q2) results. Overall, the Q2 results turned out to be better than expected for most large drugmakers. And this has made the outlook for the second half of 2022 a lot brighter.

Access the Pipeline Prospector Dashboard for July 2022 Newsmakers

Pfizer, Merck, Sanofi’s Q2 results beat estimates

During Q2, companies like Pfizer, Merck and Sanofi managed to beat estimates for both earnings and sales. While Merck, AstraZeneca and GSK have raised their sales guidance for 2022, Sanofi has increased its expectations of earnings growth.

Pfizer’s Q2 sales surged to a record high. At US$ 27.7 billion, Pfizer reported a 47 percent or US$ 8.8 billion increase in revenues over the same quarter last year. Pfizer maintained its previously issued sales guidance for 2022 as well as its forecast for its Covid-19 vaccine (Comirnaty) and its anti-viral therapy (Paxlovid).

At US$ 14.6 billion, Merck posted robust sales growth of 28 percent in Q2, over the same quarter last year. Sanofi posted an 8.1 percent increase in Q2 sales, driven by growth in sales of its anti-inflammation drug Dupixent. Its rare diseases, vaccines and consumer healthcare units also performed better.

Novartis reported Q2 sales growth of 5 percent. The Q2 revenue from its heart failure drug Entresto jumped 33 percent to US$ 1.13 billion. Sales of its arthritis drug — Cosentyx — increased by 12 percent to US$ 1.28 billion. Novo Nordisk announced sales growth of 25 percent in Danish kroner in the first half of 2022. The growth is driven by an increasing demand for its GLP-1-based diabetes treatments, particularly Ozempic.

BMS posted a revenue of US$ 11.89 billion, as opposed to US$ 11.7 billion posted in Q2 2021, Johnson & Johnson reported a growth of 3 percent with sales of US$ 24 billion, while AstraZeneca’s Q2 sales were up 37 percent to US$ 10.77 billion. AbbVie reported a revenue growth of 4.5 percent to US$ 14.5 billion for the second quarter. And GSK reported a 19 percent increase in Q2 sales at £6.9 billion (US$ 8.71 billion).

Access the Pipeline Prospector Dashboard for July 2022 Newsmakers

Novo Nordisk, Novartis, Astra see rise in stock prices

July was a good month for Novo Nordisk with lots of positive news, which resulted in a 4 percent increase in its stock price. First, Novo reported positive phase 3 results for its hemophilia drug — concizumab — and found that it reduced the number of treated bleeds in patients by 86 percent when given once-daily as a subcutaneous injection.

Second, there was good news pertaining to Novo’s anti-diabetes med semaglutide (Wegovy). The Institute for Clinical and Economic Review (ICER) brought out a report assessing four different medications for patients looking to manage their obesity. ICER found that patients hit greater weight loss targets with semaglutide as compared to its peers. Moreover, there was good news from trials on its once-weekly insulin — icodec — in adults with type 2 diabetes.

It was a good month even for Novartis, whose stock increased by 2 percent in July. The National Institute for Health and Care Excellence (NICE) in the UK has recommended the use of Novartis’ Piqray (alpelisib) in combination with Faslodex (fulvestrant) as a targeted treatment for advanced breast cancer. Moreover, Novartis and the University of California, Berkeley, have extended their five-year-old research-based collaboration to develop next-generation therapeutics. And both the FDA and EMA have agreed to review a biosimilar to Biogen’s Tysabri (natalizumab), which has been developed by Novartis’ generic unit — Sandoz — and Polpharma Biologics.

In negative news, Novartis scrapped the US submission of tislelizumab as a monotherapy for non-small cell lung cancer (NSCLC) after the FDA delayed a decision for the drug in previously treated esophageal squamous cell carcinoma (ESCC).

AstraZeneca acquired TeneoTwo and also nabbed EU recommendations for two of its blockbusters – Tezspire and Ultomiris for severe asthma and rare muscle-wasting disease myasthenia gravis, respectively – along with a priority review for Enhertu from the FDA as a treatment for HER2-low metastatic breast cancer. All this positive news resulted in a 2 percent increase in its stock in July. And this month, the FDA has approved Enhertu as the first therapy to treat patients with HER2-low breast cancer.

Astra’s gain was Gilead’s loss. Its stock plummeted 2 percent in July as its med Trodelvy faced competition from Enhertu. According to analysts, in HR-positive breast cancer, Enhertu will become standard of care regardless of HER2 expression status.

Access the Pipeline Prospector Dashboard for July 2022 Newsmakers

Termination, failure of trials impact stocks of AbbVie, Sanofi, Merck

Among mega cap companies, stocks of AbbVie, Sanofi, Merck and BMS took a beating due to termination and failure of clinical trials. AbbVie terminated an early stage trial of lemzoparlimab (a drug it is jointly developing with I-Mab) in adults with multiple myeloma.

AbbVie has also decided to terminate a collaboration with Alector to develop AL003 for Alzheimer’s disease. With biosimilar competition eroding the sales of Humira in Europe, investors were hoping to see better performance of its aesthetics and cancer drugs. However, AbbVie’s aesthetics portfolio posted a 4.4 percent dip in Q2 sales (over Q2 2021) due to the impact of Covid-19 restrictions in China and the suspension of operations in Russia. These developments resulted in a 5 percent dip in AbbVie’s stock.

However, all news for AbbVie was not negative — the European Commission (EC) approved AbbVie’s Rinvoq (upadacitinib) for the treatment of active non-radiographic axial spondyloarthritis (nr-axSpA) and moderate-to-severe ulcerative colitis in adult patients.

The FDA has said it cannot approve Sanofi and Lexicon’s application for their type 1 diabetes drug sotagliflozin due to safety concerns. Sanofi has also walked away from a kidney disease therapy which it was developing along with Regulus Therapeutics. Together, this and other news led to a 2 percent drop in the shares of Sanofi.

Bristol Myers Squibb’s share prices also fell 3 percent. BMS’ promising CAR-T treatment Breyanzi generated just US$ 39 million in sales, down from US$ 44 million in the previous period, as a result of manufacturing issues. BMS has also hit a snag in its phase 3 trial investigating the company’s Opdivo and Yervoy combo in renal cell carcinoma after the study “did not meet the primary endpoint of disease-free survival”.

Merck’s share price fell 1 percent on news that it has decided to end a phase 3 trial (along with AstraZeneca) that evaluates Lynparza as a treatment for colorectal cancer. Another setback for Merck was the failure of Keytruda in a phase 3 trial for its use in head and neck cancer.

Merck’s blockbuster Januvia (sitagliptin) went off patent in July, and around 100 generics of this popular anti-diabetes drug are likely to hit the market soon. With the entry of generics, the price of Januvia is already down 60 percent.

Access the Pipeline Prospector Dashboard for July 2022 Newsmakers

Moderna, BioNTech stocks gain over demand for Omicron boosters

Among large cap gainers, Moderna’s stock gained 9 percent on the back of its Covid-19 vaccine. In June, an FDA panel voted in favor of including a SARS-CoV-2 Omicron component in Covid-19 vaccines that would be used for boosters in the US beginning in fall 2022. Moderna has said it expects its Omicron booster to be available by late October or early November.

Moderna’s Covid vaccine is also scaling new heights by bagging approvals in younger age groups in many countries across the world. However, Alnylam has sued both Moderna and Pfizer over Covid-19 vaccine patent infringement. The lawsuit claims that both companies violated a newly granted patent pertaining to lipid nanoparticle technology that has been central to delivering mRNA vaccines into human cells.

BioNTech stock moved up 5 percent on news that Pfizer and BioNTech have received a large initial order from the US government for Omicron boosters. FDA granted full approval to Pfizer's Covid-19 vaccine for adolescents between the ages of 12 and 15 years.

Another large cap gainer was Biogen, whose stock went up 3 percent after FDA accepted its amyotrophic lateral sclerosis (ALS) therapy (lecanemab) for review. With an FDA application completed in May and the priority review status granted in July, Eisai and Biogen have seen lecanemab’s regulatory timeline cut from 10 months to six.

The FDA has also accepted a new drug application (NDA) for Biogen’s tofersen, an investigational drug for ALS. The application has been granted priority review status, and the approval for the drug is expected around January 25, 2023.

Access the Pipeline Prospector Dashboard for July 2022 Newsmakers

Monkeypox outbreak brings gains for Bavarian Nordic, SIGA Technologies

Among small cap gainers were Apellis Pharmaceuticals (26 percent), Pliant Therapeutics (125 percent), Bavarian Nordic (42 percent) and SIGA Technologies (77 percent).

On July 23, the World Health Organization (WHO) declared the ongoing monkeypox outbreak a public health emergency of international concern. The outbreak has brought gains for Bavarian Nordic and SIGA Technologies, since the former makes a smallpox vaccine (Jynneos) and the latter makes a smallpox medication (Tpoxx). Bavarian Nordic has received multiple contracts to supply its vaccine to various countries. The vaccine recently received a marketing authorization for monkeypox in Europe.

Shares of Pliant Therapeutics rose 125 percent after announcement that its experimental drug candidate for idiopathic pulmonary fibrosis had met both its primary and secondary endpoints in a phase 2a trial. The drug has also received a Fast Track designation from the FDA for the potential treatment of primary sclerosing cholangitis.

FDA granted a priority review status to Apellis’ NDA for intravitreal pegcetacoplan, an investigational, targeted C3 therapy for the treatment of geographic atrophy (GA) secondary to age-related macular degeneration.

Legend Biotech (-14 percent) was the biggest small cap loser. The company scrapped phase 1 plans for a cell therapy that just six weeks ago was freed from an FDA hold. The decision was based on the finding that the CAR-T candidate had failed to show benefit in a clinical trial held in China.

Access the Pipeline Prospector Dashboard for July 2022 Newsmakers

Astra acquires TeneoTwo; Avista Therapeutics partners with Roche

Like June, July wasn’t a big month for pharma M&As. The month saw a string of small deals. For instance, Theravance Biopharma said it will sell its royalty interests in Trelegy Ellipta (a drug that cures chronic obstructive pulmonary disease) to Royalty Pharma for approximately US$ 1.1 billion in upfront cash with over US$ 1.5 billion in potential total value.

The biggest M&A was AstraZeneca’s acquisition of TeneoTwo, including its phase 1 clinical-stage T-cell engager — TNB-486 — in a deal worth around US$ 1.27 billion. The acquisition of TNB-486 aims to accelerate the development of the potential new medicine for B-cell hematologic malignancies, including diffuse large B-cell lymphoma and follicular lymphoma.

Avista Therapeutics has partnered with Roche to develop next-generation AAV gene therapy vectors for ocular diseases using Avista’s single-cell AAV engineering (scAAVengr) platform technology. Roche has offered up to US$ 1 billion to secure the right to assess and license AAV capsids developed by Avista.

Access the Pipeline Prospector Dashboard for July 2022 Newsmakers

Our view

This is the second month when the biotech stocks appear to be out of the woods. Improved Q2 performance by leading pharma players only bolsters that trend.

Over the last few months, we have been anticipating higher M&A activity in the pharmaceutical industry. After a lackluster July, August has opened with a bang with Pfizer acquiring Global Blood Therapeutics for US$ 5.4 billion and Amgen’s US$ 3.7 billion acquisition of ChemoCentryx.

M&A is a key means by which investors gauge the health of a sector and its ability to secure returns. Therefore, increased M&A activity by cash-rich players (such as Pfizer) should strengthen investor confidence in the drug industry, making it easier for smaller players to secure funds from investors to fund more acquisitions.

Increased M&A activity in the beginning of August may also be an indication that the market finds the current valuations to be too low. And that the only way for pharma stocks to move is upwards.

Access the Pipeline Prospector Dashboard for July 2022 Newsmakers

Pharma & Biotech Newsmakers in July 2022

| Company | Country | Currency | Market Cap (Bn) | Change In Market Cap (M) | Stock Price | Change In Price |

|---|

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Pharma & Biotech Recap by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”